Pain Trade Is Higher: Hong Kong Rallies As Fund Managers Reduce Exposure

3 Min. Read Time

Key News

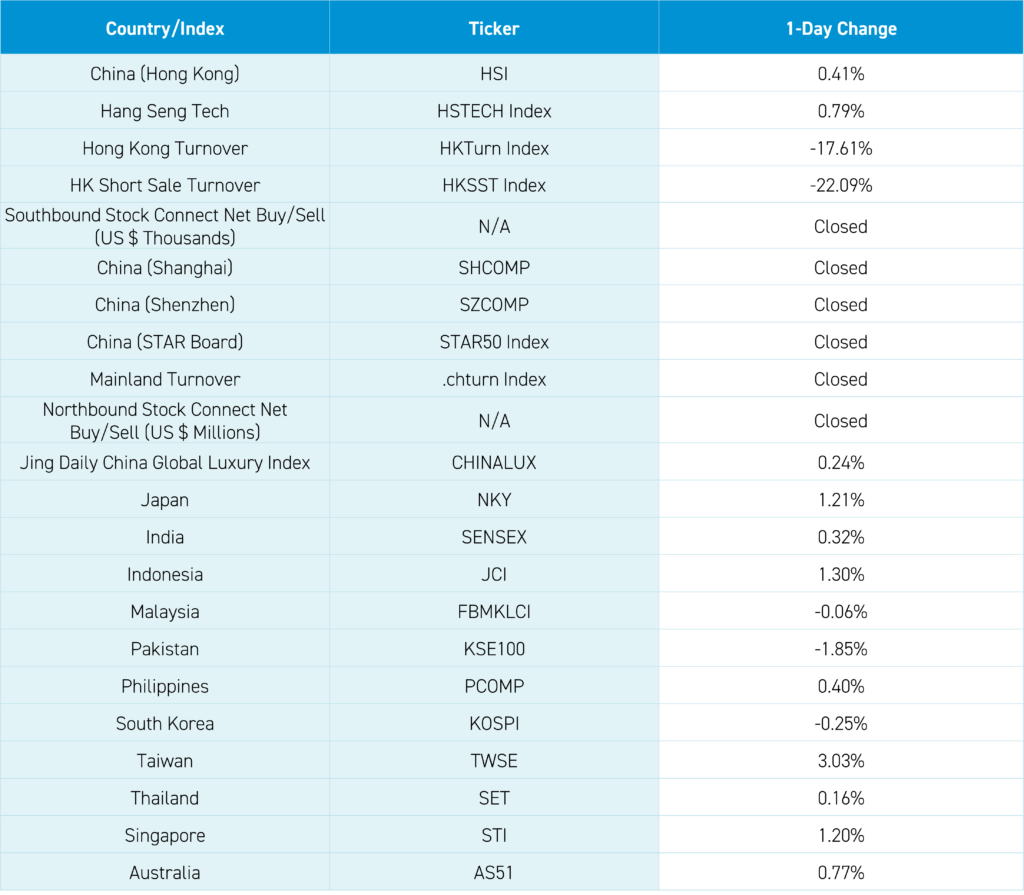

Asian equities rebounded overnight, as Taiwan returned from holiday in good spirits, jumping +3%, led by an analyst upgrade of Taiwan Semiconductor Manufacturing Company (TSMC). At the same time, Japan managed a gain despite entering the official definition of recession on a GDP print that missed consensus by a country mile.

Chinese New Year travel and consumption data continues to come in strong, with a strong increase in hotel bookings of +60% year-over-year, according to the Ministry of Commerce. Meanwhile, Meituan reported a +36% YoY increase and +155% versus 2019 in “daily consumption growth.” E-Commerce spending appears to be coming in strong, though Hainan Island, China’s Hawaii, does not have enough planes to get people home. Macau and Hong Kong visitor numbers look strong too.

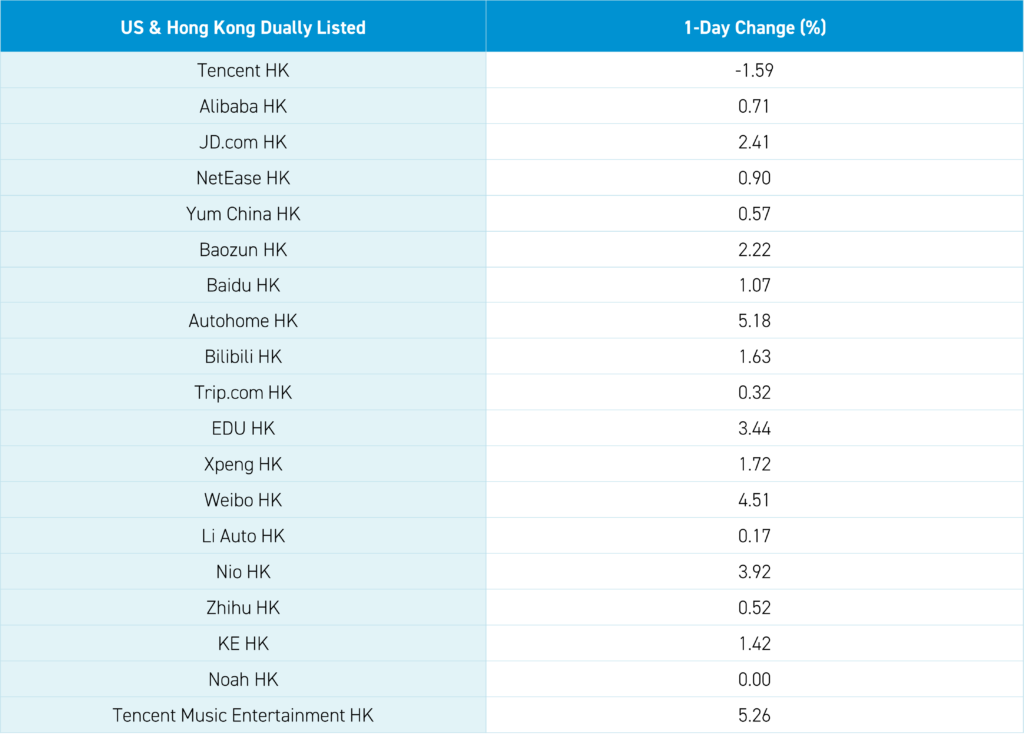

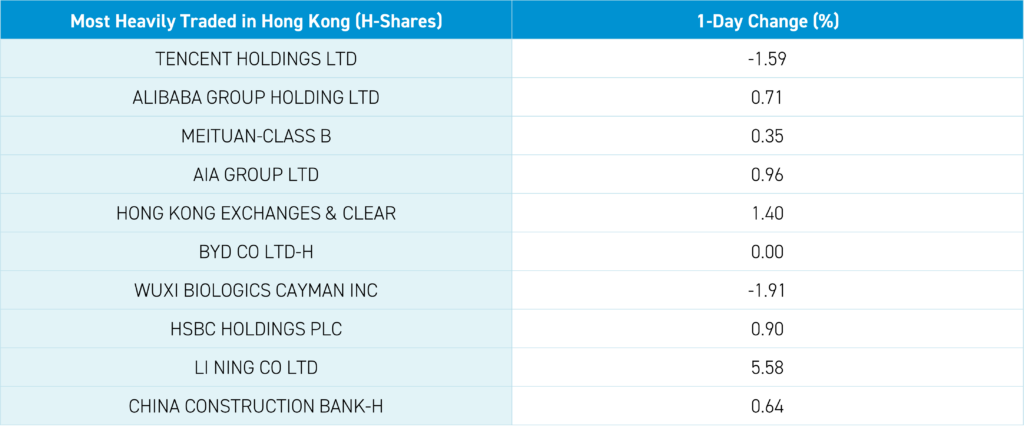

Hong Kong opened lower but managed to rebound, led by Hong Kong’s most heavily traded stock Tencent, which fell -1.59% as gaming activity has been a touch light during New Year’s, though January gaming data looks strong, Alibaba, which gained +0.71%, Meituan, which gained +0.35%, AIA, which gained +0.96%, and Hong Kong Exchanges (HKEX), which gained +1.4%.

One fallacy people bring up when discussing China is that “we can’t trust the data.” However, overnight, the real-time app data for e-commerce and online gaming came out. Your “free” app sells your data, including what you are downloading and how much time you spend on apps. Meanwhile, “screen scrapers” visit E-Commerce websites to determine changes in inventory levels.

Volumes were abysmal again at just 46% of the 1-year average, though that will change on Monday when China re-opens. Wuxi Biologics fell -1.91% despite the company filing with HKEX that the US Congress allegations are false. I am not sure why they don’t sue in court to prove the issue. After the Hong Kong close, six mega-banks announced they “…have taken active actions to deploy and implement related work, support reasonable financing needs for real estate projects, and achieve results.” While the real estate sector was off in Hong Kong overnight, this is another decisive step to support the beleaguered sector. The banks noted they will be involved in 8,200 projects following a January 12th announcement from the Ministry of Housing and Urban-Rural Development.

Would you believe that Canada has a larger weight than China in the MSCI All Country World Index, despite having a GDP of $2.1 trillion versus China’s $17.9 trillion (GDP data from World Bank 2022)? It’s true as of the month end of January 2024! Recently released research from Copley Fund Research that examined 340 global equity fund managers responsible for $1 trillion in AUM revealed that nearly 80% are underweight China. AUM in China has fallen to $19.3 billion from the 2020 peak of $50 billion. Remember, these managers are benchmarked to the MSCI All Country World Index, which has just over a 2% allocation to China.

According to Steven from Copley Fund Research, the average weight in the funds has reached a record low of 2.11%, a record number are underweight (78.5%), and 19% have eliminated China completely from their portfolios. The funds have 37% of their China allocations in AIA (remember that AIA is not considered a China stock due to its Hong Kong domicile, which means it is part of developed market indices), Tencent, and Alibaba, while "76% of Global funds own Microsoft at an average weight of 3.6%, which puts into context how seriously Global managers view China & Hong Kong at this point.” Last month, Steven highlighted one of the top-performing “EM” funds. I am using quotations because the United States is the Developing World Fund’s largest country allocation. The manager is underweight in every emerging market country as they own many developed market stocks.

In their defense, without owning US stocks, they would be getting crushed and potentially going out of business. Nonetheless, as an index purist, I find it mildly disconcerting. It is worth noting that several prominent hedge funds increased their China weights based on Q4 SEC 13Fs. Hedge funds can hedge, unlike their long-only mutual fund managers. Check out Steven’s work! You’ll enjoy it as much as I do.

After tomorrow's close, Hang Seng Indices will provide their pro-forma for index rebalance, including additions to Southbound Stock Connect. XPeng is a leading candidate for Southbound Connect inclusion leading to this week’s rally.

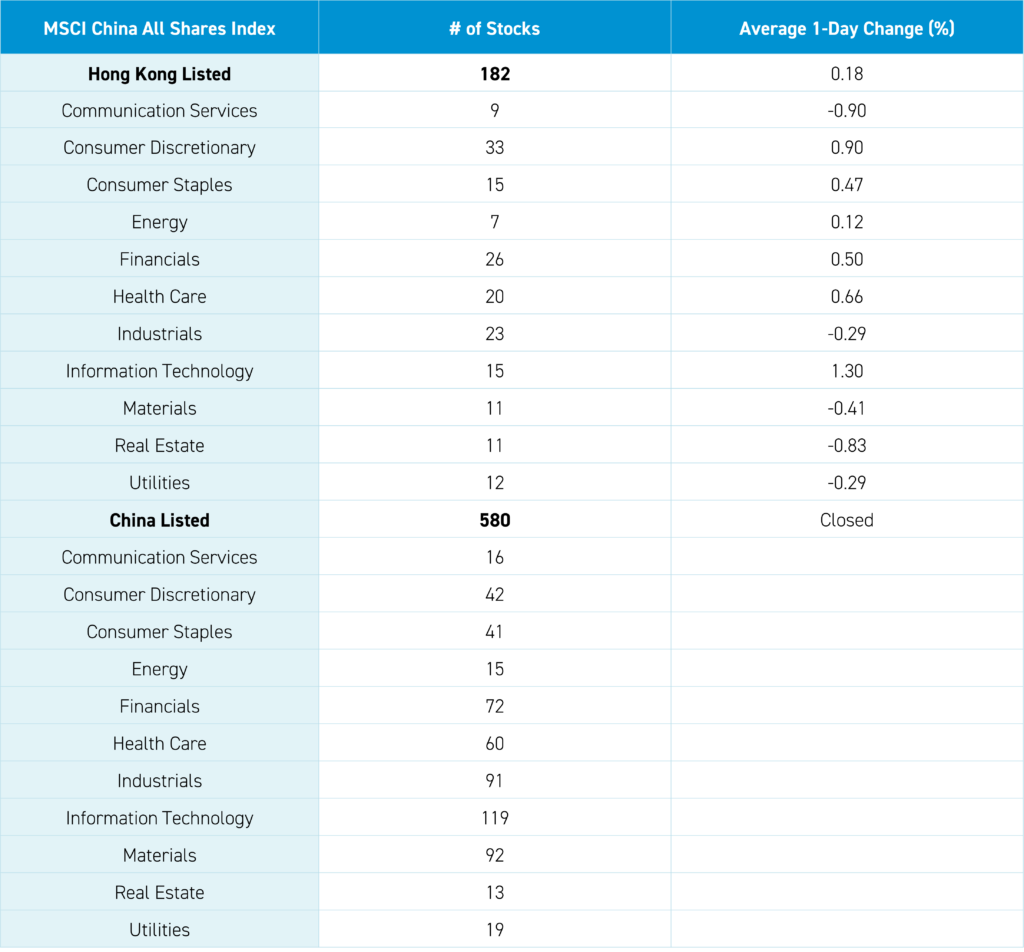

The Hang Seng and Hang Seng Tech indexes gained +0.41% and +0.79%, respectively, on volume that declined -17.61% from yesterday, 46% of the 1-year average. 232 stocks advanced, while 224 declined. Main Board short turnover declined -22.09% from yesterday, 45% of the 1-year average (remember Hong Kong short turnover includes ETF short volume, driven by market makers’ ETF hedging). The growth factor and large caps outperformed the value factor and small caps. The top sectors were tech +1.3%, discretionary +0.9%, and healthcare +0.66%, while communication -0.9%, real estate -0.83% and materials -0.41%. The top sub-sectors were media, semis, and technical hardware, while food/staples, software, and business/professional services were the worst. Southbound Stock Connect was closed.

Shanghai, Shenzhen, and STAR Board were closed.

Last Night’s Performance

Last Night's Exchange Rates, Prices, & Yields

Mainland China's fixed income, currency, and commodity markets were closed overnight.