Hong Kong Rises Despite Geopolitical Bark

4 Min. Read Time

Key News

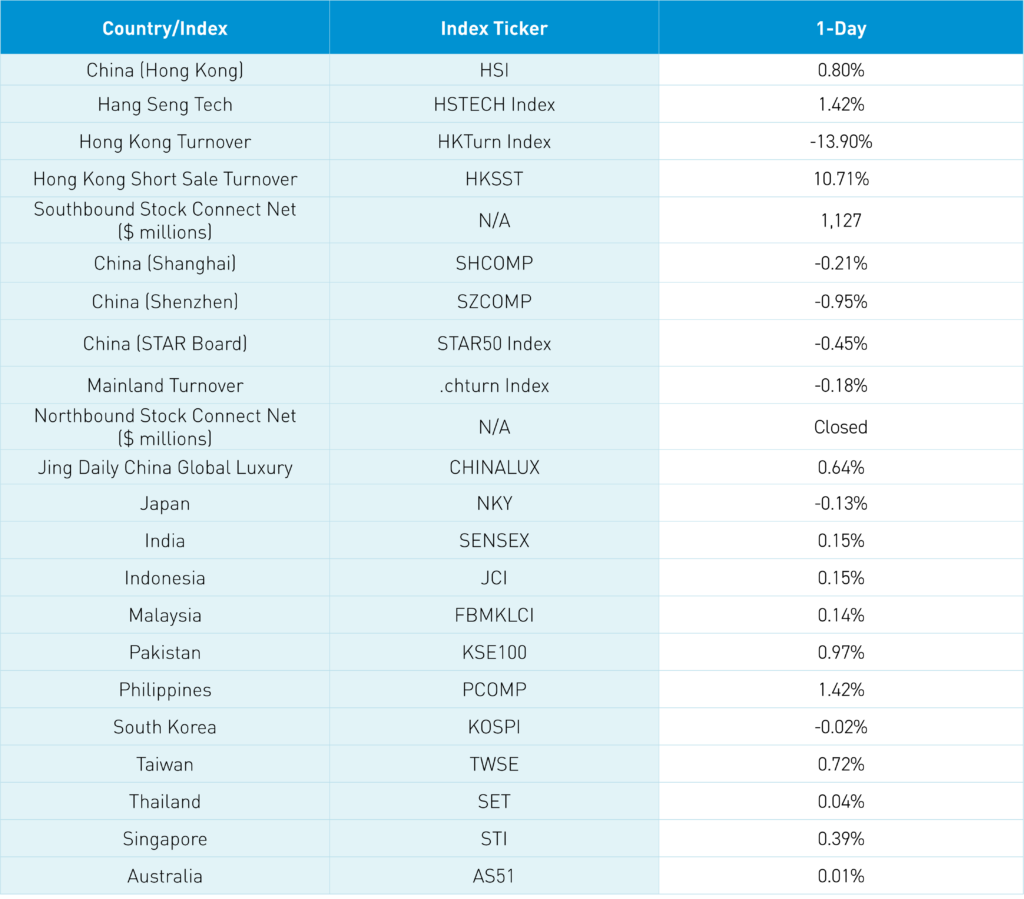

Asian equities were mixed overnight as the Philippines outperformed. Hong Kong opened lower but grinded higher, led by growth stocks despite geopolitical headwinds as a busy week for Q1 financials results kicks off.

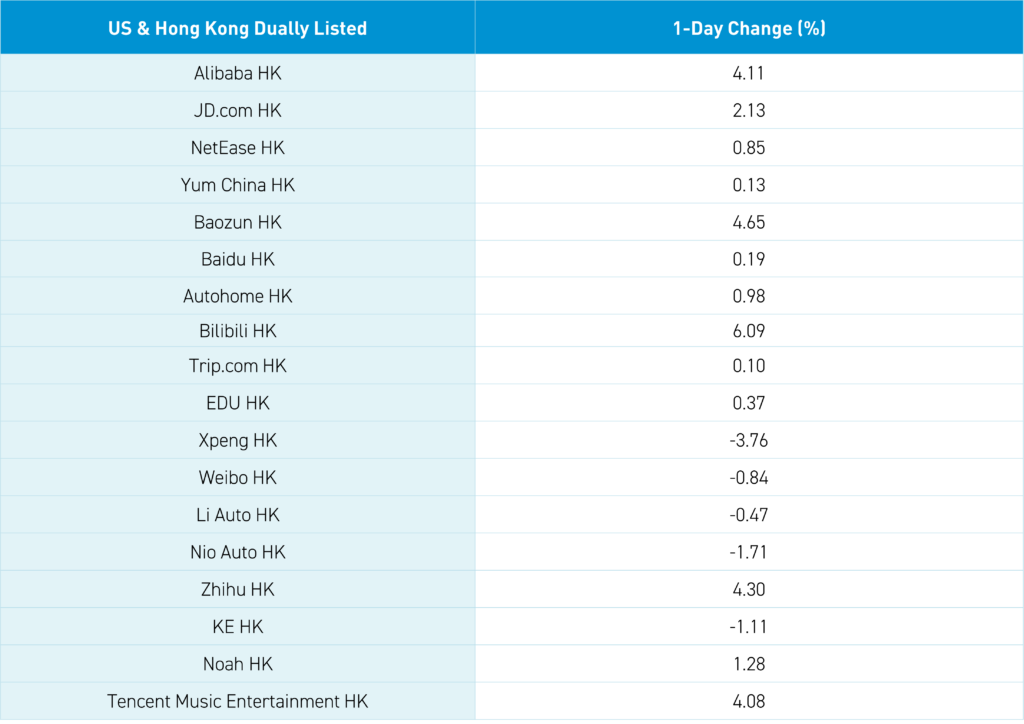

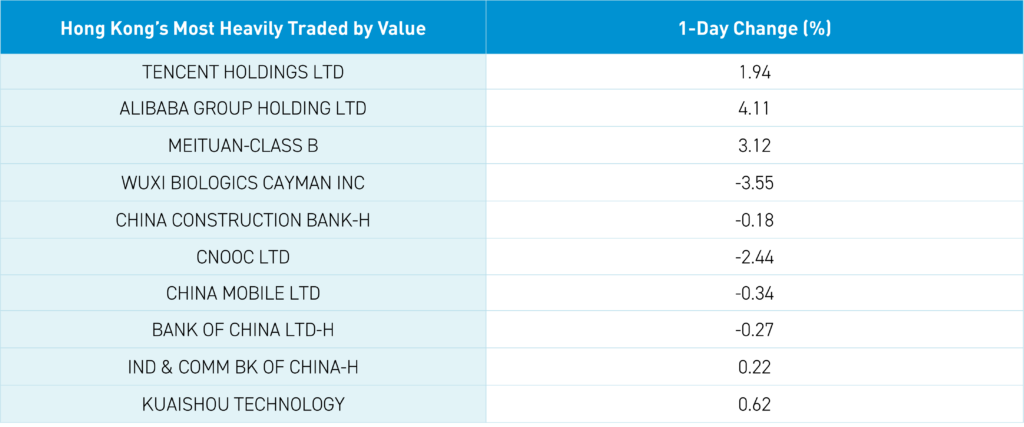

The Hang Seng gained +0.8%, closing above the 19,000 level, while the Hang Seng Tech Index gained +1.42%, closing above the 4,000 level. Hong Kong’s most heavily traded stocks by value were Tencent, which gained +1.94% in advance of earnings tomorrow (US morning/post-Hong Kong close), Alibaba, which gained +4.11% (earnings tomorrow, US morning/post-Hong Koing close), Meituan, which gained +3.12%, Wuxi Biologics, which fell -3.55%, and China Construction Bank, which fell -0.18%.

Tomorrow’s Earnings Releases: Preview

Alibaba – The earnings release is for fiscal Q4 2024, which is somewhat confusing as the company’s fiscal years are ahead by three quarters. Investment is expected to weigh on net income and earnings per share (EPS), while China’s E-Commerce revenue growth is expected to increase by +4.7% year-over-year (YoY), which could surprise to the upside while international E-Commerce is expected to grow +50% YoY, though is likely to remain a small segment.

What to watch: an update on share buybacks and maybe another dividend after posting their 1st dividend ever in December 2023.

- Q4 2024 Revenue Expectations: +6% YoY to RMB 219 billion versus Q4 2023’s RMB 208.2

- Adjusted Net Income Expectations: -6% to RMB 26.237 billion versus Q4 2023’s RMB 27.96

- Adjusted EPS Expectations: -3% to RMB 10.43 versus Q4’s RMB 10.71

Tencent – Earnings release is for Q1 2024.

What to watch: update on share buybacks.

- Revenue expectations: +6% YoY to RMB 158 billion versus Q4 2023’s RMB 150 billion

- Adjusted Net Income Expectations: +32% to RMB 42.8 billion versus Q4 2023’s RMB 32.5B

- Adjusted EPS Expectations: +34% to RMB 4.48 versus Q4 2023’s RMB 3.35

Internet stocks had a good day in Hong Kong. Following the close in Hong Kong, online music & entertainment platform Tencent Music Entertainment (TME) and online streaming company Huya both beat on the big three: revenue, adjusted net income, and adjusted EPS. Southbound Stock Connect had very high volumes today with a healthy $1.13 billion worth of net buying, led by a big net buy for the Hong Kong Tracker ETF coming from Mainland investors.

Key News (Continued)

The move comes despite Biden’s Tuesday announcement of a 100% tariff on China electric vehicle (EV) imports though the move is symbolic as 100% of 0% = 0%. There was also chatter that solar will be spared increased tariffs.

Wuxi Biologics fell -3.55% and Wuxi AppTec gained +4.46% as the Biosecure Act would give US companies eight years until they would have to stop working with banned companies. If there is one example of how the media is clearly doing the government’s bidding, it would be this bill. Congress has become judge, jury, and executioner without any evidence on medical companies that operate a dozen facilities in the US that employ thousands of Americans. Big government means big money for US media companies. That being said, the New York Times has published a great article on the massive headache that such a ban could potentially cause for the US pharmaceutical industry. The article mentions that nearly one third of drugs currently on the market in the US were involved with one of the WuXi companies either in their development or current production.

Mainland China took a breather and consolidated, despite a slew of new economic data. EV battery maker CATL was off -2.04% on the Biden news, while LONGi Green Energy gained +1.61%.

April’s consumer price index (CPI) increased +0.30% versus expectations of +0.20% and March’s +0.1%, while the producer price index (PPI) fell -2.5% versus expectations of -2.3% and March’s -2.8%. Year-to-date (YTD) new loans and aggregate financing both missed expectations, clearly demonstrating that supply is not the issue, but rather demand is the culprit and needs policy support.

Northbound Stock Connect was closed in advance of Hong Kong’s holiday on Wednesday.

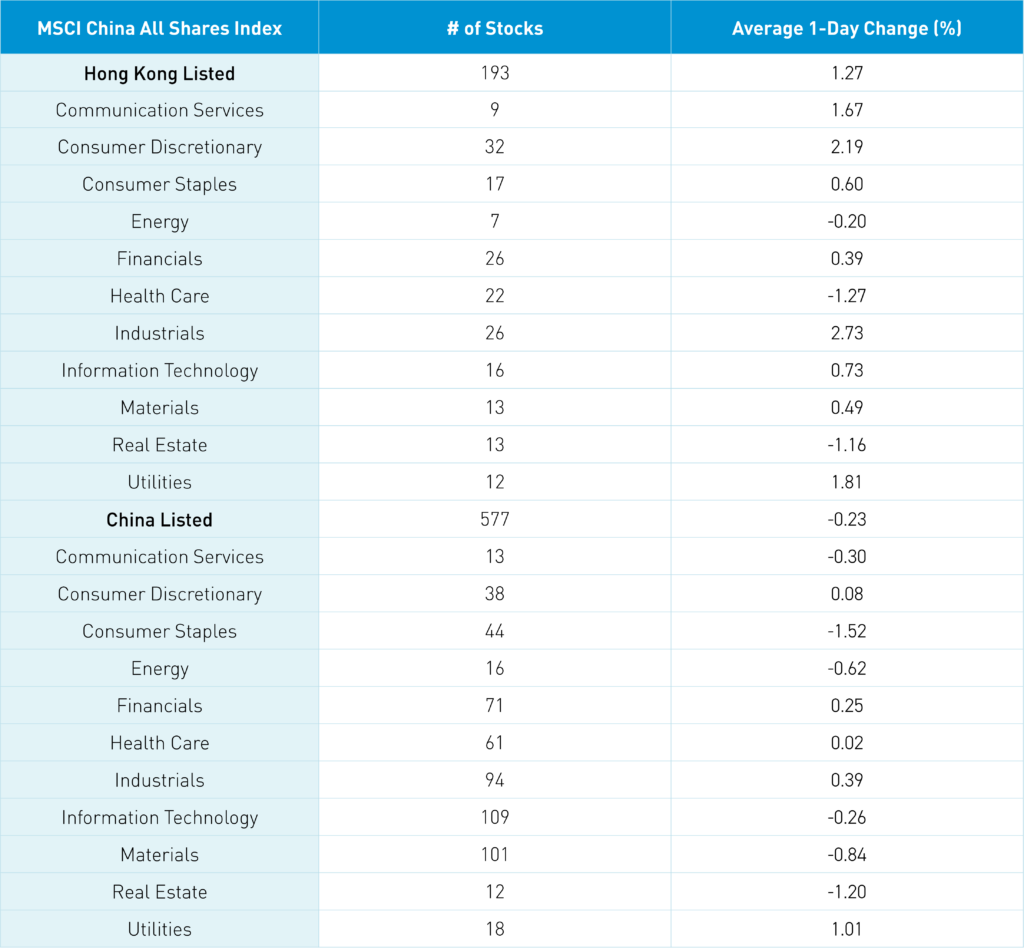

The Hang Seng and Hang Seng Tech indexes gained +0.80% and +1.42%, respectively, on volume that declined -13.9% from Friday, which is 148% of the 1-year average. 329 stocks advanced while 155 declined. Main Board short turnover increased +10.71% from Friday, which is 134% of the 1-year average, as 16% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). All factors were positive as growth and small caps outpaced value and large caps. The top-performing sectors were Industrials, which gained +2.73%, Consumer Discretionary, which gained +2.13%, and Utilities, which gained +1.81%. Meanwhile, Health Care fell -1.27%, Real Estate fell -1.16%, and energy fell -0.20%. The top-performing subsectors were retail, media, and transportation. Meanwhile, energy, pharmaceuticals, and telecom services were among the worst-performing. Southbound Stock Connect volumes were very high as Mainland investors bought a healthy net $1.13 billion worth of Hong Kong-listed stocks and ETFs, including the Hong Kong Tracker ETF, which saw a large net inflow.

Shanghai, Shenzhen, and the STAR Board fell -0.21%, -0.95%, and -0.45%, respectively, on volume that decreased -0.18% from Friday, which is 107% of the 1-year average. 1,153 stocks advanced while 3,824 declined. The value factor and large caps “outperformed” (i.e. fell less than) the growth factor and smaller caps. The top-performing sectors were Utilities, which gained +1.01%, Industrials, which gained +0.39%, and Financials, which gained +0.25%. Meanwhile, Consumer Staples fell -1.52%, Real Estate fell -1.2%, and Materials fell -0.84%. The top-performing subsectors were marine industry, shipping, water supply, and household appliances. Meanwhile, leisure products, internet, and chemicals were among the worst-performing. Northbound Stock Connect was closed due to Hong Kong’s holiday Wednesday. CNY and the Asia Dollar Index were both off slightly versus the US dollar. Treasury bonds rallied and copper gained while steel fell.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.23 versus 7.23 yesterday

- CNY per EUR 7.81 versus 7.79 yesterday

- Yield on 1-Day Government Bond 1.42% versus 1.42% yesterday

- Yield on 10-Year Government Bond 2.29% versus 2.34% yesterday

- Yield on 10-Year China Development Bank Bond 2.39% versus 2.42% yesterday

- Copper Price +0.55%

- Steel Price -0.08%