Biden’s Alibaba Bark Has No Bite

<1 Min. Read Time

Key News

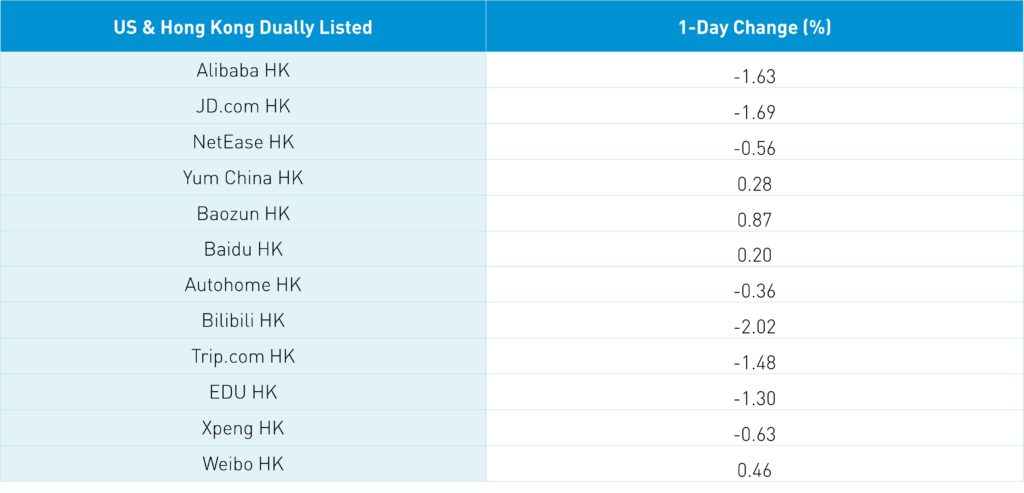

Asian equities were a sea of red other than China and the Philippines overnight. Reuters is reporting “according to three people briefed on the matter… the Biden Administration is reviewing e-commerce giant Alibaba’s cloud business to determine whether it poses a risk to US national security”. Clearly, there are some loose lips if three different people were willing to spill the beans. However, this is a non-event as even the article admits Alicloud only has $50 million of revenue generated in the United States. If this happens:

A) Alibaba should sue in US court as it would win just as Xiaomi and Tik Tok did.

B) Microsoft and Amazon could be the target for a tit for tat response due to their cloud business in China.

Over the three-day weekend, the PBOC cut the 1-year medium-term lending facility from 2.95% to 2.85% and the reverse repo rate to 2.1% from 2.2%. Banks are expected to lower their loan rates in response. The cut occurred on Monday as the December/2021 data release largely beat expectations and policymakers recognize China’s economy will face some challenges in 2022. 2021 GDP growth year-over-year was 8.1%, Q4 GDP was 4%, 2021 retail sales rose +12.5%, December retail sales rose +1.7%, 2021 industrial production rose +9.6%, and December industrial production rose +4.3%. Getting the consumer going should be a key focus though we will see further easing measures as policymakers act proactively.

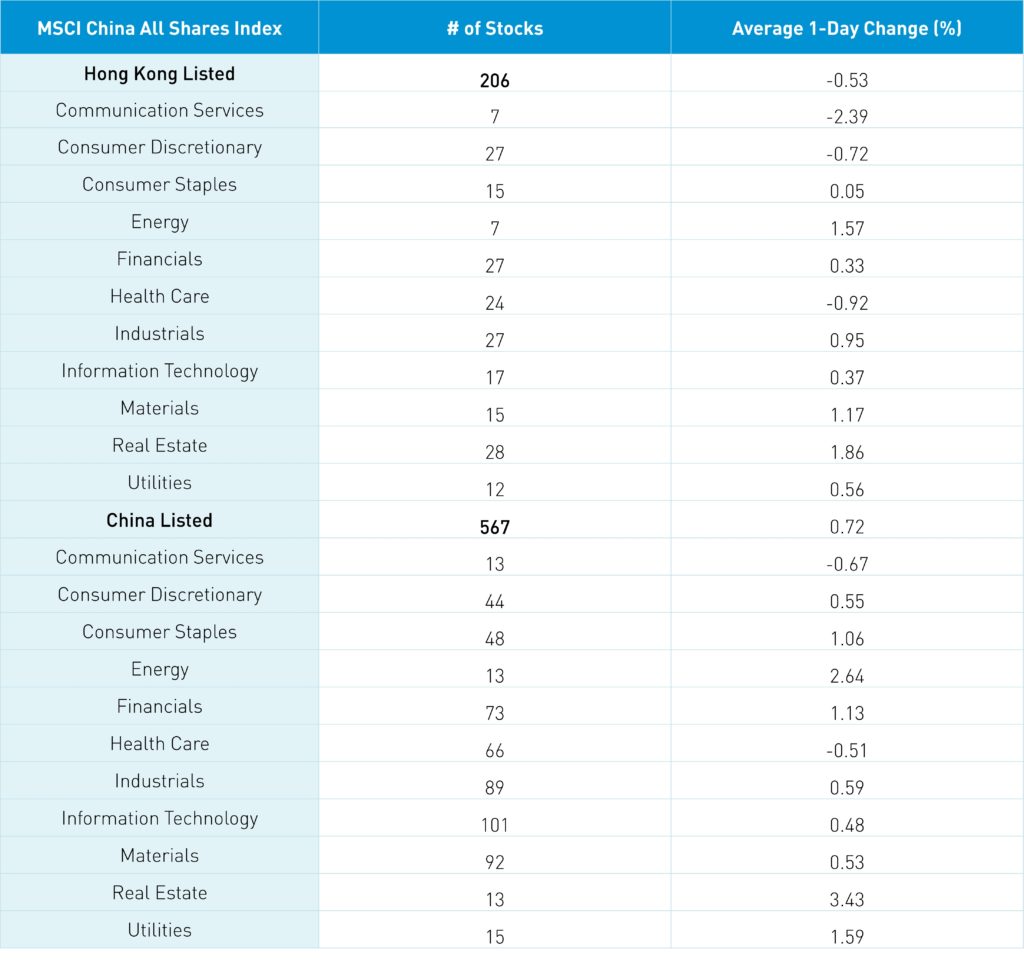

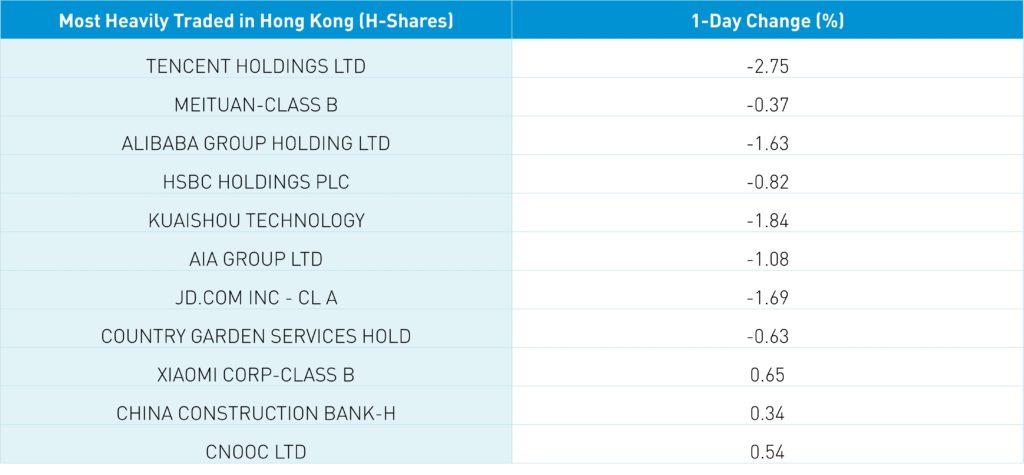

On Monday, Mainland markets posted small gains while Hong Kong was off a touch. Overnight, we had a similar market response as Hong Kong was off with internet stocks down after a strong start to the year. Tencent has been buying back 440,000 shares a day though has seen net selling by Mainland investors via Southbound Stock Connect over the past two days. Meituan has seen net buying from Mainland investors.

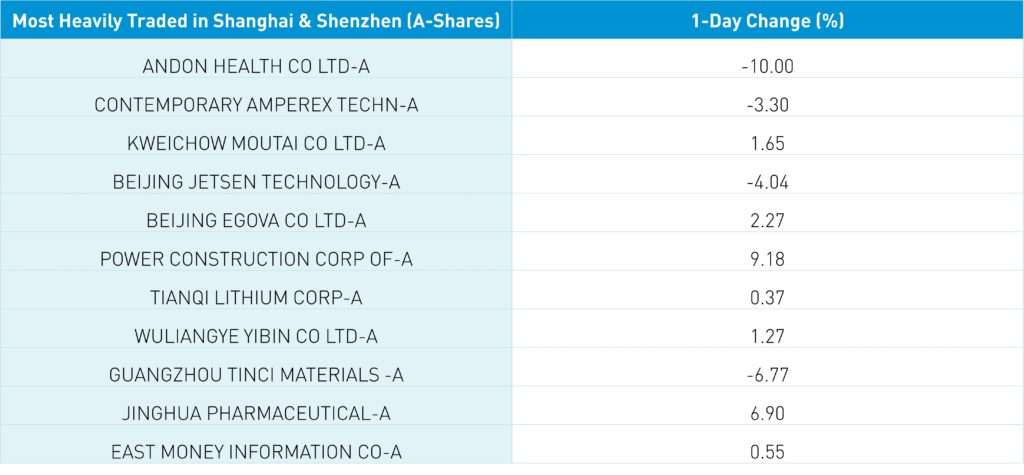

Most sectors were up today though the tech heavyweights weighed on the Hang Seng. Liquor stocks had a strong day in both Hong Kong and the Mainland in advance of Chinese New Year celebrations while real estate is seen as a beneficiary of lower rates. Shanghai outperformed overnight while healthcare and biotech were off. Foreign investors were net buyers of Mainland stocks on Monday, purchasing a total of $268 million and another $367 million today via Northbound Stock Connect.

A sleeper story was the strength of the Renminbi on Monday as it dipped below 6.35 though it eased back to 6.3 overnight.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.35 versus 6.35 yesterday

- CNY/EUR 7.22 versus 7.27 yesterday

- Yield on 10-Year Government Bond 2.74% versus 2.79% yesterday

- Yield on 10-Year China Development Bank Bond 3.05% versus 3.08% yesterday

- Copper Price -0.17% overnight