Mainland Sees Massive Buying, Hong Kong Growth Flies, Week in Review

5 Min. Read Time

Week in Review

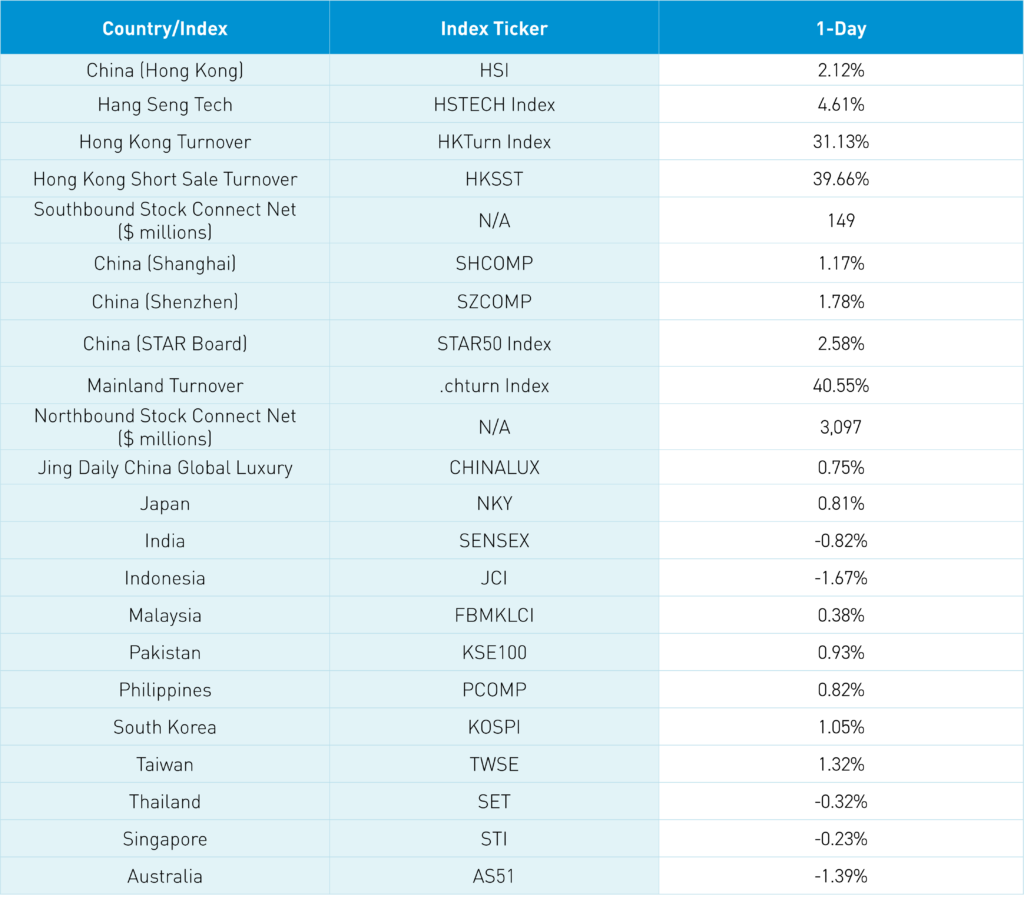

- This week brought both the Hang Seng and the Shanghai Composite into positive territory, year-to-date (YTD) while nearly all Asian equity indexes were higher this week except for Indonesia and Australia.

- The CSI Overseas China Internet Index has outpaced the Nasdaq Composite by nearly 20% since February.

- UBS upgraded China stocks to overweight this week while Goldman Sachs said Mainland stocks warranted a “re-rating” in a research note after

- The Loan Prime Rate (LPR), which helps set mortgage rates, was left unchanged on Monday, as expected.

Friday’s Key News

Asian equities were mixed overnight, as Hong Kong, Mainland China, Taiwan, and South Korea outperformed, gaining more than +1%. Meanwhile, Australia, Indonesia, and India posted losses.

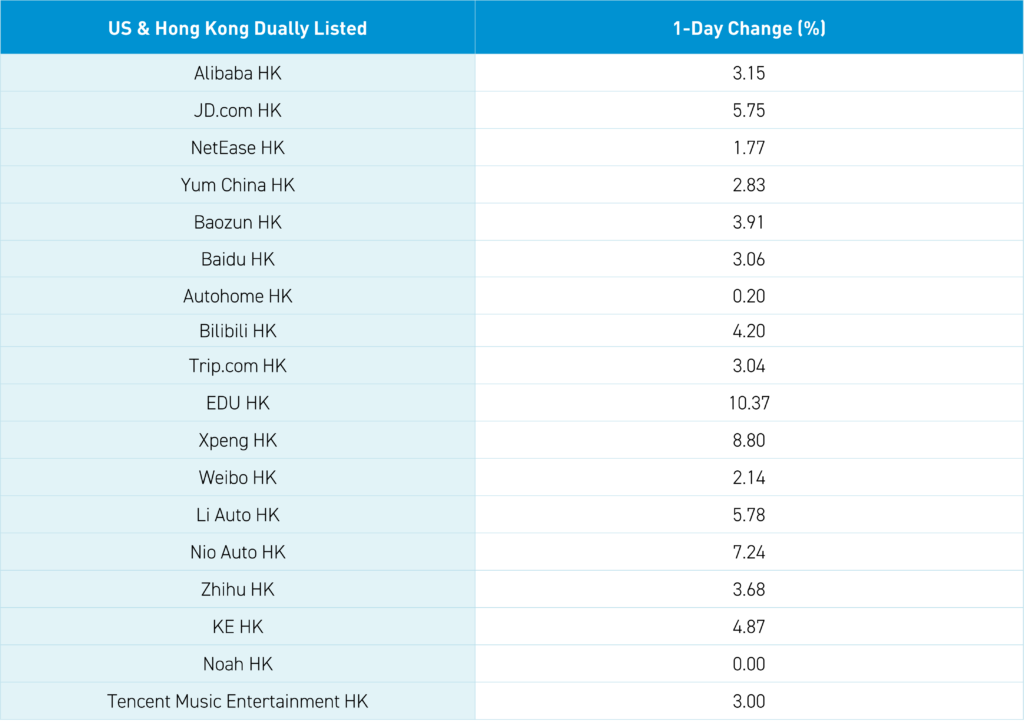

There were multiple catalysts for today’s China rally including the Ministry of Commerce issuing “Implementation Rules for the Subsidies for Trade-in-Listed Vehicles,” which provides a RMB 10,000 subsidy for trading in an old car for an electric vehicle (EV). This sent BYD higher by +4.42% while Li Auto gained +5.78%, Xpeng gained +8.80%, and NIO gained +7.24%. The Beijing Auto Show is also helping the space, featuring multiple, great-looking new launches, including NIO’s ET7 sedan, Huawei-BAIC’s new S9, and BYD’s aZ9 GT and Ocean-M hatchback. NIO and Lotus are partnering on battery swap technology.

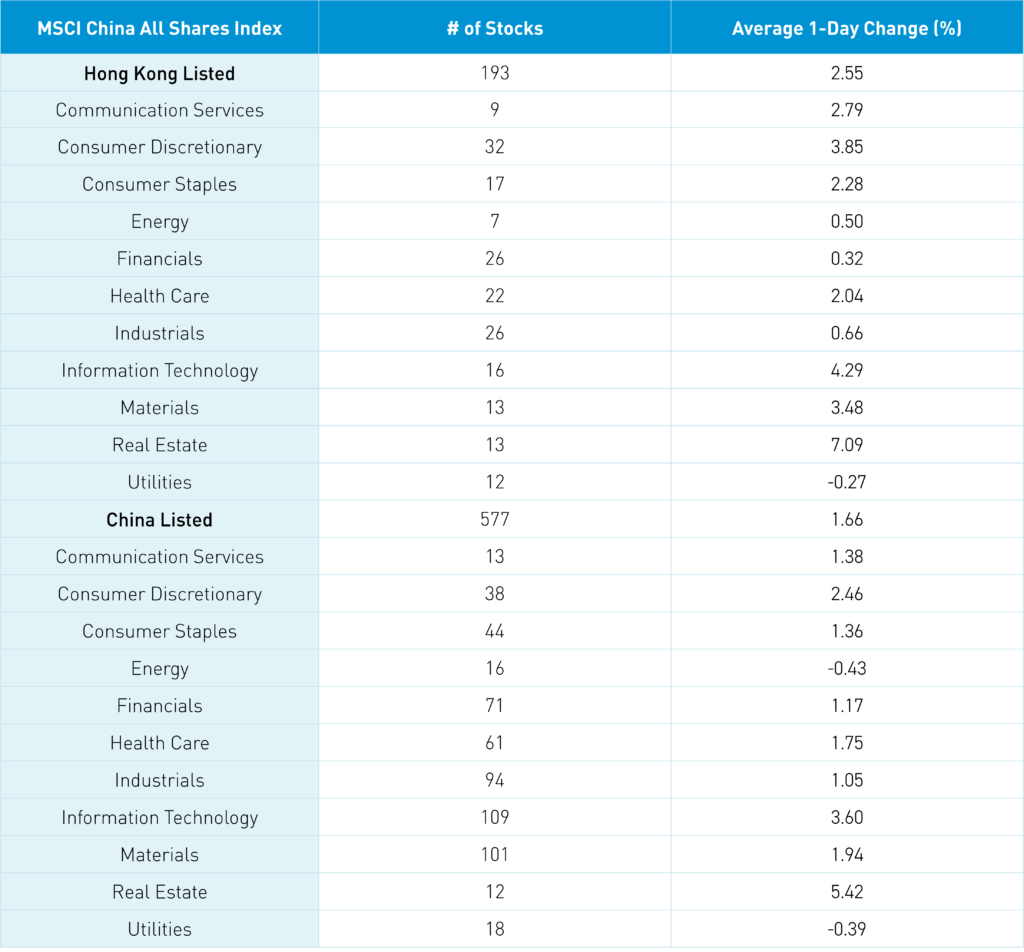

Real estate was the top-performing sector in Mainland China, where it gained +5.42% and Hong Kong, where it gained +7.09%, following the Bloomberg article highlighting UBS’ China and Hong Kong property head John Lam turning positive on the sector after his 2021 downgrade of the sector and especially after Evergrande’s default. On the Mainland, there was also talk of Chengdu, Nanjing, and WuXi land auctions going well, a sign of life for the sector. I still prefer the bonds over the stocks as a real estate recovery play, but no one cares despite the very high yields.

Financials underperformed overall, but brokers soared on the Ministry of Finance’s talk of potentially strengthening the sector through mergers.

President Xi's meeting with US Secretary of State Blinken is a positive, as well.

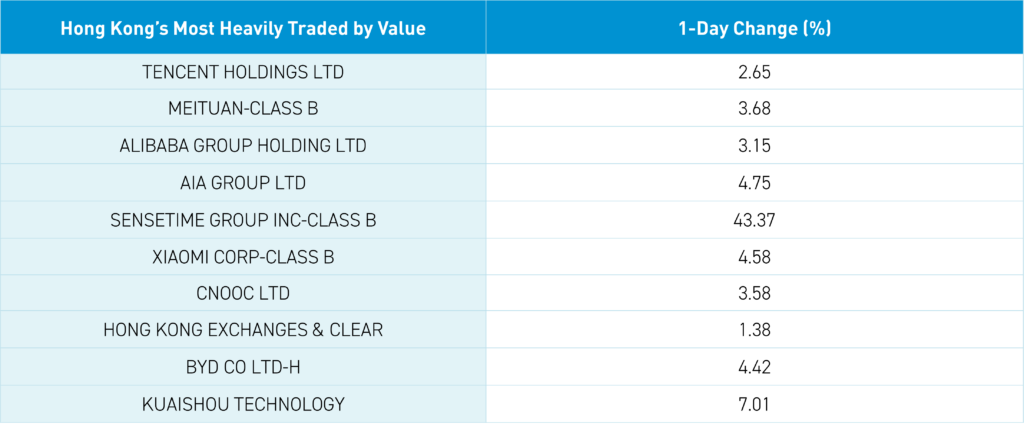

The Hang Seng Index closed above its 200-day moving average for the first time since August 2023 on very high volume, which is 161% of the 1-year average, and very strong advancers versus decliners. Hong Kong’s most heavily traded stocks were Tencent, which gained +2.65%, Meituan, which gained +3.68%, Alibaba, which gained +3.15%, AIA, which gained +4.75%, and Sense Time, which gained +43.37% after yesterday’s news of its new Sense Nova 5 large language model. Growth stocks had a very strong session, indicating foreign investors' interest is picking up as Southbound Stock Connect was not a factor today, with only $149 million worth of net buying.

Mainland China had a strong day as well on volume that was 127% of the 1-year average and good breadth. The Shanghai Composite is now through its 200-day moving average and has reached its highest level since October 2023. This includes massive buying via Northbound Stock Connect today, which indicates strong support from the National Team. Today was the 5th largest net buy via Northbound Stock Connect since the program was launched. Small caps had a strong day, indicating local investors are warming to the rebound, as the STAR Board gained +2.58% versus the Shanghai, which gained +1.17%. This week brought both the Hang Seng and the Shanghai Composite into positive territory, year-to-date. Read below on why we remain constructive on the trade.

We articulated that investors went underweight or neutral on China in the following order: US investors (due to Trump’s trade war, tech competition, Zero Covid, internet regulation), followed by European investors (due to their overweight to Russia stocks and fear over a similar situation in East Asia), followed by Asian investors, who hung in there, but were hurt when the post COVID reopening trade fizzled out, and, lastly, investors located in China, who were hit by January’s derivative-induced meltdown. We believe this underweight will unwind itself in the opposite order. Step 1 could be Chinese investors buying China, which is already happening. Exhibit A: The National Team, or institutional investors associated with sovereign wealth, has already begun buying in size through Hong Kong accounts via Northbound Stock Connect. Today was the fifth largest net purchasing of Mainland stocks via Northbound Stock Connect with $3.1 billion worth of net buying (out of 2,190 trading days). Northbound Stock Connect YTD net buying went up by 50% today to $9.926B The National Team’s favorite Mainland-listed ETF (ticker 510300 CH) had volume todaythat was twice yesterday’s (1.37 million shares versus yesterday’s 664,000). Geez, I wonder who bought Mainland stocks today? Chinese investors are also buying Hong Kong-listed stocks via Southbound Stock, with only $149 million worth of net buying today, though the YTD total is $26.5 billion versus $40 billion in 2023. This is against the backdrop of a massive global and US investor overweight to US stocks (really US large growth and US tech stocks) after outperforming every stock market globally for 15 years with some “diversification” to India and Japan. US Q1 GDP growth? Not good! US inflation? Still high! Poor GDP Growth + high inflation = Stagflation! Could higher for longer hurt US tech stocks? Maybe, though India is overvalued, and Japan’s yen is in intervention territory. I suspect Asian investors are starting to take some profits from US tech, India, and Japan and roll it into cheap Chinese stocks. It is still early days, though!

The Hang Seng and Hang Seng Tech indexes gained +2.12% and +4.61%, respectively, on volume that increased +31.13% from yesterday, which is 161% of the 1-year average. 428 stocks advanced while 68 stocks declined. Main Board short turnover increased +39.65% from yesterday, which is 150% of the 1-year average, as 17% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). All factors were positive as the growth factor and small caps outpaced the value factor and large caps. The top-performing sectors were Real Estate, which gained +7.08%, Technology, which gained +4.29%, and Consumer Discretionary, which gained +3.84%. Meanwhile, Utilities fell -0.28%. The top-performing subsectors were autos, technical hardware, and diversified financials. Meanwhile, Utilities and Banks were among the worst-performing. Southbound Stock Connect volumes were moderate/high as Mainland investors bought a net $149 million worth of Hong Kong-listed stocks and ETFs, including the Bank of China and Kuaishou, which were large net buys, while Meituan was another large net sell, HSBC was a moderate net sell, and the Hong Kong Tracker ETF was a small net sell.

Shanghai, Shenzhen, and the STAR Board gained +1.17%, +1.78%, and +2.58%, respectively, on volume that increased +41% from yesterday, which is 127% of the 1-year average. 3,476 stocks advanced while 1,458 declined. All factors were positive as the growth factor and small caps outpaced the value factor and large caps. The top-performing sectors were Real Estate, which gained +5.42%, Technology, which gained +3.60%, and Consumer Discretionary, which gained +2.46%. Meanwhile, utilities and energy were off -0.39% and -0.43%, respectively. The top-performing subsectors were securities brokers, precious metals, and computer hardware. Meanwhile banking, highways, and coal were among the worst-performing. Northbound Stock Connect volumes were moderate as foreign investors bought a massive net $3.1 billion worth of Mainland stocks, including China Merchants Bank, BYD, and CATL, which were large net buys. Meanwhile, the Bank of Jiangsu, ICBC, and Zijin Mining were net sells.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.25 versus 7.24 yesterday

- CNY per EUR 7.76 versus 7.77 yesterday

- Yield on 1-Day Government Bond 1.40% versus 1.36% yesterday

- Yield on 10-Year Government Bond 2.31% versus 2.26% yesterday

- Yield on 10-Year China Development Bank Bond 2.40% versus 2.35% yesterday

- Copper Price +0.56% overnight

- Steel Price +0.35% overnight