All Quiet On The Western Front, “ATMX” Outperforms Ahead of Fed Press Conference

2 Min. Read Time

Key News

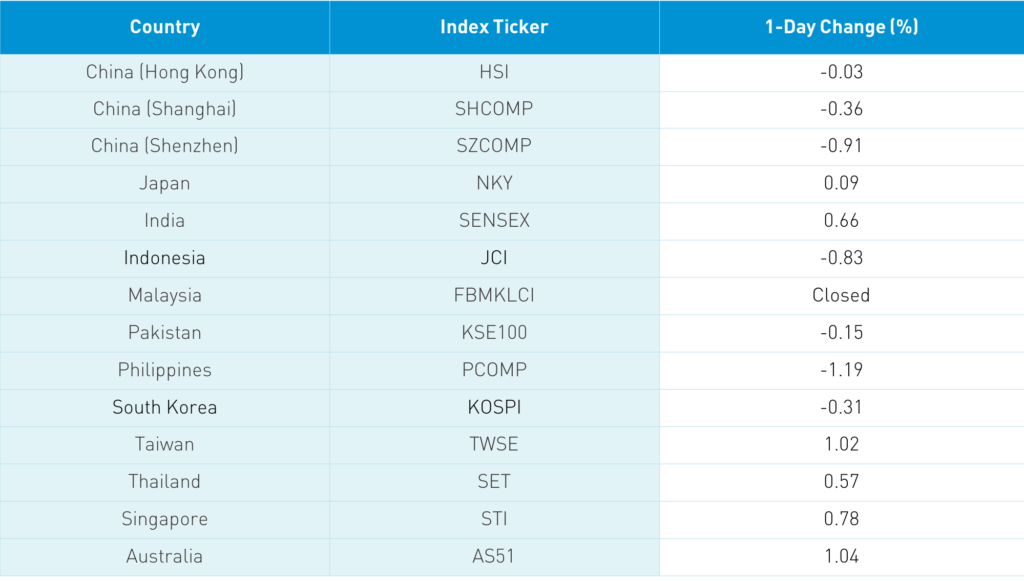

It was a quiet night for Asian equities ahead of today’s 2 pm press conference with Fed Chairman Jerome Powell. Hong Kong was basically flat as “ATMX” stocks were the volume leaders. Alibaba HK rose +2.09%, Tencent rose +0.94%, Meituan Dianping rose +1.89%, and Xiaomi rose +1.79%. Semiconductor Manufacturing popped +3.63% as the company appears to be picking up Huawei business as US chip makers are cut off from the company. EV company BYD gained +6.47% following an analyst upgrade.

Mainland China was off on profit taking in favored sectors such as health care, liquor, and tech. Small and micro caps under-performed while growth names were clipped. There were several IPOs in the Mainland market today, which may have driven investors’ attention and money away from current listings as investors rushed to participate in the IPOs. Heathcare’s under-performance on the Mainland was a surprise considering that President Xi announced a renewed effort to raise the standard of healthcare in China. Despite this, Hong Kong-listed healthcare names reacted positively to the news as a source noted that a coronavirus vaccine could be ready by November. We are currently seeing an increased focus on reforming healthcare, which we saw in the aftermath of SARS as well.

The National Taxpayers Union Foundation released an interesting piece which explains that tariffs represent a tax on US consumers and manufacturers. As we’ve discussed previously, US manufacturers tend to produce refined goods using low-cost inputs from other countries. The timing of their release was directly followed by the WTO’s announcement that US tariffs on China violated its rules. Unfortunately, the ruling may have a muted impact on lawmakers. However, the collective effort to devalue the US dollar has made US imports more expensive, which is bad for consumers and raises the price of inputs for manufacturers. The weaker dollar is also meant to make finished US goods more competitive. Why not help manufacturers by eliminating the tariffs as well and thereby lower the prices of inputs? It would actually give the US economy a stimulus shot without expanding the budget deficit. While this would be completely logical, it is highly unlikely to happen, which is a shame all around.

H-Share Update

The Hang Seng had ended a choppy session down -0.03%/-7 index points at 24,725. Volume was off -11% from yesterday, which is below the 1-year average. Breadth was off with 21 advancers and 28 decliners. The broader Hang Seng Composite Index was up +0.39% with 217 advancers and 233 decliners. The 204 Chinese companies listed in Hong Kong and within the MSCI China All Shares Index gained +0.58% led by discretionary +1.66%, tech +1.1%, and industrials +0.94%. Laggards included utilities -0.97%, staples -0.66%, and financials -0.15%. Southbound Stock Connect volumes were light as Mainland investors bought $238 million worth of Hong Kong stocks today. Southbound Connect trading accounted for approximately 10% of turnover in Hong Kong.

A-Share Update

Shanghai and Shenzhen opened lower and bounced around the room before easing somewhat to close -0.36% and -0.91%, respectively, as volumes slumped -6%, falling below the 1-year average. Small and mid caps underperformed large caps. The 517 Mainland stocks within the MSCI China All Shares Index declined -0.39% led by real estate +1.18%, energy +0.79% and utilities +0.44%. Meanwhile, laggards included healthcare -1.51%, staples -1.42%, and tech -0.71%. Northbound Stock Connect volumes were light as foreign investors bought $109 million worth of Mainland stocks today. Northbound Stock Connect trading accounted for 6.4% of Mainland turnover.

Last Night’s Prices & Yields

- CNY/USD 6.76 versus 6.78 yesterday

- CNY/EUR 8.02 versus 8.04 yesterday

- Yield on 1-Day Government Bond 0.81% versus 0.81% yesterday

- Yield on 10-Year Government Bond 3.13% versus 3.08% yesterday

- Yield on 10-Year China Development Bank Bond 3.68% versus 3.65% yesterday