LPRs Unchanged As Stimulus Remains Measured

3 Min. Read Time

| Upcoming Event: |

| KraneShares Bay Area Innovation Forum Join us Thursday, April 28th for our virtual conference at 11:00 am PST (2:00 pm EST) Featuring 12th US ambassador to China, Terry Branstad Click here to register. |

Key News

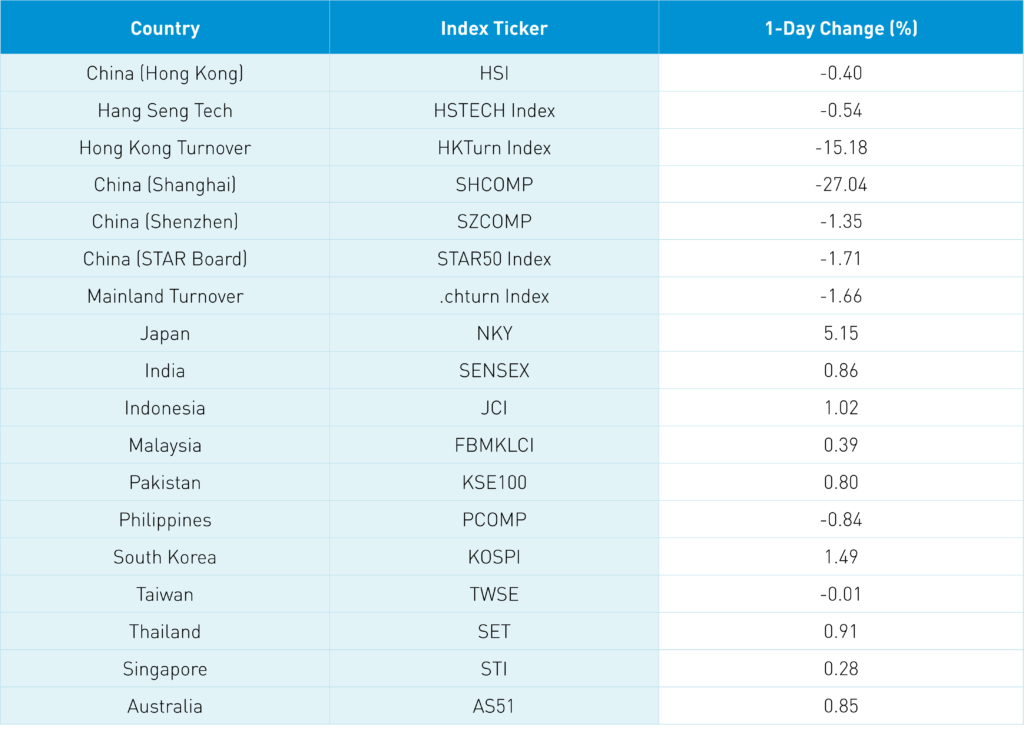

Asia markets were largely higher, led by Japan, India, and the Philippines, while Hong Kong, Mainland China, and South Korea closed lower.

The PBOC kept the 1, and 5-year loan prime rates (LPRs), which help set mortgage rates, unchanged at 3.7% and 4.6%, respectively, leading to a significant drop in real estate stocks as the sector fell -6.05% overnight in Hong Kong and -6.26% in Mainland China. The PBOC’s measured and incremental easing and newly announced implementation of economic measures deemed to have a more direct impact on the real economy has dampened investor sentiment, particularly on the Mainland. The economy faces challenges though keeping some dry powder makes sense as investors will adjust their expectations to this new approach. In April, the PBOC transferred profits to the government, $93.6B of which will go to companies and citizens. We can see the effect as the State Administration of Taxation reported overnight that 527,000 taxpayers received distributions totaling RMB 420 billion as part of tax rebates driven by VAT adjustments. The PBOC said it would hold a symposium to articulate policies on supporting the real economy soon.

Energy and material stocks were off, falling -4.94% and -4.04 in Hong Kong, respectively, and -3.46% and -5.03% on the Mainland, respectively, as commodity/natural resource prices weakened. Covid restrictions have produced a knock-on effect of stabilizing commodity prices.

Mainland-listed battery maker CATL (300750 CH) was off -7.55% on concerns that the company will not be able to source lithium, though Sungrow Power’s earnings miss and stock drop of -20% weighed on the clean technology space. Sungrow grew revenues +36% to RMB 4.57B from Q1 2021’s RMB 2.25 though net income was light, gaining only +6% year-over-year.

Sports apparel maker Li Ning jumped +4.38% on strong Q1 results.

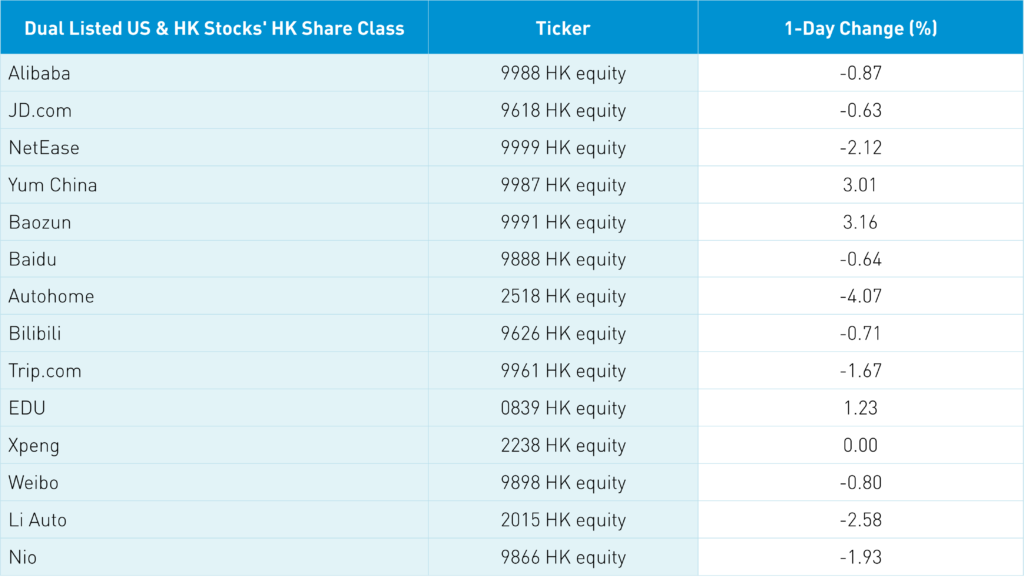

CNY depreciated versus the US dollar slightly, -0.28% to 6.41 as US Treasury yields rise though the HK dollar was steady. Hong Kong-listed internet stocks were off slightly though held up well on a relative basis.

Our friend Jonathan asked about the two-week comment period ending last Saturday addressing the CSRC’s proposal to eliminate the rule prohibiting the PCAOB from doing onsite audit inspections in China. A source in China told me that once the comment period ends, there is usually time before the adjustment takes place. When this happens, it could be a very positive development. This rule has prevented the auditors of US-listed Chinese companies from allowing the PCAOB to conduct audit reviews. It is feasible that the US and China are talking about this rule going away though that is pure speculation on my part. It is also possible that China simply removes the rule. Remember that the HFCAA states that the Mainland auditors need to be PCAOB-approved. We shall see if allowing the audit reviews leads to a change in status. Let’s hope technical issues do not result in the unmitigated disaster that delisting would cause for US and global investors.

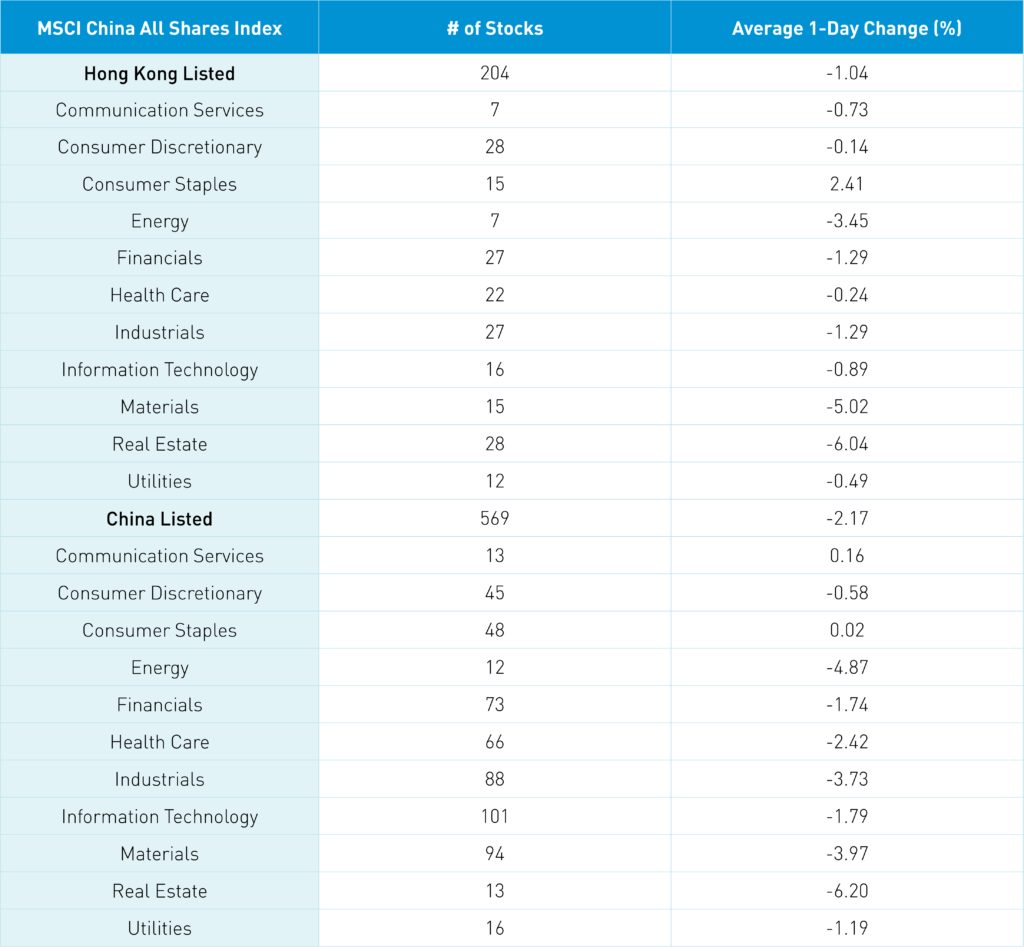

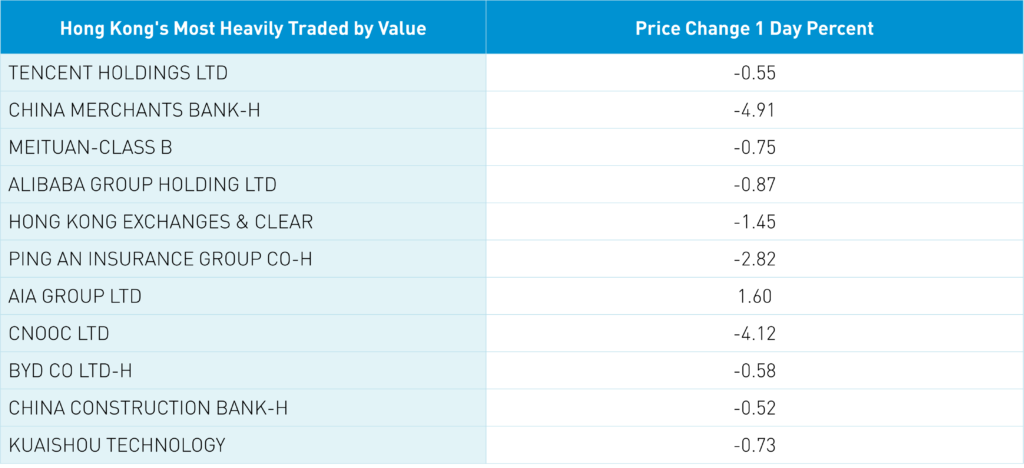

The Hang Seng Index and Hang Seng TECH Index closed -0.4% and -0.54%, respectively, on volume that was -15.18% from yesterday, which is 68% of the 1-year average. Decliners outpaced advancers by nearly 2 to 1. Meanwhile, short selling volume fell by -23% from yesterday, which is 79% of the 1-year average. Consumer staples was the only sector in the green, gaining +2.4% though consumer discretionary fell -0.14% and healthcare fell -0.24%. Real estate was off by -6.04%, materials fell -5.03%, energy fell -3.45%, and financials fell -1.3%. It is interesting to note that size was the best performing factor while dividend and value were the worst. Mainland investors were net sellers of Hong Kong stocks though Meituan saw a small inflow as Tencent was sold somewhat.

Shanghai, Shenzhen, and the STAR Board were off -1.35%, -1.71%, and -1.66%, respectively, on volumes that were +5.15% higher than yesterday, 76% of the 1-year volume. Decliners outpaced gainers by 3 to 1 as communication was the only positive sector, gaining +0.1%. Real estate was off by -6.26%, followed by energy, which fell -4.93%, materials, which fell -4.04%, and industrials, which fell -3.8%. Foreign investors sold -$824 million worth of Mainland stocks via Northbound Stock Connect. Treasury bonds sold off, CNY weakened by -0.28% versus the US dollar, and copper gained +0.86%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD

- CNY/EUR

- Yield on 1-Day Government Bond 1.39% versus 1.38% yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.82% yesterday

- Yield on 10-Year China Development Bank Bond 3.05%

- Copper Price +0.86% overnight