Live From Hong Kong: Alibaba Heads Toward Southbound Inclusion

3 Min. Read Time

Key News

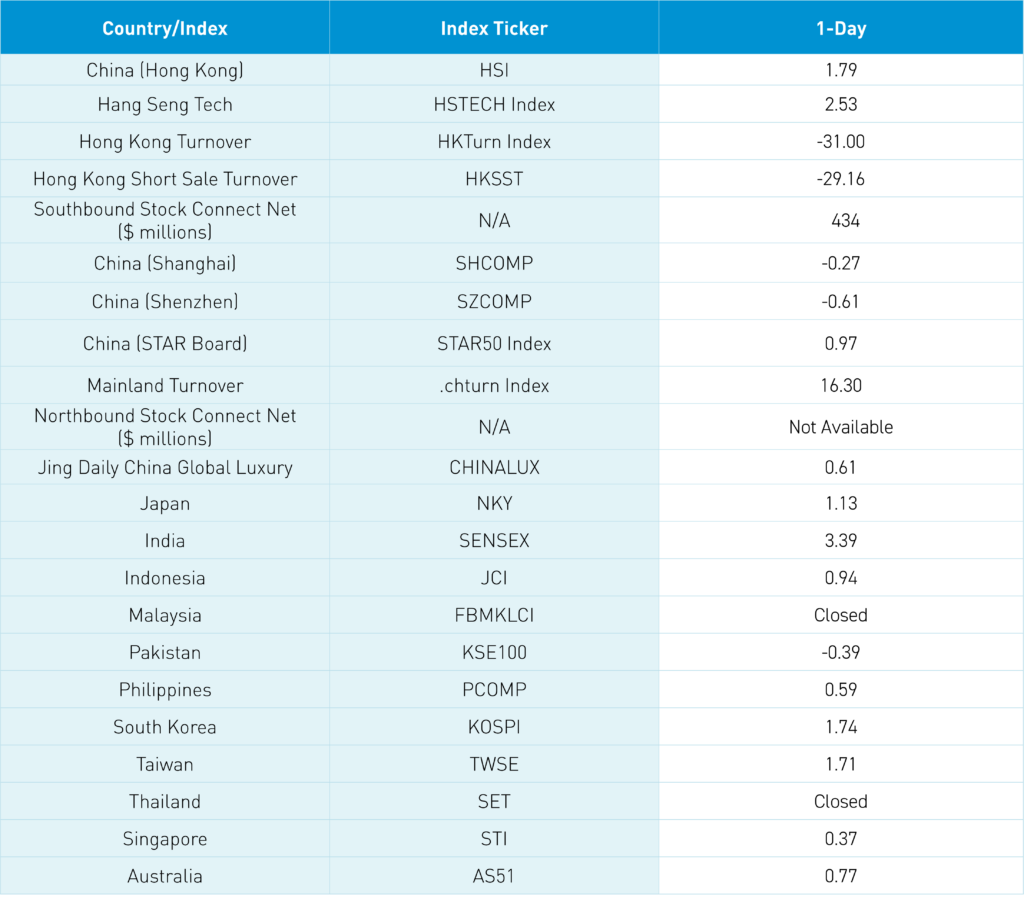

Asian equities cheered my return to the region and Friday’s light US inflation data with strong results, led by Hong Kong. India was a bright spot on strong results from Modi’s BJP party. However, Mainland China underperformed, Malaysia was closed for Yang Dipertuan Agong’s birthday, and Thailand was closed for Queen Suthida Bajrasudhabimalakshana’s Birthday.

There were several positives that lifted the Hong Kong market while Mainland China bounced around the room to ultimately close lower. There was an interesting divergence today in Hong Kong and Mainland China. There has been a noticeable positive uptake in local Hong Kong-based investors' sentiment versus my trip here back in December. Meanwhile, one source noted that the Mainland’s animal spirits have been slower to rebound, in comparison.

Hong Kong’s markets were pressured last week by MSCI’s net sell in China and profit taking from overbought levels due to the strong rally since January. With the index selling done, it wasn’t too surprising to see a bounce, aided by a better-than-expected May Caixin Manufacturing PMI release of 51.7 versus an expected 51.6 and April’s 51.4. I couldn’t help but laugh at a Western media headline on the PMI calling it a “data anomaly, not cause for relief”. We can’t have good China news, can we?

Suzhou became the last city to announce lower first and second home loan limits as Hong Kong-listed real estate stocks rallied, though Mainland-listed real estate stocks were off.

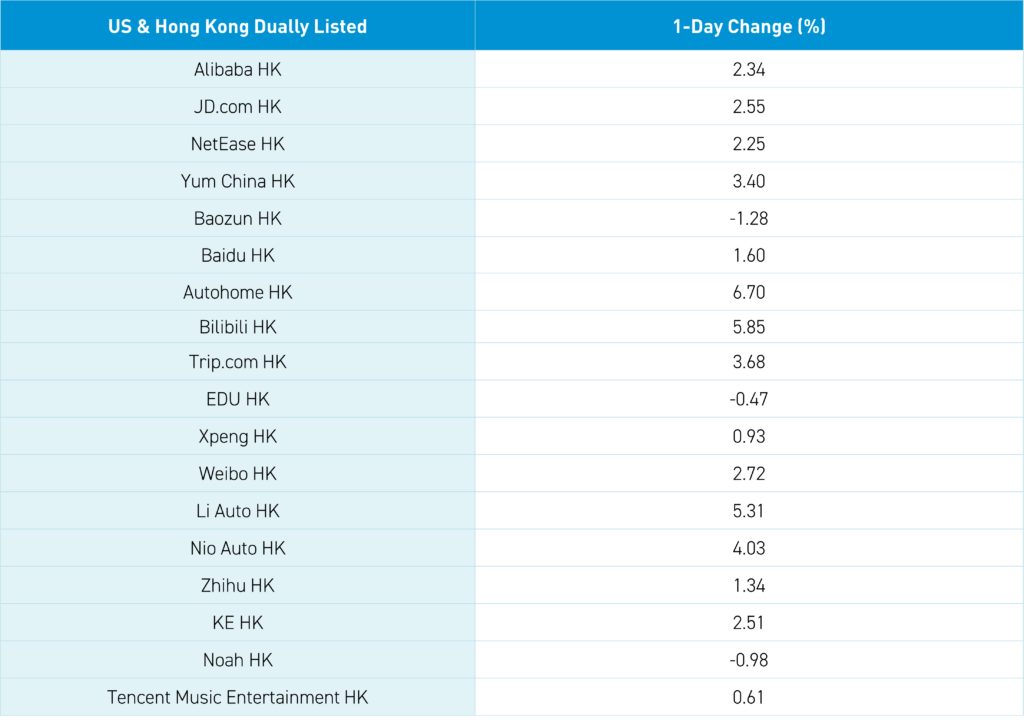

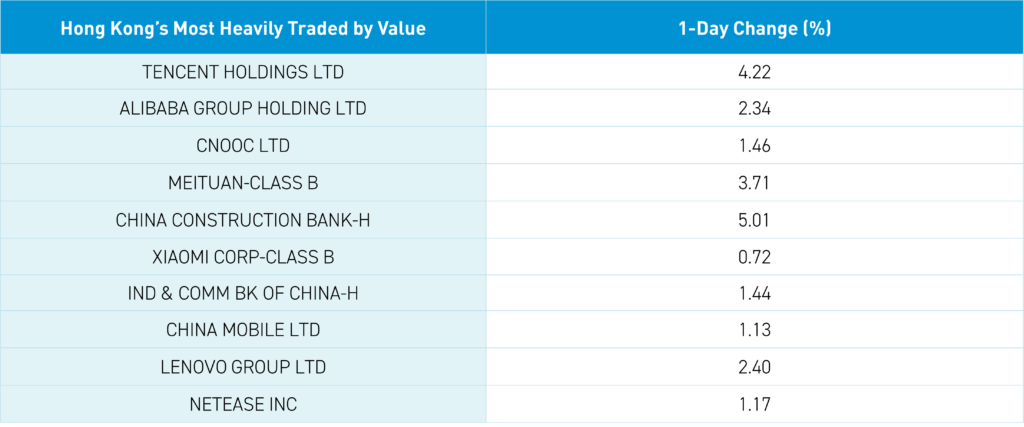

The Hong Kong market had a strong day, led by growth stocks, as Hong Kong’s most heavily traded stocks by value were Tencent, which gained +4.22%, Alibaba, which gained +2.34%, China Mobile, which gained +1.46%, and Meituan, which gained +3.71%, and BYD, which gained +5.01%.

Several Hong Kong news sources noted the belief that Alibaba could be added to Southbound Stock Connect as early as September if the primary listing conversion goes off without a hitch in August. This is sooner than I anticipated, as I had thought March 2025 would be the earliest. Remember that Tencent has just over 9% of their shares held by mainland investors via Southbound Stock Connect.

BYD and the electric vehicle (EV) ecosystem had a strong day following strong May sales with BYD reporting 331,817 new energy vehicles (EVs and hybrids) sold in May, which is an increase of +38.13% year-over-year.

It was an above average day in terms of Hong Kong-listed stock buying from Mainland investors, who purchased a net $434 million.

Semiconductors had another good day as Chinese investors, like global investors, love all things Jensen Huang.

Health Care was the only down sector in Hong Kong, following the US Congress’ call to investigate Genscript Biotech, which fell -17.7%. Don’t these people have better things to do?

Mainland China had a choppy session but slipped in the afternoon. My jet lag is kicking in, so off to bed but with more insights to share with you tomorrow!

The Hang Seng and Hang Seng Tech indexes gained +1.79% and +2.53%, respectively, on volume that declined -31% from Friday, which is 130% of the 1-year average. 335 stocks advanced, while 147 declined. The Main Board short turnover declined -29.16% from Friday, which is 90% of the 1-year average, as 12% of turnover was short turnover (Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). All factors were positive as growth and large caps outperformed value and small caps. The top-performing sectors were Communication Services, which gained +3.68%, Industrials, which gained +2.19%, and Consumer Discretionary, which gained +2.79%. Meanwhile, Health Care was down by -0.6%. The top-performing subsectors were autos, software, and retail. Meanwhile, food and beverage, pharmaceuticals, and healthcare equipment were among the worst-performing subsectors. Southbound Stock Connect volumes were moderate as Mainland investors bought a net $434 million worth of Hong Kong-listed stocks and ETFs, including China Mobile, which was a large net buy.

Shanghai, Shenzhen, and the STAR Board diverged to close -0.27%, -0.61%, and +0.97%, respectively, on volume that increased +16.3% from Friday, which is 98% of the 1-year average. 759 stocks advanced while 4,271 declined. The top-performing sectors were Utilities, which gained +1.78%, Technology, which gained +1.44%, and Consumer Discretionary, which gained +1.17%. Meanwhile, Materials fell -1.28%, Financials fell -0.76%, and Communication Services fell -0.27%. The top-performing subsectors were marine industry, shipping, soft drinks, and motorcycles. Meanwhile, education, paper, and base metals were among the worst-performing subsectors. Northbound Stock Connect volumes were high. CNY was off versus the US dollar. Treasury bonds rallied. Copper and steel both fell.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.25 versus 7.24 Friday

- CNY per EUR 7.86 versus 7.86 Friday

- Yield on 10-Year Government Bond 2.29% versus 2.29% Friday

- Yield on 10-Year China Development Bank Bond 2.40% versus 2.41% Friday

- Copper Price -0.60%

- Steel Price -0.97%