Strategist Upgrades Maintain Hong Kong’s Rise

4 Min. Read Time

Key News

Asian equities were largely higher as Hong Kong and Singapore outperformed while Mainland China was off.

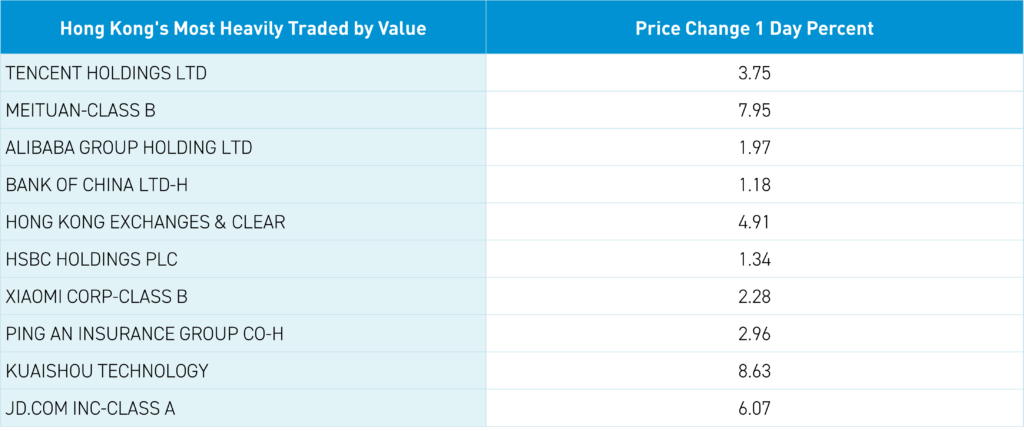

Hong Kong-listed growth and technology stocks powered higher following a strong day for their US-listed counterparts yesterday. Hong Kong’s most heavily traded stocks by value were Tencent, which gained +3.75% after purchasing another 3 million shares, Meituan, which gained +7.95% after purchasing 4 million shares, Alibaba, which gained +1.97%, Bank of China, which gained +1.18%, and Hong Kong Exchanges, which gained +4.91%.

Catalysts today include verbal support from the China Securities Regulatory Commission (CSRC), China's SEC, of Hong Kong as a financial hub. This was followed by today’s news that UBS’ emerging markets strategy team upgraded China to overweight, with an emphasis on internet and consumer stocks. Meanwhile, Goldman Sachs’ Chief China Equity Strategist outlined how a potential “re-rating” of Chinese equities could occur following the "Nine Opinions" released by the government, which I discuss below.

Intra-day, the market powered through today’s Wall Street Journal headline on the US government weighing sanctions on Chinese banks if they are found to be aiding Russia, which is widely seen as a negotiating tool for Secretary of State Blinken’s China trip. I recall one month ago, Chinese banks took steps to ensure they were not aiding Russia’s war efforts.

I suppose the passage of a bill in the House that includes the TikTok ban did not phase the market, as most recognize that a ban will be challenged in the courts. Another non-event was Chinese bubble tea maker Sichuan Baicha, which raised $331 million in their Hong Kong IPO, though the stock slumped -26.86%.

Hong Kong-listed technology stocks continued to widen their outperformance of US-listed technology stocks since February. Investors are woefully poorly positioned if this continues.

Mainland China was lower despite press on the $40 billion worth of local equity ETF buying from Central Huijin Investment, which is akin to China’s sovereign wealth fund. Foreign investors were net sellers of Mainland stocks, to the tune of -$400 million, though several foreign favorites saw net positive inflow, including Zijin Mining and Kweichow Moutai.

Japanese stocks have benefited from both the government’s purchase of nearly $500 billion worth of Japanese equity ETFs since 2010 and, more recently, the corporate governance reform focused on companies raising their price-to-book ratios above one.

The "Nine Opinions" highlighted by Goldman is actually a release titled “Several Opinions on Strengthening Supervision and Preventing Risk to Promote High-Quality Development of the Capital Market” was released on Friday, April 12th. Interestingly, this release did not come from the CSRC, but rather from the State Council, the upper echelon of China’s government. The document states that the government intends to "Strengthen the supervision of cash dividends of all listed companies. For companies that have not paid dividends for many years or have a low dividend ratio, major shareholders will be restricted from reducing their holdings, and risk warnings will be implemented. Meanwhile, they will also implement "Increased incentives for high-quality dividend-paying companies and take multiple measures to increase dividend rates.” It also states the intention to “Guide listed companies to repurchase their shares and then cancel them in accordance with the law.”

Bloomberg News is reporting that total Mainland China equity ETF buying by China’s sovereign wealth fund was at least $43 billion in Q1 2024 versus only $6.8 billion in the second half of 2023. The report does not touch on individual stock buying. Does this scenario sound familiar? Hopefully, Chinese stocks will follow the same path as Japanese stocks, i.e., higher!

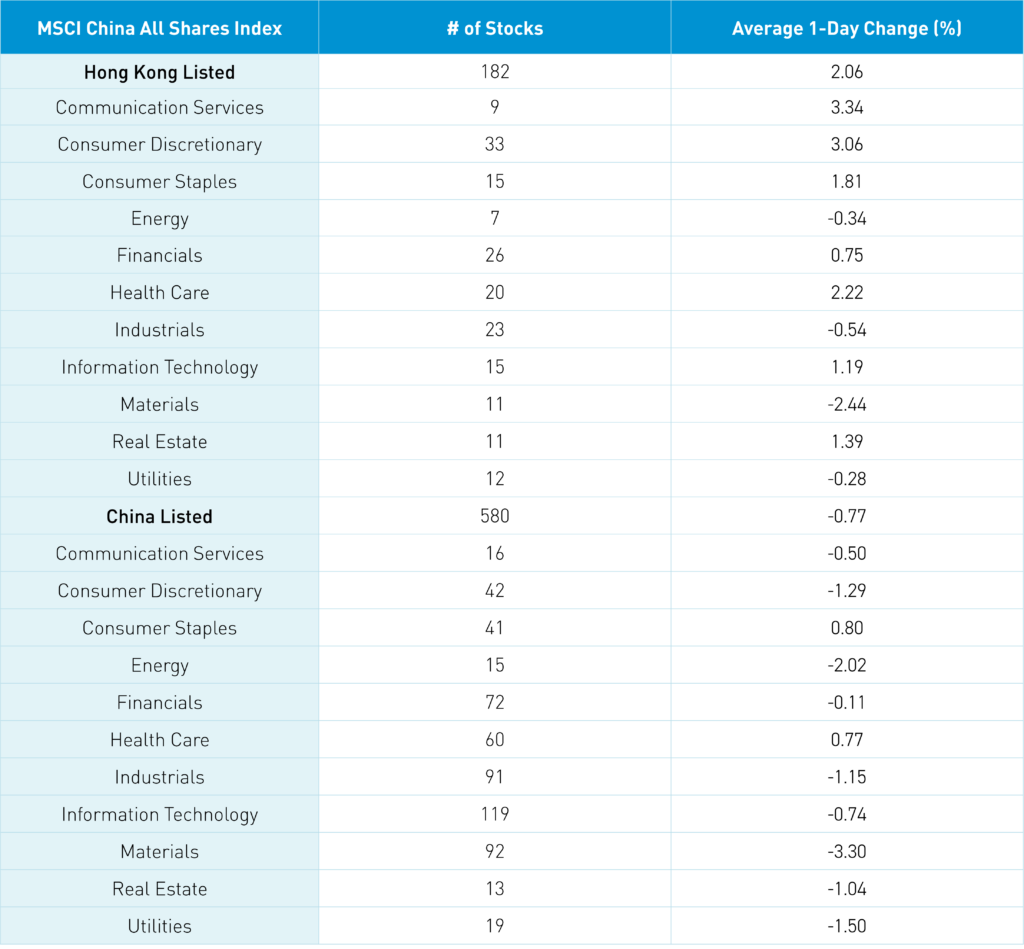

The Hang Seng and Hang Seng Tech indexes gained +1.92% and +3.38%, respectively, on volume that increased +10.56% from yesterday, which is 119% of the 1-year average. 316 stocks advanced, while 155 declined. Main Board short turnover increased by +12.31% from yesterday, which is 126% of the 1-year average, as 19% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The growth factor and large caps outperformed the value factor and small caps. The top-performing sectors were Communication Services, which gained +3.34%, Consumer Discretionary, which gained +3.06%, and Health Care, which gained +2.23%. Meanwhile, Materials fell -2.44%, Industrials fell -0.53%, and Energy fell -0.33%. The top-performing subsectors were retail, software, and pharmaceutical/biotech. Meanwhile, food & beverage, materials, and capital goods were among the worst-performing subsectors. Southbound Stock Connect volumes were moderate as Mainland investors bought a net $298 million worth of Hong Kong-listed stocks and ETFs, including the Bank of China, which was a large net buy, Tencent, and Hong Kong Exchanges (HKEX). Meanwhile, HSBC, Meituan, and Zijin Mining were moderate net sells.

Shanghai, Shenzhen, and the STAR Board fell -0.74%, -0.19%, and -0.54%, respectively, on volume that decreased -5.61% from yesterday, which is 90% of the 1-year average. 3,024 stocks advanced, while 1,909 declined. All factors were negative, though the growth factor fell less than the value factor. Consumer Staples and Health Care gained +0.80% and +0.77%, respectively, while Materials fell -3.3%, Energy fell -2.02%, and Utilities fell -1.5%. The top-performing subsectors were chemicals, education, and healthcare. Meanwhile, precious metals, base metals, and petrochemicals. Northbound Stock Connect volumes were moderate as foreign investors sold a net -$413 million of Mainland stocks though Zijin Mining, Kweichow Moutai, and CMOC were moderate net buys. Meanwhile, Midea was a moderate net sell, along with CITS and IFYTEK. CNY was off slightly versus the US dollar. Treasury bonds fell. Copper and steel both declined.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.24 versus 7.24 yesterday

- CNY Per EUR 7.72 versus 7.70 yesterday

- Yield on 10-Year Government Bond 2.22% versus 2.24% yesterday

- Yield on 10-Year China Development Bank Bond 2.29% versus 2.31% yesterday

- Copper Price -1.52%

- Steel Price -0.22%