PBOC Cut & Policy Stimulus Fuel Rally and Hope for More, Alibaba Bonus Feature

3 Min. Read Time

Key News

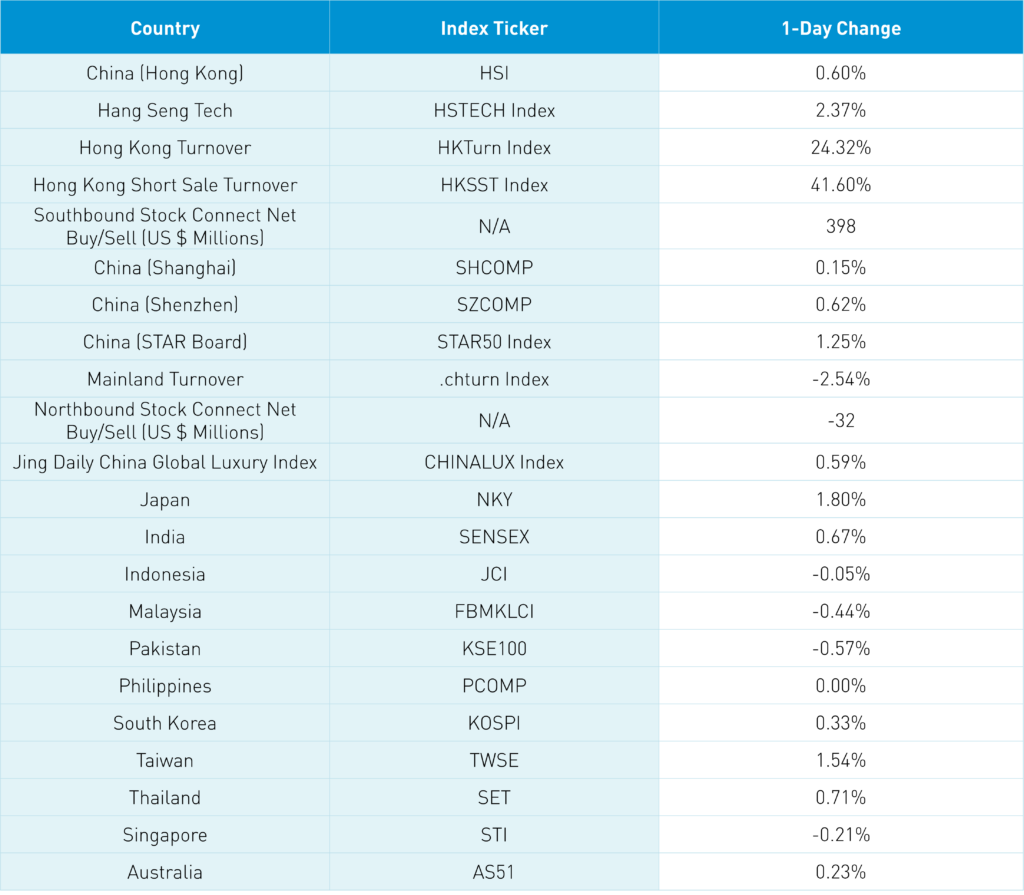

Asian equities were higher, led by growth stocks following Oracle’s results, which were released after the US market’s close.

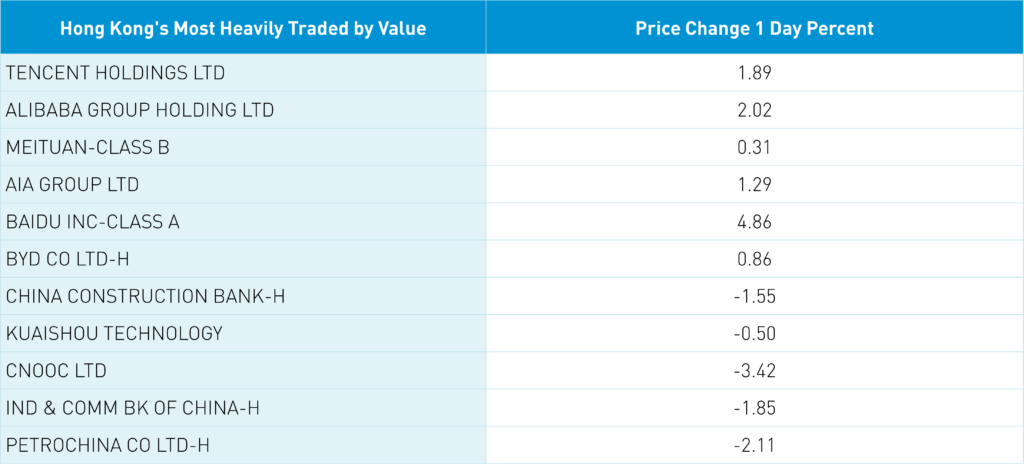

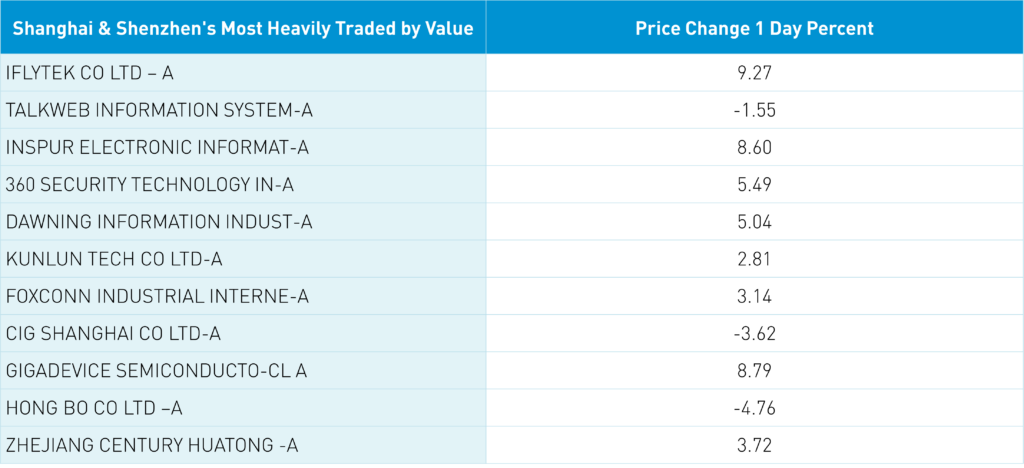

Hong Kong rallied mid-morning as the People's Bank of China (PBOC) cut the 7-day reverse repo rate from 2% to 1.9%, fueling gains in Hong Kong's most heavily traded stocks: Tencent, which gained +1.89%, Alibaba, which gained +2.02%, Meituan, which gained +0.31%, AIA, which gained +1.29%, Baidu, which gained +4.86%, and BYD. which gained +1.36%. This raises the probability that the medium-term lending facility (MLF) rate and the 1 and 5-year loan prime rates (LPRs) will be cut Wednesday and next Monday, respectively. Bloomberg News reported in the early afternoon that policymakers are “…considering a broad package of stimulus proposals, which include support for areas that include real estate and domestic demand, according to people familiar with the matter.” This news jump-started the Mainland market as Shanghai and Shenzhen are both above the 3,200 and 2,000 levels.

On the stimulus news, Hong Kong and China were led higher by growth sectors including technology, consumer discretionary, communication services, and real estate. After the close, the rationale for the rate cut and stimulus was made evident by May aggregate financing and new loan data, which both missed expectations, i.e. both were higher month-over-month. We should assume that Thursday’s industrial production, retail sales, and fixed asset investment are not going to be great. The market rallied on the news, though not on high volumes. The market is asking for proof of stimulus amid an under-allocation to Mainland China and Hong Kong stocks. If we receive proof, along with more details on US Secretary of State Blinken’s China visit, the rally could get legs as money comes in from the sidelines. Skepticism of the rally can be seen in the very high Main Board short sales, as 23% of turnover was short turnover. The three highest short turnover volumes were all Hong Kong-listed ETFs, with their percentage of short turnover at 90%, 85%, and 56%! The short interest could act as a further catalyst as shorts will be forced to cover on higher moves. CNY was off versus the US dollar due to the PBOC cut.

Next Monday, the Hong Kong Exchanges will launch the HKD-RMB Dual Counter Model with twenty-three Hong Kong-listed stocks eligible for purchase in RMB rather than Hong Kong dollars. This would facilitate trading as Mainland investors will be able to buy the Hong Kong stocks in CNY rather than Hong Kong dollars and thus avoiding the currency conversion. In order for Mainland investors to purchase Hong Kong-listed stocks, they utilize Southbound Stock Connect, which explains the list of twenty-three stocks, including fan favorites such as Tencent, Kuiashou, Meituan, BYD, Baidu, and JD.com. Alibaba is on the list, though the Hong Kong listing is not included in Southbound Stock Connect as the US is still the primary listing, as secondary listings are not eligible for Southbound inclusion. Nothing indicates that Alibaba will become Connect eligible next Monday, but one would think it would happen in the coming months. It would be a significant catalyst as 9.7% of Tencent’s market cap, 12.8% of Meituan's, and 14.4% of Kuiashou's are held by Mainland investors via Southbound Stock Connect.

The Hang Seng and Hang Seng Tech indexes gained +0.6% and +2.37%, respectively, on volume that increased +24% from yesterday, which is 85% of the 1-year average. 293 stocks advanced, while 191 declined. Main Board short turnover increased 41.6% from yesterday, which is 115% of the 1-year average, as 23% of the turnover was short turnover. The growth factor outperformed the value factor as small caps outpaced large caps. The top sectors were tech +3.64%, real estate +2.27%, and communication +2.21%, while energy -1.54%, financials -0.7%, and utilities –0.41%. The top sub-sectors were semis, technical hardware, and media, while energy, household products, and telecom. Southbound Stock Connect volumes were light/moderate as Mainland investors bought $398 million of Hong Kong stocks, with Meituan a moderate net sell, Tencent and Kuiashou both small net buys.

Shanghai, Shenzhen, and STAR Board gained +0.15%, +0.62%, and +1.25%, respectively, on volume that decreased -2.54% from yesterday, which is 102% of the 1-year average. 2,393 stocks advanced, while 2,220 declined. Growth factors outperformed value factors as large caps outpaced small caps. The top sectors were communication +2.02%, tech +1.83%, and staples +0.37%, while energy -0.94%, utilities -0.61%, and industrials -0.28%. The top sub-sectors were computer hardware, software, and cultural media, while oil/gas, telecom, and coal were the worst. Northbound Stock Connect volumes were light as foreign investors sold -$32 million of Mainland stocks, with Foxconn a large net buy and Kweichow Moutai and Longi Green Tech small net sells. CNY was off versus the US dollar though the Asia dollar index rallied. Treasury bonds rallied while copper eased and steel gained.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.15 versus 7.15 yesterday

- CNY per EUR 7.72 versus 7.69 yesterday

- Yield on 10-Year Government Bond 2.62% versus 2.67% yesterday

- Yield on 10-Year China Development Bank Bond 2.77% versus 2.82% yesterday

- Copper Price -0.13% overnight

- Steel Price +0.74% overnight