Hong Kong & Mainland China Higher with a China/US Tech Deep Dive

4 Min. Read Time

Key News

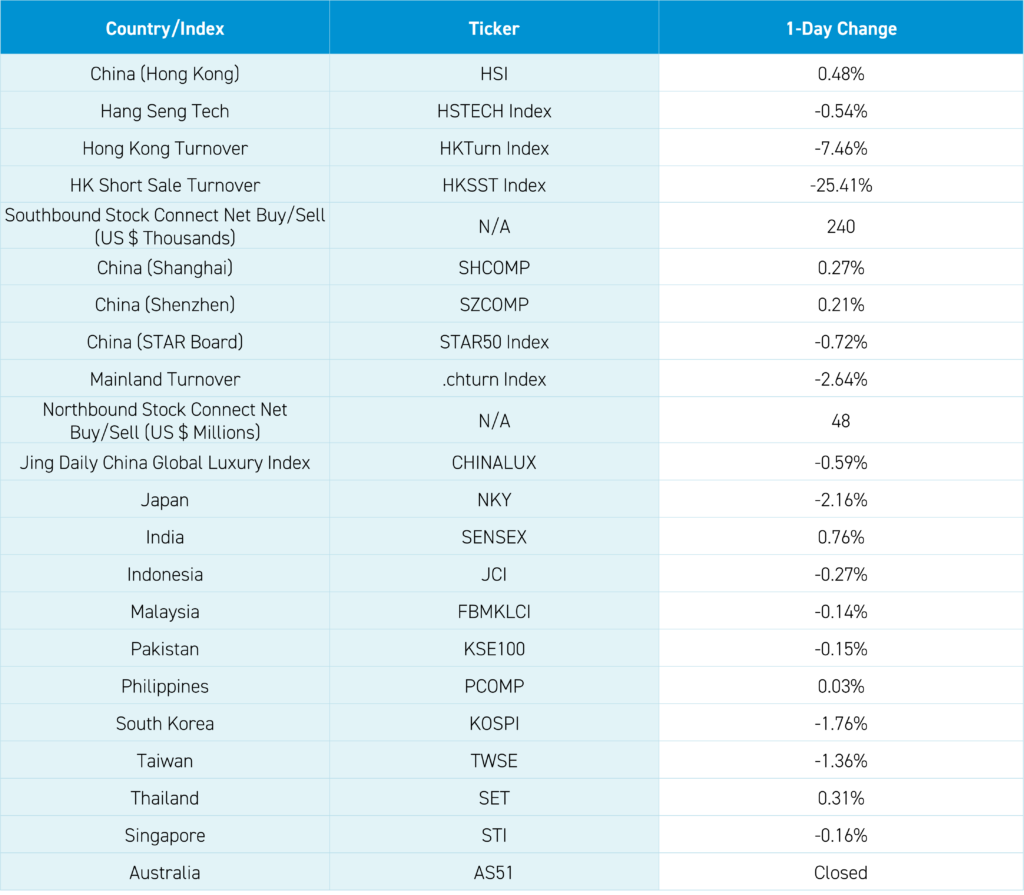

Asian equities were mixed following Meta’s earnings miss, as Hong Kong, Mainland China, and India outperformed, while Japan, South Korea, and Taiwan underperformed. Australia was closed for ANZAC Day, which commemorates the landing of Australian and New Zealand forces on the Gallipoli Peninsula during World War 1, according to Microsoft Copilot.

Bank of America’s Global Fund Manager Survey reports Long Magnificent 7 is the most crowded trade, with short China equities as the second. As we discuss below, going long US tech and short China tech has been inflicting pain since the Chinese market bottomed on February 2nd.

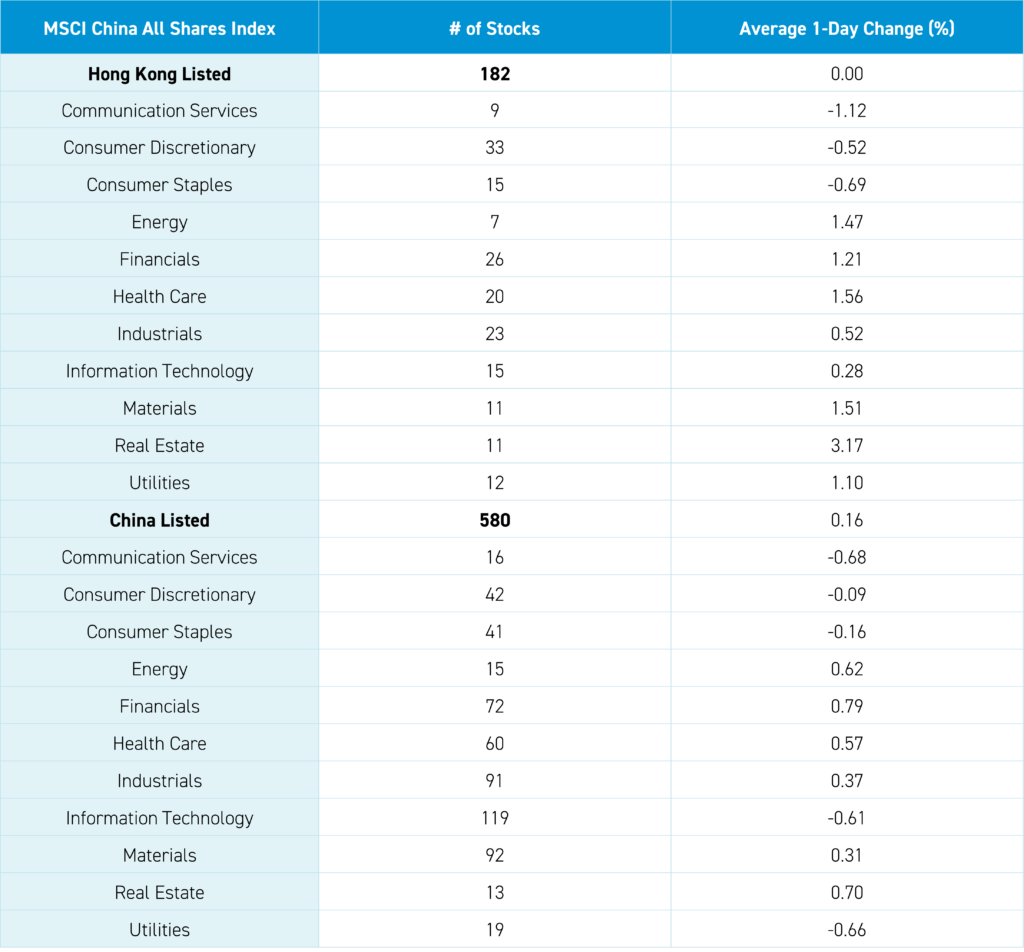

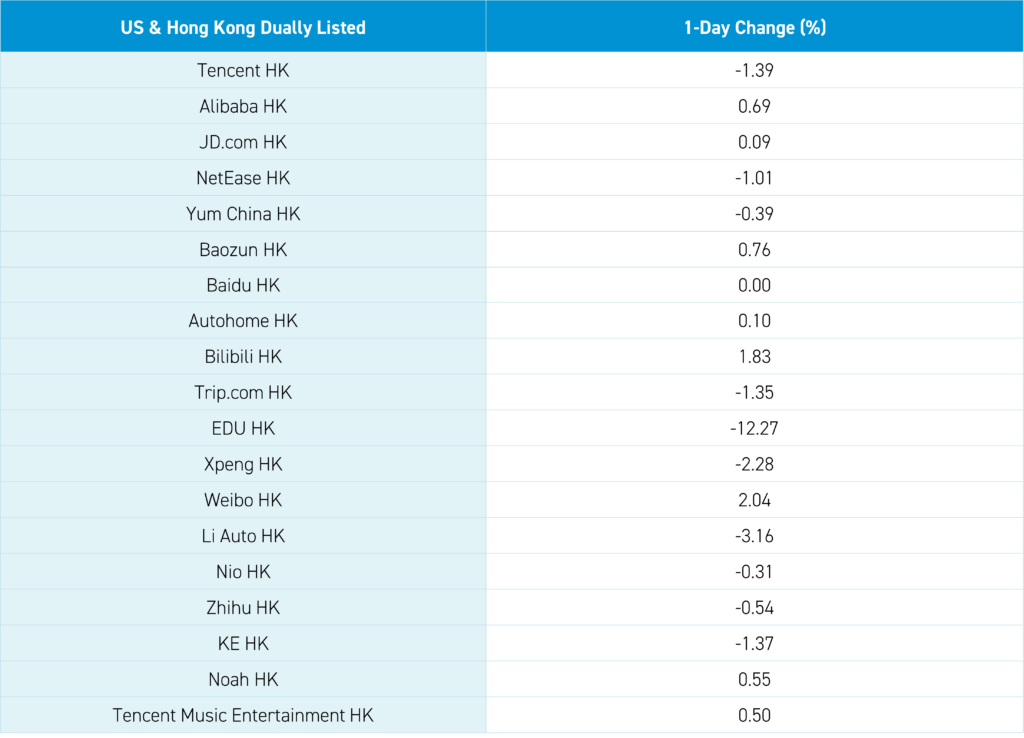

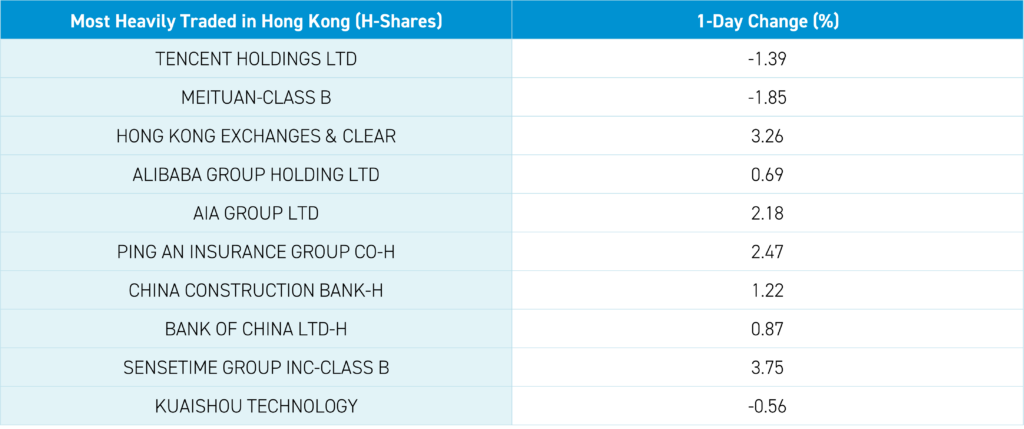

There was light news in Hong Kong as the market opened lower, but grinded higher in choppy trading as value sectors outpaced growth. The Hang Seng Index gained +0.54% while the Hang Seng Tech Index was off -0.49%, with internet names mixed after a strong run. Hong Kong’s most heavily traded stocks by value were Tencent, which fell -1.39%, Meituan, which -1.85%, Hong Kong Exchanges, which gained +3.26%, Alibaba, which gained +0.69%, and AIA, which gained +2.18%. Real estate was the top-performing sector after yesterday’s news of Shenzhen relaxing home purchase restrictions, while healthcare bounced back today. Mainland investors bought a net $240 million worth of Hong Kong-listed stocks and ETFs via Southbound Stock Connect.

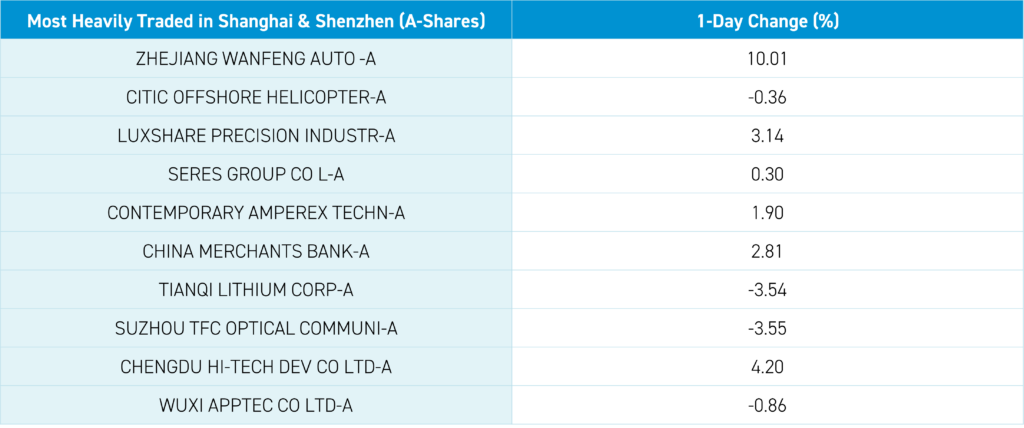

Mainland China was mixed as Shanghai and Shenzhen posted small gains led by value sectors after opening lower though the STAR Board declined -0.72%. Mega/large caps are outperforming significantly compared to small caps year-to-date. Earnings season is in full swing for Mainland stocks, with Great Wall Motors +7.04% after revenue increased +48% year over year and net income increased a mere +1.753% YoY! Treasury and corporate bonds continue to rally in China, which we’ll discuss more tomorrow! TAL Education reported Q4 results before the US market that beat analyst expectations. The Beijing Auto Show started today with multiple new car announcements expected and was attended by the management teams of automakers globally.

If I could predict the future, I would charge 2 & 20 fees. Despite my lack of a magic crystal ball, there is a rationale for why I am constructive on Chinese equities. The bottom in Chinese equities may have occurred on February 2nd after the derivative-induced meltdown in January following a multi-year ownership reduction in Chinese stocks. Since then, the outperformance of China Tech versus US Tech has been significant, about +18 %. This rally has garnered ZERO attention from the Western financial media. The underweight to Chinese equities started with US investors (Trump/Trade, War/Zero COVID/Internet regulation), followed by European investors (fearing Russia/Ukraine could be China/Taiwan), followed by Asian investors (slower exposure decline due to geographic/economic importance and proximity) and lastly Chinese investors. I suspect the re-rating of China will occur in the opposite order.

Step 1 might have already taken place as Southbound Stock Connect has been strong year-to-date with $26 billon of net buying versus $40 billon in 2023. The daily net buy amount since the "9 Measures/Opinions" announcement on April 12th is 2X the year-to-date (YTD) average ($600 million versus $300 million). Step 2 would be for Asian investors to take profits/a portion of their allocation in high-valuation US Tech, Indian, and Japanese stocks and reinvest in cheap Chinese stocks. This will be harder to discern, though clearly some of the shine has come off of US Tech, professional investors’ weight to India is decreasing on valuations, and the Yen per USD number being above 150 makes a currency intervention feasible. This process won’t happen overnight, except for hedge funds, technical analysts, and trend followers, who historically can pivot quickly as they are motivated by profit while being unencumbered by emotional biases. Time will tell how this plays out.

The Hang Seng and Hang Seng Tech indexes diverged to close +0.48% and -0.54%, respectively, on volume that decreased -7.46% from yesterday, which is 123% of the 1-year average. 304 stocks advanced, while 165 declined. Main Board short turnover fell -25.41% from yesterday, which is 108% of the 1-year average, as 16% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor outperformed the growth factor. The top sectors were real estate +3.18%, healthcare +1.57%, and materials +1.52%, while communication -1.11%, staples -0.68%, and discretionary -0.51%. The top sub-sectors were insurance, diversified financials, and energy, while software, food/beverage, and retailing were the worst. Southbound Stock Connect volumes were moderate/high as Mainland investors bought $240mm of Hong Kong stocks and ETFs with Bank of China moderate net buy, Tencent and Hong Kong Exchanges small net buys, while Meituan was a large net sell.

Shanghai, Shenzhen, and the STAR Board diverged to close +0.27%, +0.21%, and -0.72%, respectively, on volume that decreased -2.64% from yesterday, which is 90% of the 1-year average. 2,702 stocks advanced, while 2,183 declined. The value factor and large caps outperformed the growth factor and small caps. The top sectors were financials +0.79%, real estate +0.7%, and energy +0.62%, while communication -0.68%, utilities -0.66% and tech -0.61%.The top sub-sectors were forest, airport, and aviation, while motorcycle, communication equipment, and aerospace/military were the worst. Northbound Stock Connect volumes were moderate as foreign investors bought $48mm of Mainland stocks with CMB a moderate net buy, LXJM a moderate/small net buy, and CATL a small net buy, while Midea Group, Transsion, and Haier were small net sells. CNY and the Asia dollar index were off small versus the US dollar. Treasury bonds rallied. Copper and steel gained.

Happy birthday to my wife!

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.24 versus 7.24 yesterday

- CNY Per EUR 7.77 versus 7.74 yesterday

- Yield on 10-Year Government Bond 2.26% versus 2.27% yesterday

- Yield on 10-Year China Development Bank Bond 2.34% versus 2.35% yesterday

- Copper Price +0.85%

- Steel Price +0.38%