Real Estate Rockets While Baidu & JD.com Earnings Are On Deck

2 Min. Read Time

Key News

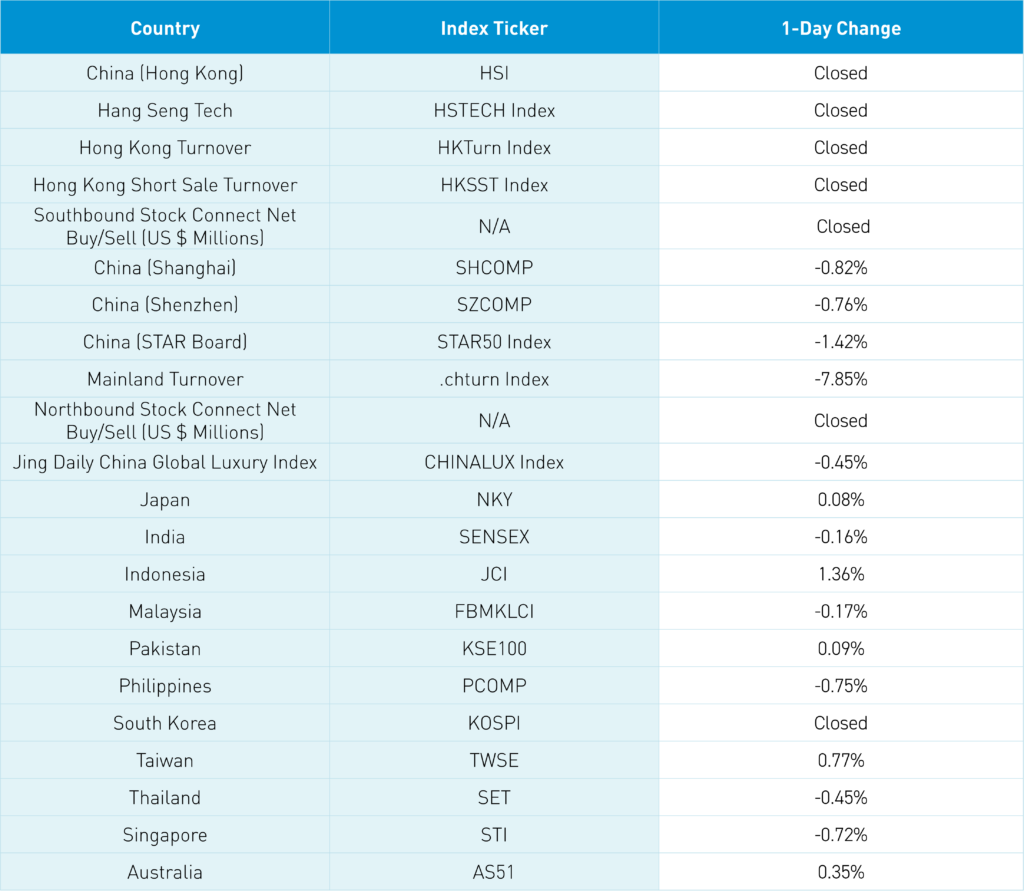

Asian equities were mixed overnight, with the US dollar weaker overnight before today’s US CPI release and Hong Kong closed for Buddha’s birthday.

It was quiet overnight, with Hong Kong closed, resulting in light volumes as both Shanghai and Shenzhen fell to the bottom of their recent trading range. Biden’s China tariffs likely weighed on sentiment as it garnered significant media coverage in China as solar and wind underperformed.

Real estate was the top performer on chatter that the Chinese government will buy unsold apartments in order to stabilize housing prices and support property developers. The apartments could be used for lower-income urban residents, I suspect, if that story is true. Property developer bonds rallied on the news as my call for investors to buy the bonds goes unheeded as I believe one might garner equity like returns with a tasty yield to protect to the downside.

MSCI released their pro forma for the month-end index rebalance last night, with China’s weight sliding slightly to 25.4% from 25.7% as 56 companies will be deleted while 10 are added. Hillhouse, a globally focused private equity firm founded by a Chinese-born Yale graduate/former Yale Endowment employee, filed its SEC 13F indicating further buying of their top publicly traded holding Pinduoduo with 1.68mm more shares from their Q4 13F to 11.79mm shares.

Sell-side analysts are singing Tencent’s accolades after their very strong financial results yesterday and further shareholder-friendly buyback. I’ve not seen as many reports on Alibaba after their top line beat but bottom line miss, which appears driven by having to write down their investments in publicly traded companies, though I’ve not had the chance to speak to the company yet. In addition to the strong buyback (reduced shares outstanding by 5.1% in the last year) and large dividend announced ($1.66 in 2 payments), the addition to Southbound Stock Connect is a strong catalyst following their designation of Hong Kong as their primary listing, in my opinion. With this addition, 900 million people will be able to buy Alibaba’s stock for the first time. Think that’s a positive? Me too.

Baidu and JD.com will report tomorrow morning, as the former announced the launch of its 6th-generation robotaxi. It will be a busy morning!

If you hear someone say the Chinese need to sell TikTok, it indicates they are uninformed as TikTok’s parent is owned by Americans, as evidenced by 3 of 5 board seats held by Americans.

Hong Kong was closed today.

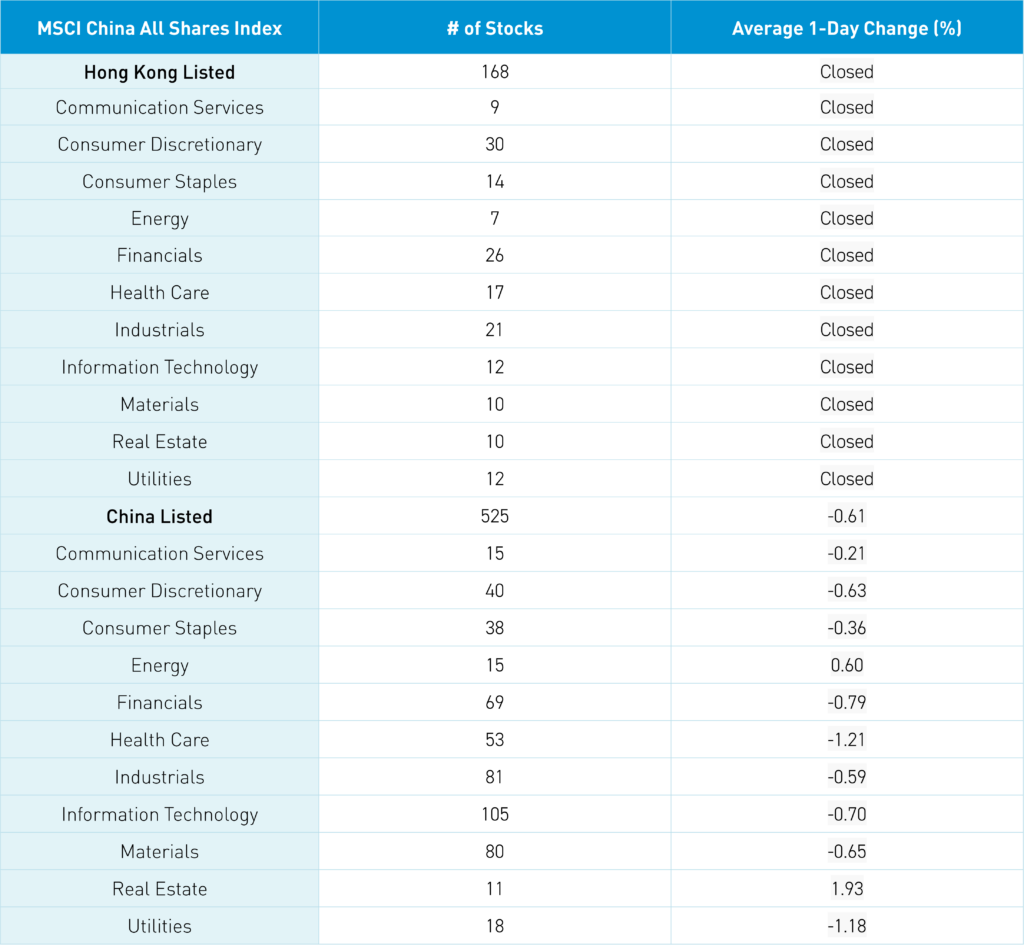

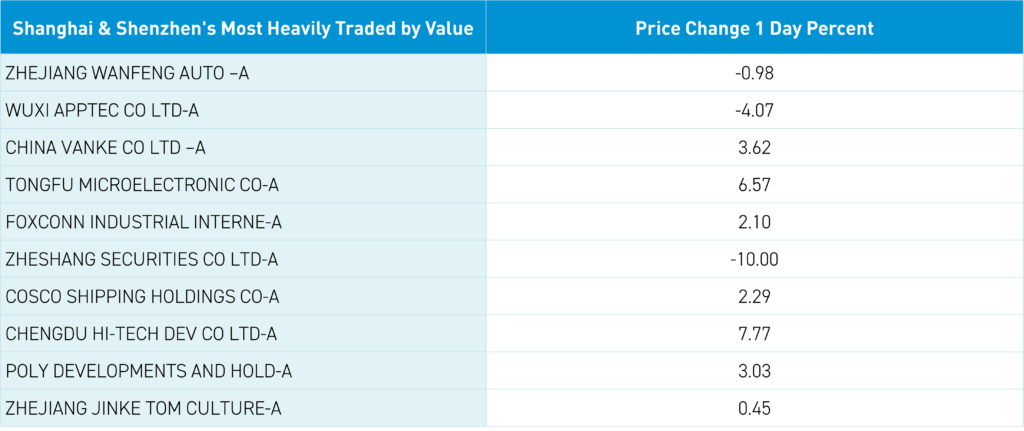

Shanghai, Shenzhen, and STAR Board fell -0.82%, -0.76%, and -1.42% on volume -7.85% from yesterday, which is 89% of the 1-year average. 1,432 stocks advanced, while 3,460 declined. All factors were negative as the value factor and large caps fell less than the growth factor and small caps. Real estate and energy gained +1.93% and +0.6%, while healthcare -1.21%, utilities -1.18%, and financials -0.8%. The top sub-sectors were real estate, household products, and shipping/marine, while motorcycle and auto were the worst. Northbound Stock Connect was closed. CNY and the Asia dollar gained versus the US dollar. Treasury bonds fell. Copper and steel both fell.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.22 versus 7.23 yesterday

- CNY per EUR 7.81 versus 7.80 yesterday

- Yield on 10-Year Government Bond 2.30% versus 2.29% yesterday

- Yield on 10-Year China Development Bank Bond 2.40% versus 2.39% yesterday

- Copper Price -0.27%

- Steel Price -0.88%