Foreign Investors Raise China Allocations Overnight

3 Min. Read Time

| Upcoming Webinars |

| Join us on Wednesday, January 11th at 11 am EST for our webinar: Managed Futures: 2022 Unwrapped and Remixing Classic Portfolios Click here to register Join us on Thursday, January 12th at 10 am EST for our China webinar: Back to Business for China & 2023 Outlook Click here to register |

Key News

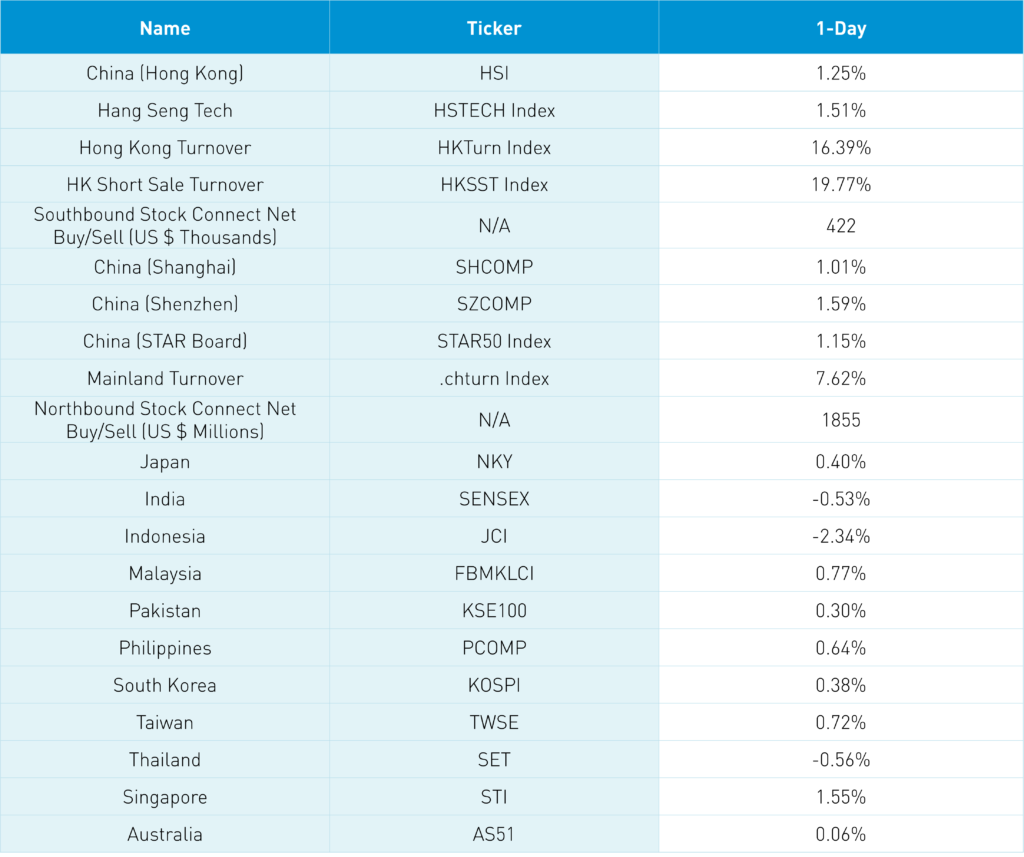

Asian equity markets were higher as Hong Kong, China, and Singapore outperformed, while Indonesia was off more than -2%.

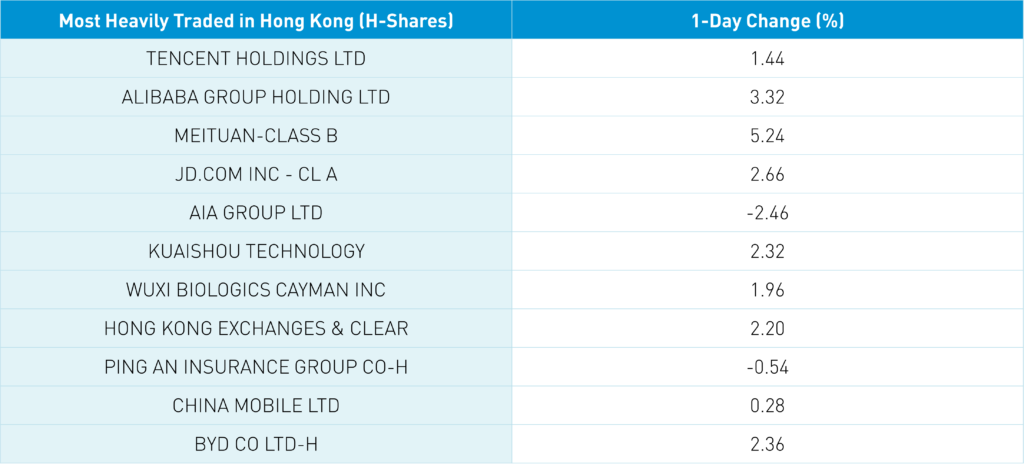

Relatively quiet from a news perspective though Hong Kong volume was strong as the Hang Seng Index gained +1.25%, closing above the 21K level after punching through the 20K level earlier this week. Hong Kong's growth stocks had a strong day, led by internet stocks with Tencent +1.44%, Alibaba HK +3.32%, Meituan +5.42%, and JD.com HK +2.66%. The dual-listed names didn’t rally as much as the US ADRs yesterday so we could see weakness in the ADRs today.

With professional investors underweight China, it will be interesting to see if the dip in ADRs today is bought after yesterday’s strong move and after overseas investors bought $1.8 billion worth of Mainland stocks overnight. Exacerbating this issue is our Yogi Berra quote that “China can’t outperform if India outperforms,” which is interesting as India has had a somewhat lackluster start to 2023 and underperformed China and Hong Kong over the last three months. Indonesia’s weakness was attributed to “investors are looking to increase allocations to cheaper northern markets…strong performance in other Asian markets including Hong Kong and China is attracting more buyers away from Indonesia,” according to Bloomberg News. Thus today could be interesting.

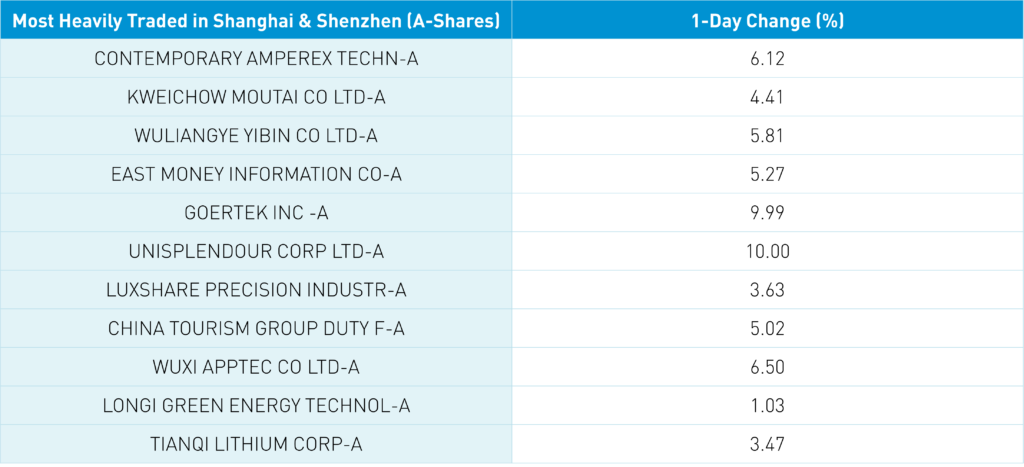

Mainland China's strong day highlighted the outperformance of large-cap/mega-cap stocks favored by foreign and domestic investors. Interesting that Tencent was a moderate net sell in Southbound Stock Connect though Kuiashou had a significant/moderate net buy. The first 18 most heavily traded stocks in the Mainland were positive, with EV battery giant CATL +6.12%, liquor giant Kweichow Moutai +4.41%, liquor peer Wuliangye Yibin +5.81%, broker East Money +5.27% and Apple supplier GoerTek +9.99%. Self-serving and highly biased, but I would argue you don’t need an active manager to own these stocks.

Foreign investors bought a healthy $1.855 billion of Mainland stocks via Northbound Stock Connect. This action indicates professional investors scrambling to raise/initiate their China positions after being underweight. Real estate was again in focus as the CBRIC and PBOC adjusted housing loan qualifications to make it easier for buyers in another supportive measure. December Caixin Services PMI was released overnight at 48 versus expectations of 46.8 and November’s 46.7. As a diffusion index, readings below 50 indicate a contraction month over month. As our friend Dave would say, “market no care, so neither should you.” Markets are forward-looking, i.e., China reopening, and not backward-looking, i.e., the media. Hong Kong's reopening measures include the restarting of the Macau ferry.

I highly recommend Tim Ferriss’ two podcast interviews with legendary investor Ed Thorp. Their first conversation includes a discussion of our biases, including fundamental attribution error, which Thorp attributes to a conversation with Charlie Munger. Thorp defines fundamental attribution error as “the human tendency to make assumptions that are not fully justified by the evidence.” In finance, we are supposed to be data-driven though much I see or read in the media is hyperbole. Something to think about! More importantly, check out the Tim Ferris Show interviews with Thorp.

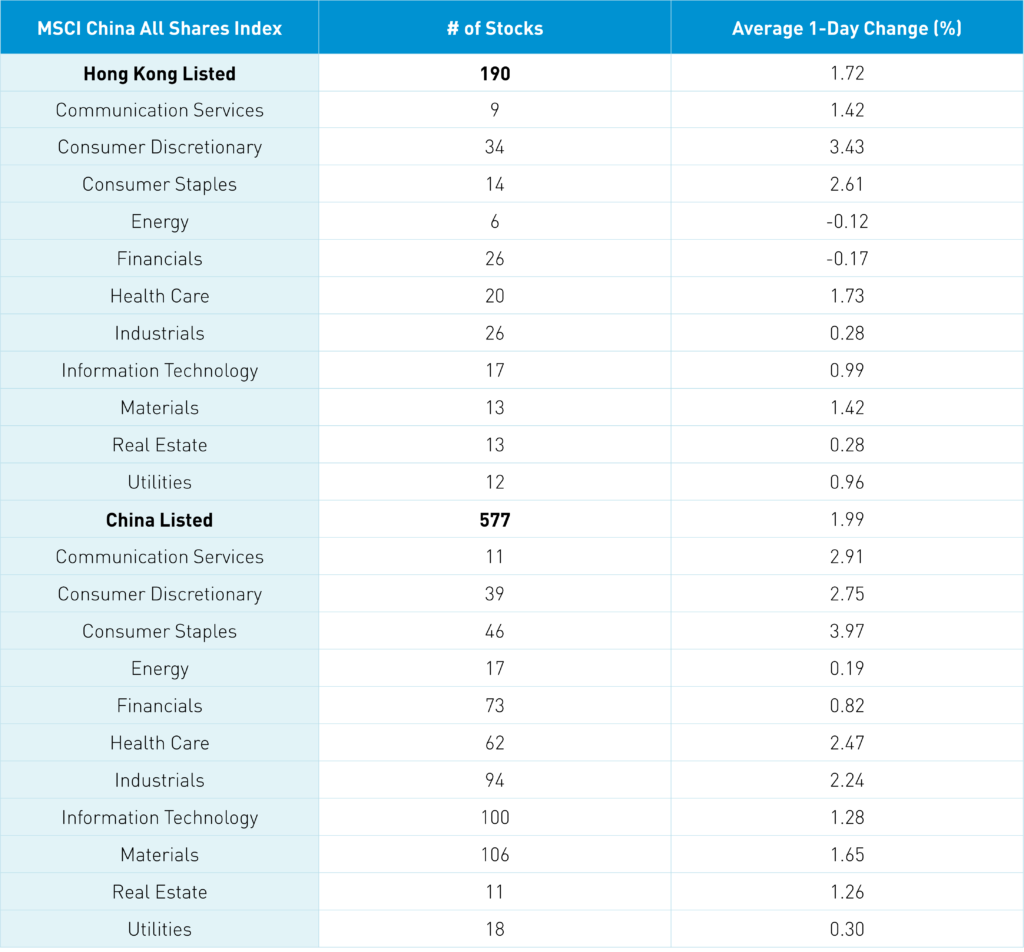

The Hang Seng and Hang Seng Tech gained +1.25% and +1.51% on volume +16.39% from yesterday, which is 139% of the 1-year average. 312 stocks advanced, while 183 stocks declined. Main Board short turnover increased +19.9% from yesterday, 127% of the 1-year average, as 16% of turnover was short turnover. Growth factors outperformed value factors as small caps edged out large caps. Top sectors were discretionary +3.46%, staples +2.64%, and healthcare +1.76%, while energy and financials were off -0.1% and -0.14%. The top sub-sectors were retailers, auto, and consumer durables/apparel, while insurance, healthcare equipment, and household products were at the bottom. Southbound Stock Connect volumes were moderate/high as Mainland investors bought $422mm of Hong Kong stocks today, with Kuaishou a moderate/large net buy, Meituan a small net buy, and Tencent a moderate net sell.

Shanghai, Shenzhen, and STAR Board gained +1.01%, +1.59%, and +1.15% on volume +7.62% from yesterday, which is 91% of the 1-year average. 2,849 stocks advanced, while 1,680 stocks declined. Growth factors outperformed value factors as large caps outpaced small caps. All sectors were positive: staples +4%, communication +2..93%, and healthcare +2.49%. The top sub-sectors were liquor, electric power grid, restaurants/tourism, retailers, water, and highway. Northbound Stock Connect volumes were moderate/high as foreign investors bought $1.855B of Mainland stocks today. CNY gained +0.35% versus the US dollar closing at 6.87. Treasury bonds sold off along with copper -1.43%.

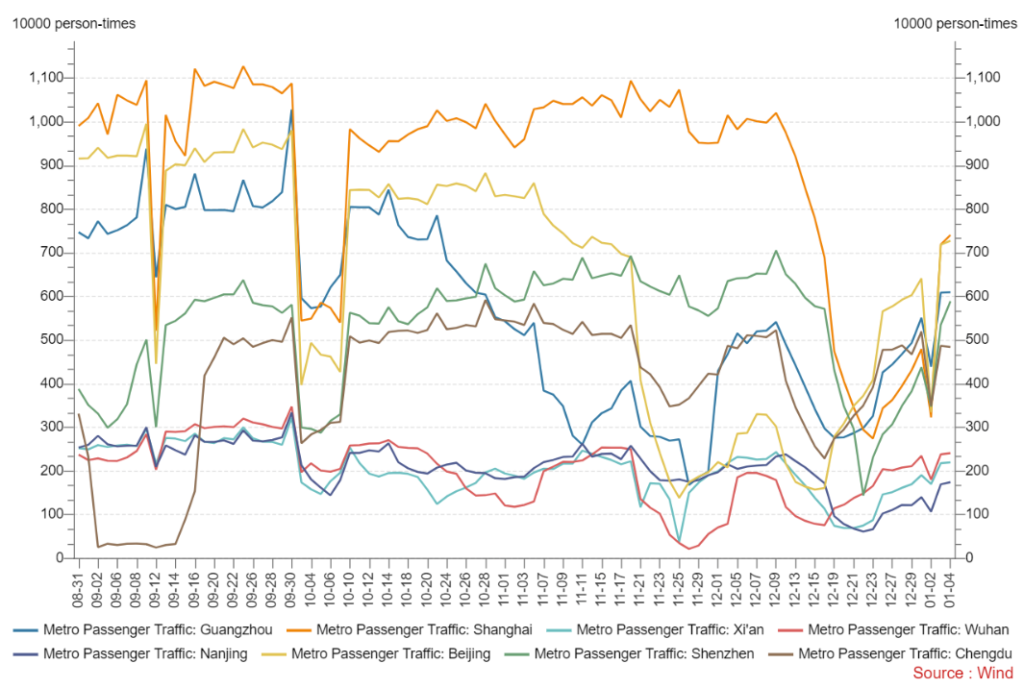

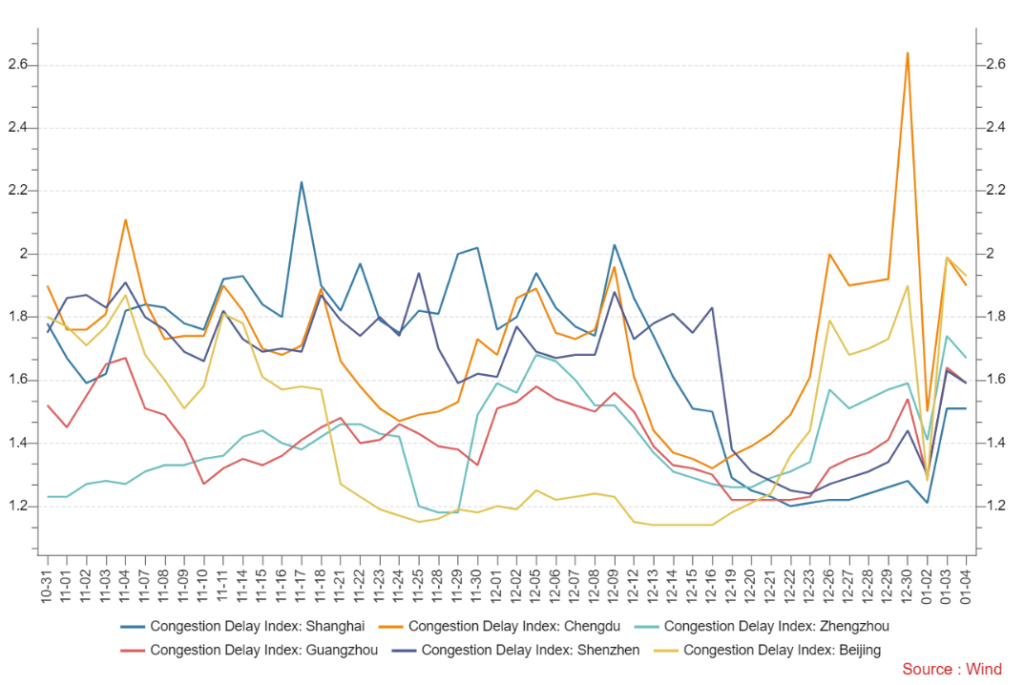

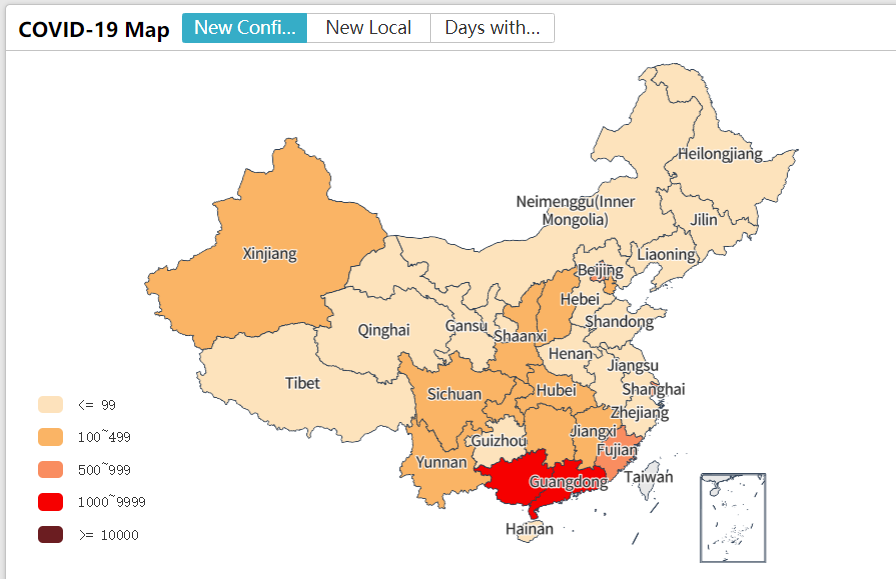

Major Chinese City Mobility Tracker

Mobility trends continue to grind higher though the new COVIDcase map shows that southern China is still in the thick of things.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.87 versus 6.88 Yesterday

- CNY per EUR 7.30 versus 7.29 Yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.81% Yesterday

- Yield on 10-Year China Development Bank Bond 2.95% versus 2.94% Yesterday

- Copper Price -1.43% overnight