Liquor Giant Kweichow Moutai and EV Battery Maker CATL Report Q1 Earnings

2 Min. Read Time

Webinar Today

Join us at 11:00 am EDT for our event:

A Quarter with Two Halves: Q1 China Internet Sector Update

Click here to register.

Upcoming Webinar

On Friday, April 30th, Nobel-Laureate Economist Robert Engle will be co-hosting:

A Financial Risk Framework For Climate Change: Portfolio Construction, Stress Testing, and Risk Transfer

Click here to register.

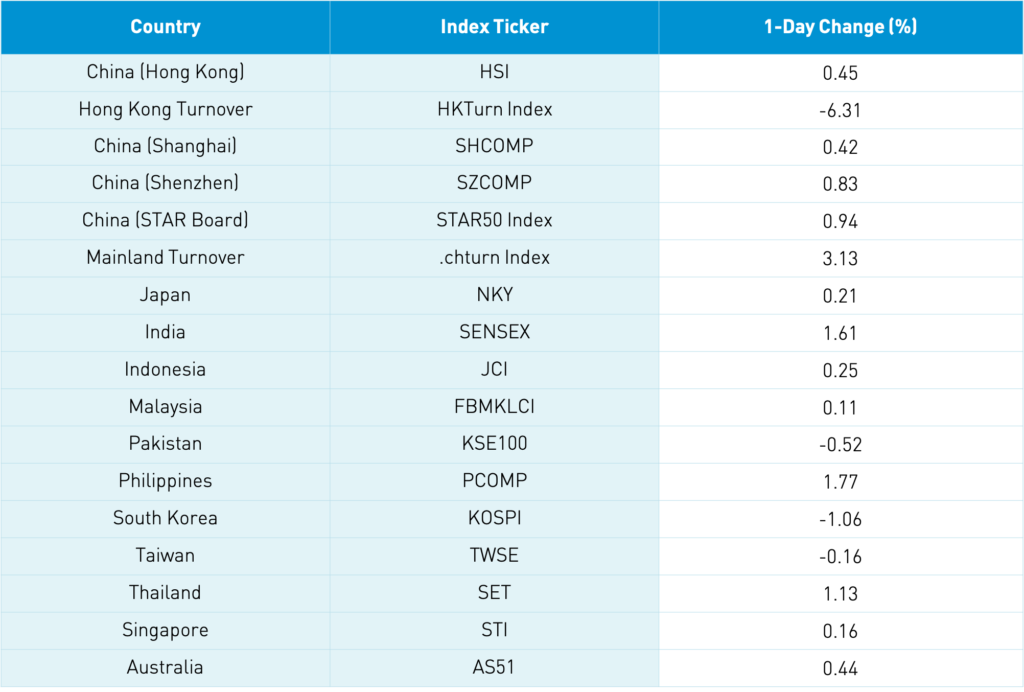

Key News

Asian equities had a strong day on light volumes with Taiwan and South Korea posting losses while India and the Philippines outperformed. It was a quiet night on the news front as investors wait on Jerome Powell’s comments today. Earnings were key drivers of individual stocks. There was some chatter about the Financial Times report that China’s population is expected to decline this year based on the yet-to-be-disclosed census, though 1.4 billion people is still a lot of people to me. There was also chatter about the examination of Ant Group’s IPO and Jack Ma not being allowed to leave the country. Is anybody allowed to travel internationally?

Before the market’s open, liquor giant Kweichow Moutai reported mixed earnings. Revenue grew 11% year-over-year and net income grew +6.6%. (Revenue CNY 27.27B, Net Income CNY 13.95B, and EPS CNY 11.11). However, shares were off -2.5% their lows. Chinese EV battery maker CATL rose +5.29% after beating analyst expectations as net income grew 22% year-over-year to RMB 5.58B ($861mm) while revenue grew +9.9% to RMB 50.3B.

Official PMIs will be released tomorrow.

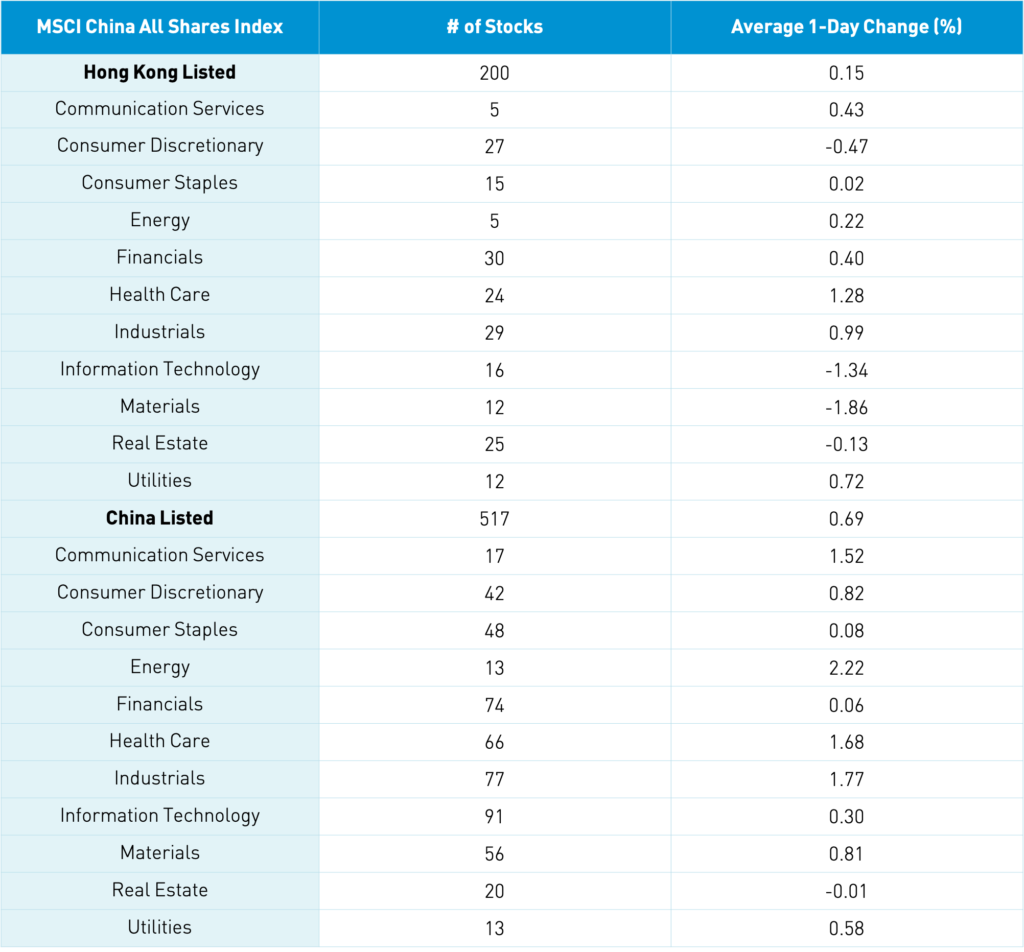

H-Share Update

The Hang Seng opened lower but grinded higher closing up +0.45% as volume slipped -6.00%, which is 85% of the 1-year average. The 200 Chinese companies within the MSCI China All Shares Index gained +0.15% led by healthcare +1.27%, industrials +0.99%, and utilities +0.71%, while materials fell -1.87%, tech -1.35%, and real estate -0.47%. Mining and metal stocks were off. Hong Kong’s most heavily traded by value was Xiaomi, which fell -3.8% on news that rival and fellow mobile phone maker Oppo will get into the EV business, Tencent, which gained +0.48%, Alibaba Hong Kong, which rose +2.3%, Meituan, which fell -1.15%, Wuxi Biologic, which rose +2.13%, HSBC, which was up +3.15%, Ping An, which gained +0.23%, Hong Kong Exchanges, which fell -0.24%, JD.com Hong Kong, which was up +2.21%, and China Construction Bank, which rose +1.57%. Southbound Connect volumes were light as Mainland investors bought $111mm of Hong Kong stocks today as Southbound trading accounted for 12.6% of Hong Kong turnover. Xiaomi was sold along with a rare Tencent outflow day.

A-Share Update

Shanghai, Shenzhen, and STAR Board overcame morning losses to close up +0.42%, +0.83%l, and +0.94% respectively. Volumes were up 3% from yesterday, which is 89% of the 1-year average. There were 1,940 advancing stocks and 1,883 declining stocks. The 517 Mainland stocks within the MSCI China All Shares Index gained +0.69%, led by energy +2.2%, industrials +1.78%, healthcare +1.69%, and communication +1.53%. The Mainland’s most heavily traded were Kweichow Moutai, which fell -2.5%, CATL, which gained +5.29%, broker East Money, which rose +5.1%, BOE Tech, which fell-1.76%, and liquor stock Wuliangye Yibin, which rose +1.34%. Northbound Stock Connect volumes were moderate as foreign investors bought $309mm of Mainland stocks as Northbound Stock Connect trading accounted for 6.3% of Mainland turnover. Bonds rallied today as CNY was basically flat versus the US $ at 6.48 and copper eased -0.4%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.48 versus 6.48 yesterday

- CNY/EUR 7.83 versus 7.83 yesterday

- Yield on 10-Year Government Bond 3.20% versus 3.21% yesterday

- Yield on 10-Year China Development Bank Bond 3.57% versus 3.59% yesterday

- China’s Copper Price -0.40% overnight