The Tidal Wave of Cash Headed To Hong Kong

5 Min. Read Time

Key News

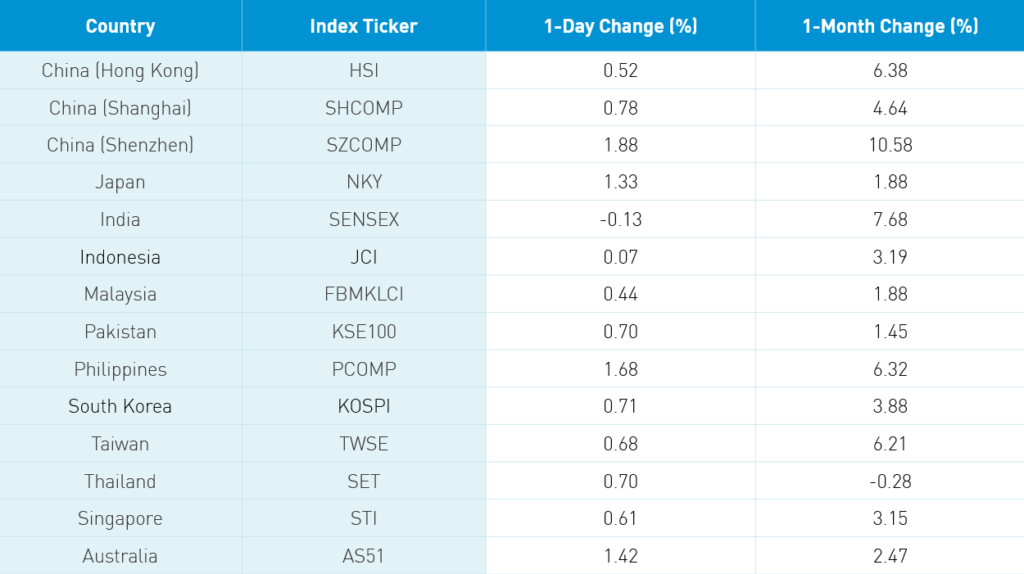

Asian equities ended a month of strong performance on a high note following a positive day in the US. The slow-motion tit for tat passing of the Hong Kong security law and the US revocation of Hong Kong’s trade status were both anticipated by the market. Hong Kong is only losing its trade status with regard to certain tech and defense exports. Lots of bark, but no bite.

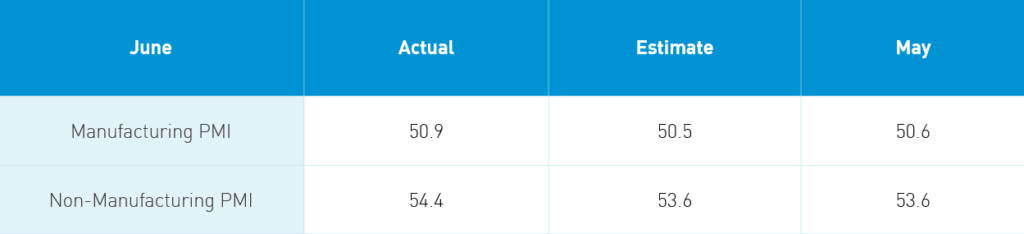

The “official” Purchasing Managers’ Indexes were released prior to the market’s open. By way of background, PMIs are diffusion indices. Readings over 50 indicate growth month over month while readings below 50 indicate contractions. Today’s “official” PMIs are compiled by the National Bureau of Statistics by surveying a large sample size of large companies. The “private” PMI is released by Mainland media company Caixin in conjunction with IHS Markit by surveying a smaller sample size of private companies, mostly medium and small enterprises. Generally speaking, investors have become less reliant on the statistics due to the increasing availability of high frequency economic data. However, they remain important guide posts.

The manufacturing PMI was powered higher by continued growth in output and new orders. Employment came in at 49.1 versus 49.4 for May while new export orders showed less of a contraction, coming in at 42.6 versus May’s 35.3. Imports also showed less of a contraction, coming in at 47 versus May’s 45.3. Input and output prices jumped while business activity expectations were strong. China won’t be immune to the economic consequence of global quarantines, but the rebound is healthy. The “official” Non-Manufacturing PMI also showed a strong pick up in June led by new orders and input prices while employment was still in contraction territory at 48.7. New export orders stayed in contraction territory at 43.3 though that figure was up from May’s 41.3.

China’s PMIs were a positive factor for Hong Kong and Mainland markets as well as news that a Wealth Management Connect program will be launched. The area around Hong Kong, which is comprised of mega city Shenzhen north of Hong Kong and eight other cities in southern China including Guangzhou, is known as the Greater Bay Area. We don’t yet know the details of the plan, but the expectation is for investors in southern China to have access to financial products offered by Hong Kong-based firms. This could lead to ETF Connect coming online as well as power demand for US-listed Chinese companies that have relisted in Hong Kong. If you thought Hong Kong’s status as a financial hub is going away, think again. Are foreign firms going to pull out before the tidal wave of money comes to Hong Kong? I don’t think so.

Another positive development was the announcement that Hainan Island, the Hawaii of China, will have its tax free shopping quota raised to RMB 100k (US $14k).

Volume leader Tencent +2.59%, Semiconductor Manufacturing +1.5% as its STAR Board IPO has been approved, and Alibaba HK +0.1%. Hong Kong Exchanges rose +3.13% thanks to 9 IPOs on the exchange today alone. Growth name Meituan Dianping was up +0.12%, JD.com HK +0.87%, and NetEase HK -1.04%. Macau stocks had a strong day on chatter that the restrictions to casino hub could be lifted soon.

Mainland China saw brokers rebound after yesterday’s selloff, driven by the Wealth Management Connect news. Tech had a great day though unfortunately we didn’t receive a lot of color on why. It is worth noting that India has banned Chinese apps such as TikTok, Weibo, and Tencent’s WeChat in retaliation for the recent border skirmish. You may recall that India had already changed its e-commerce rules to favor domestic companies after Walmart bought the private company Flipkart.

I love receiving my Investors Business Daily hard copy on Saturday morning. I know it is old school to hold a newspaper versus reading digitally, but I love spreading the paper out on a table to view the charts. My father worked in the paper business so maybe I am nostalgic in my support for his industry. One chart that jumped out to me in the futures section was copper. Since the March 23rd low, copper has rallied over 26% after falling 26% from its January 14th high. There are multiple reasons to be bearish today though bulls can find some level of comfort in copper’s resiliency. It is possible that quarantines are limiting copper production, but I’ve not seen that hypothesis confirmed. Perhaps the economic necessity of getting back to work globally is truly the rationale.

Staying on the futures theme, a broker noted that the CSRC made positive comments regarding an MSCI China A Index futures listing in Hong Kong. MSCI and HKeX launched 37 MSCI futures in Hong Kong a few weeks ago though China A was not on the list. The comments indicate a willingness to provide investors with hedging capabilities. It would also check the box on one of three issues for MSCI to begin their China A inclusion (the others being China’s same day settlement and the misalignment of Hong Kong and Mainland China market holidays). A broker felt that the news confirms that Hong Kong’s status as a financial hub is not in jeopardy.

H-Share Update

The Hang Seng opened +0.69% and was up +1.22% before easing in the afternoon session to close +0.52%/+125 index points at 24,427. Volume was nearly -8% from yesterday while breadth was positive with 26 advancers and 22 decliners. Index heavyweight Tencent +2.59%/+72 index points, HK Exchanges +3.13%/+37 index points, and today’s best performer Macau gamer Galaxy Entertainment rose +3.84%/+13 index points. Today’s worst performer was China Overseas Land & Investments -3.1%/-8 index points. Hong Kong-domiciled companies outperformed their Chinese equivalents +0.63% versus +0.01% using the HS HK 35 and China Enterprise indices as proxies. The Chinese stocks within the MSCI China All Shares Index gained +0.48% with communication +2.28%, materials +0.85%, staples +0.43%, tech +0.2%, industrials -0.01%, energy -0.14%, financials -0.16%, discretionary -0.16%, healthcare -0.88%, real estate -1.12%, and utilities -1.6%.

Southbound Connect volumes were moderate as Mainland investors were net buyers of Hong Kong stocks. Volume leaders Tencent, Hong Kong Exchanges, and China Construction Bank all saw outsized buying though Semiconductor Manufacturing was sold marginally. Mainland investors bought $673mm worth of Hong Kong stocks today as Southbound Connect trading accounted for 11.6% of Hong Kong turnover.

A-Share Update

Shanghai and Shenzhen both had strong days moving with a small pull off of the day’s highs to close +0.78% and +1.88% at 2,984 and 1,975, respectively. Volume was +3.8% from yesterday while breadth was very strong with 3,030 advancers and only 615 decliners. Mid and small caps outperformed dramatically over large caps. The Mainland stocks within the MSCI China All Shares Index rose +1.61% with tech +3.22%, communication +2.3%, discretionary +2.03%, real estate +1.78%, healthcare +1.61%, financials +1.36%, staples +1.23%, industrials +1.01%, materials +0.85%, energy +0.68%, and utilities +0.17%.

Northbound Connect trading was closed due to tomorrow’s Hong Kong market holiday.

Last Night’s Exchange Rates & Yields

- CNY/USD 7.07 versus 7.08 yesterday

- CNY/EUR 7.93 versus 7.96 yesterday

- Yield on 1-Day Government Bond 1.17% versus 0.65% yesterday

- Yield on 10-Year Government Bond 2.82% versus 2.85% yesterday

- Yield on 10-Year China Development Bank Bond 3.14% versus 3.16% yesterday