The Policy Dragon Awakens As Mainland China & Hong Kong Rally

3 Min. Read Time

Key News

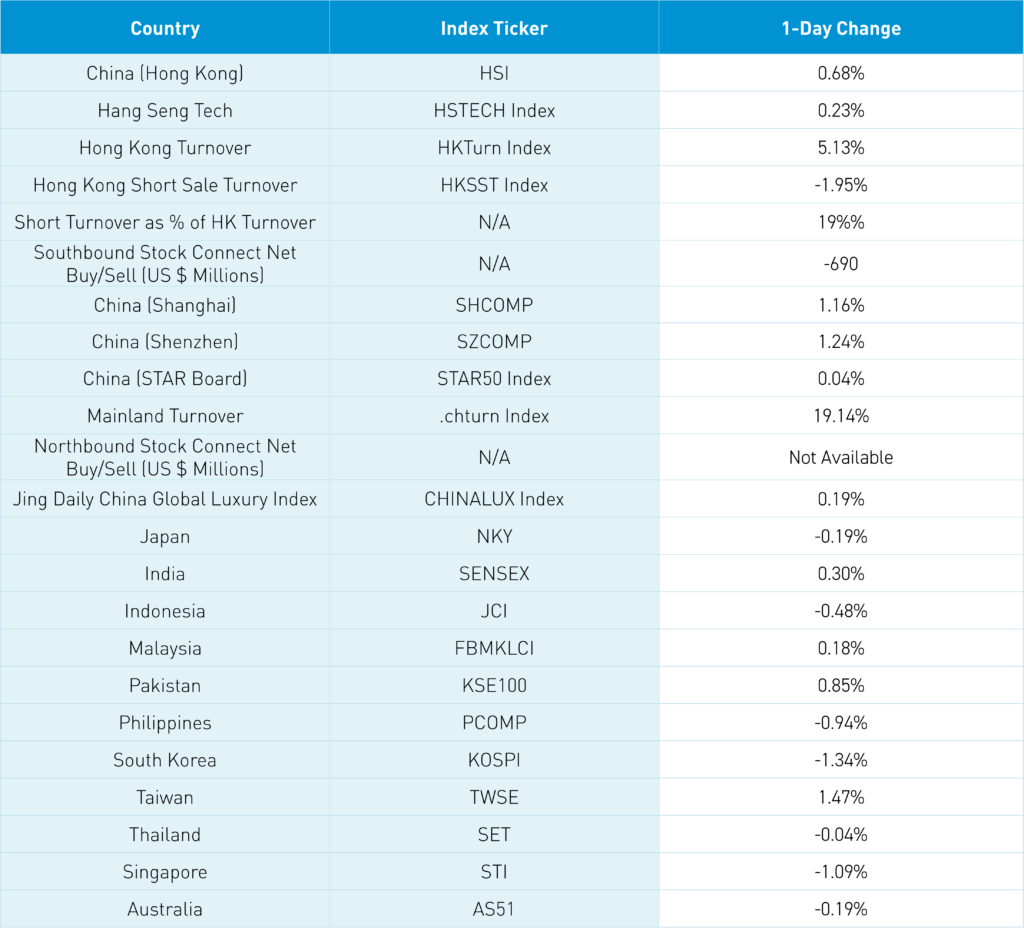

Asian equities were mixed overnight as Mainland China outperformed and South Korea underperformed.

Hong Kong and Mainland China opened higher after yesterday’s monetary policy bazooka. Still, they faded across the trading day, though both managed to post gains, especially the latter, on very higher volumes of 244% and 148% of the 1-year average, respectively.

Skeptics are pointing to the lack of fiscal policy support, though yesterday’s monetary policy moves were completely unexpected and took investors by complete surprise. A bank reserve requirement ratio (RRR) cut of 0.50% with another 0.25% to 0.50% wasn’t a shock, but we also had the 7-day reverse repo rate cut by 0.20%, which led to the loan prime rate (LPR) and deposit rates declining by 0.20%. We also had the mortgage rate reduced by 0.50%, a minimum down payment ratio reduced to 15% from 25%, and RMB 300 billion dedicated to support affordable housing.

Overnight, the medium-term lending facility rate was reduced to 2% from 2.30%. What shocked investors the most was the RMB 500 billion fund dedicated to supporting the Mainland equity market investments, which could be increased if necessary, and RMB 300 billion to support corporate buybacks, which is unprecedented.

Overnight, the China Securities Regulatory Commission (CSRC) announced it would look to reform the mergers and acquisitions rules of listed companies. After the close, the State Council announced it would look at “implementing an employment priority strategy to promote high-quality full employment,” especially for college graduates. How this would occur was a bit opaque, less a focus on vocational skills training, though we can assume more policy will be coming.

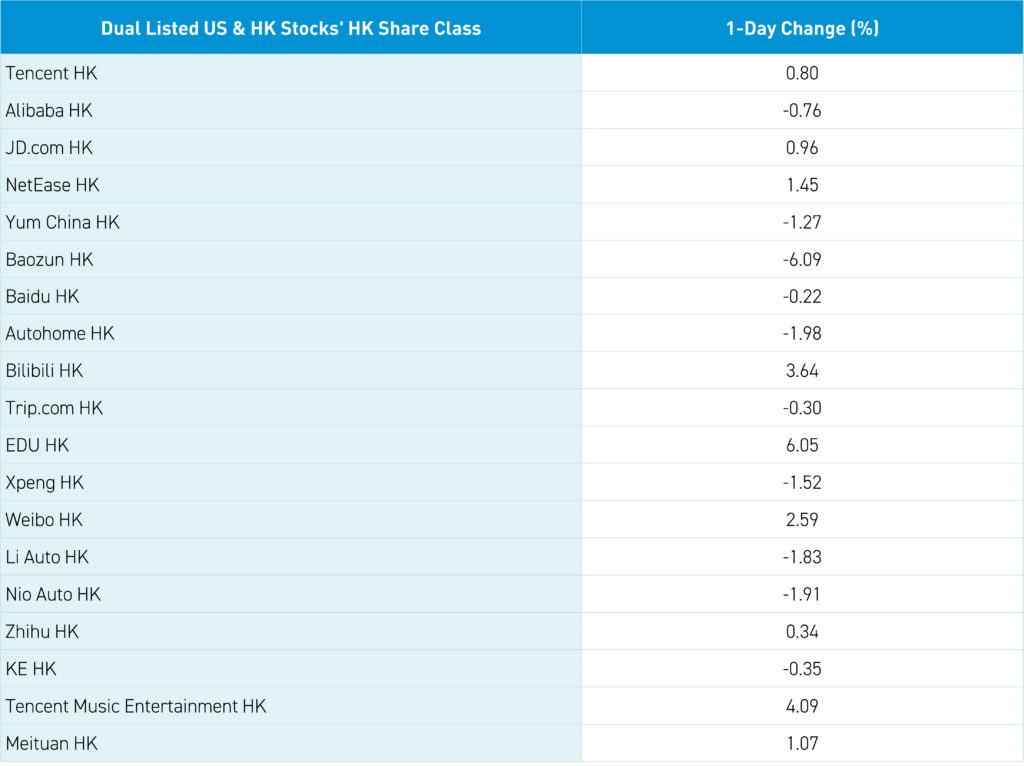

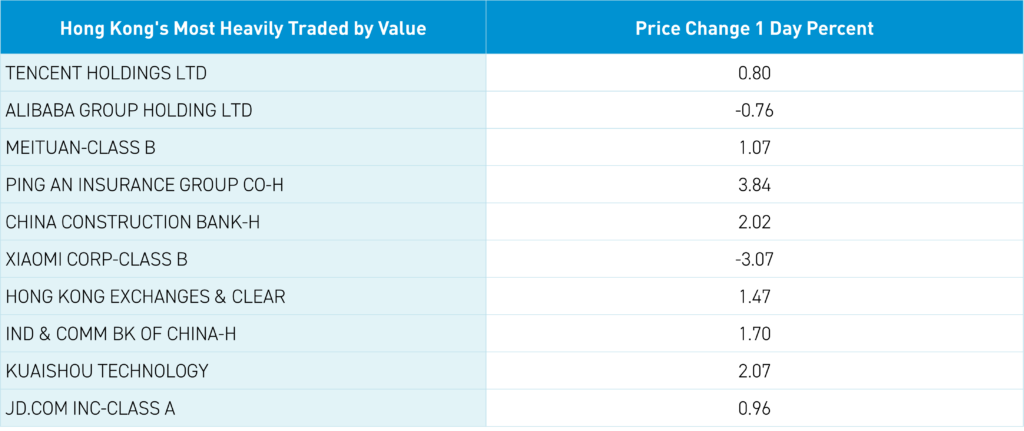

All sectors were positive in Mainland China as Northbound Stock Connect volumes were very high, indicating that overseas money came back into Mainland stocks. Did money come out of Japan and South Korea and back into "cheap" China? It is difficult to know. Mainland money came out of Hong Kong via Southbound Stock Connect with -$690 million of net selling, as Tencent and Meituan were net sells, though Alibaba had $336 million worth of net buying. Is Mainland money coming out of Hong Kong and going back into China a concern? No, because global investors are exceedingly underweight, with the rally coming a month/quarter end problematic for managers who have to disclose their holdings.

Hong Kong growth stocks are where foreign investors will gravitate in my opinion, in addition to internet names that are actually growing fundamentally, unlike most of MSCI China. One factor in today’s fade-off of the highs is starting next Tuesday. Mainland China is closed for a week due to the National holiday. I would suspect an element of Hong Kong selling from the Mainland as profit-taking prior to the holiday from Mainland investors might occur. Hong Kong is only closed next Tuesday. Regardless, the dragon is awakening!

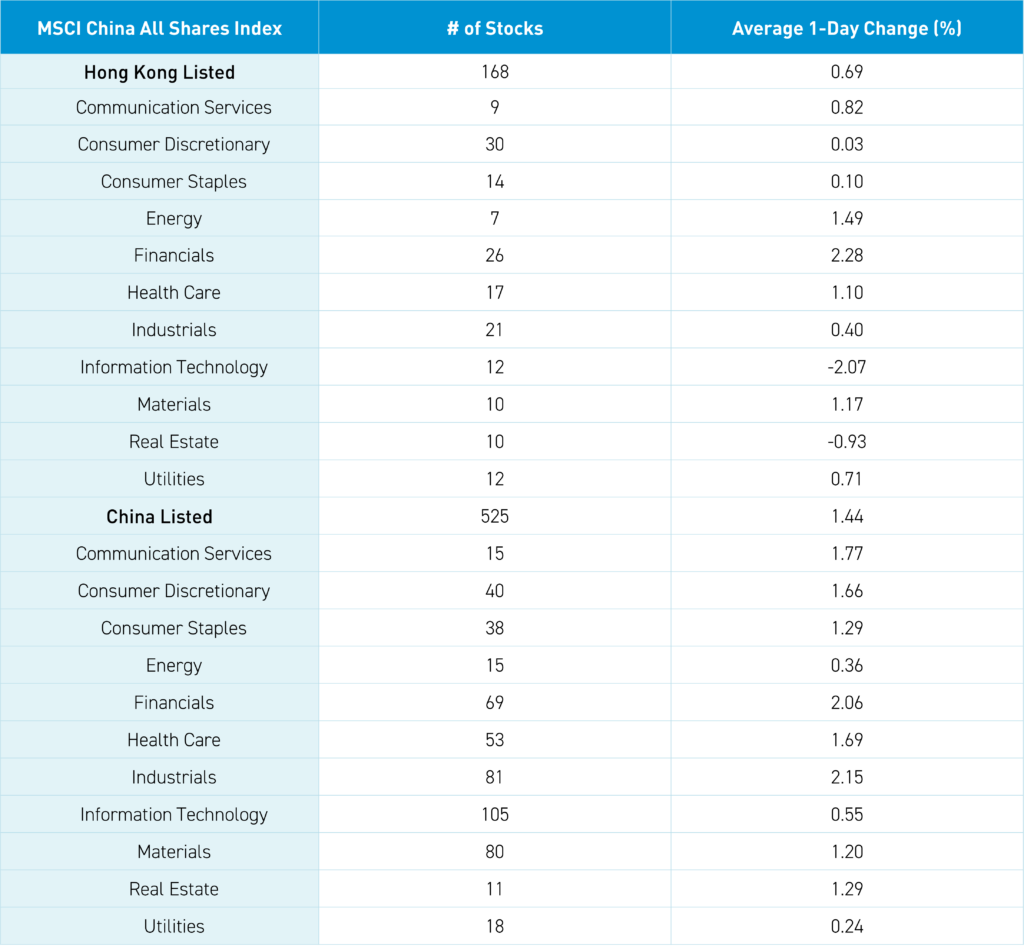

The Hang Seng and Hang Seng Tech indexes gained +0.68% and +0.23%, respectively, on volume that increased+5% from yesterday, which is 244% of the 1-year average. 286 stocks advanced, while 194 declined. Main Board short turnover fell by -1.95% from yesterday, which is 270% of the 1-year average, as 19% of turnover was short turnover (Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor and large capitalization stocks outpaced growth and small capitalization stocks. The top-performing sectors were Financials, up +2.28%, Energy, up +1.49%, and Materials, up +1.17%, while Information Technology fell -2.07% and Real Estate fell -0.93%. The top-performing subsectors included media, insurance, and capital goods. Meanwhile, technical hardware, food & beverage, and consumer services were among the worst-performing. Southbound Stock Connect volumes were very high as Mainland investors sold a net -$690 million of Hong Kong-listed stocks and ETFs, including Alibaba, which was a large net buy, Kuaishou, which was a small net buy, and Tencent and Meituan, which were large net sells.

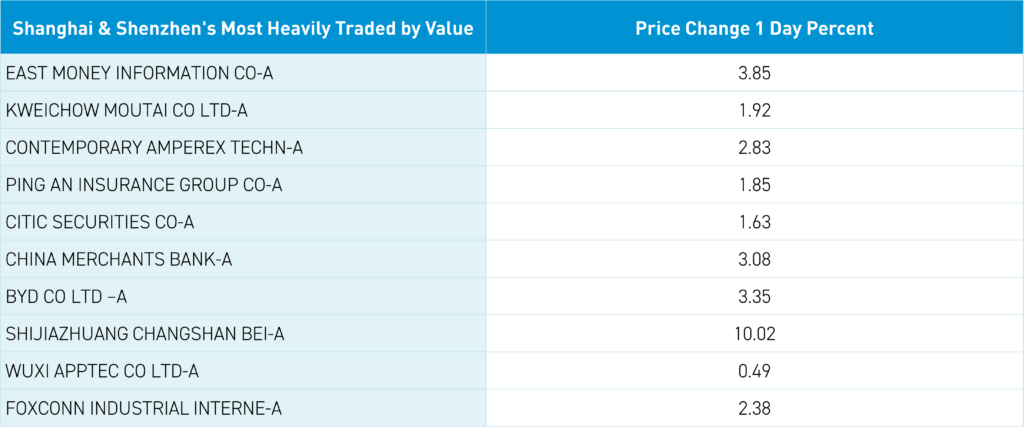

Shanghai, Shenzhen, and the STAR Board gained +1.16%, +1.24%, and +0.04%, respectively, on volume that increased +19% from yesterday, which is 148% of the 1-year average. 4,257 stocks advanced, while 727 stocks declined. The value factor and large capitalization stocks outpaced the growth factor and small capitalization stocks. All sectors were positive, led by industrials, which gained +2.19%, Financials, which gained +2.11%, and Communication Services, up +1.82%. The top-performing subsectors were diversified financials, construction, and heavy machinery. Meanwhile, oil & gas and computer hardware were among just a few negative subsectors. Northbound Stock Connect volumes were very high. CNY and the Asia Dollar Index gained versus the US dollar. Treasury bonds rallied. Copper and steel gained.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.02 versus 7.03 yesterday

- CNY per EUR 7.87 versus 7.83 yesterday

- Yield on 10-Year Government Bond 2.04% versus 2.07% yesterday

- Yield on 10-Year China Development Bank Bond 2.12% versus 2.15% yesterday

- Copper Price +1.73%

- Steel Price +3.05%