Yellen & Liu He Speak, China Health Care Outperforms

<1 Min. Read Time

Key News

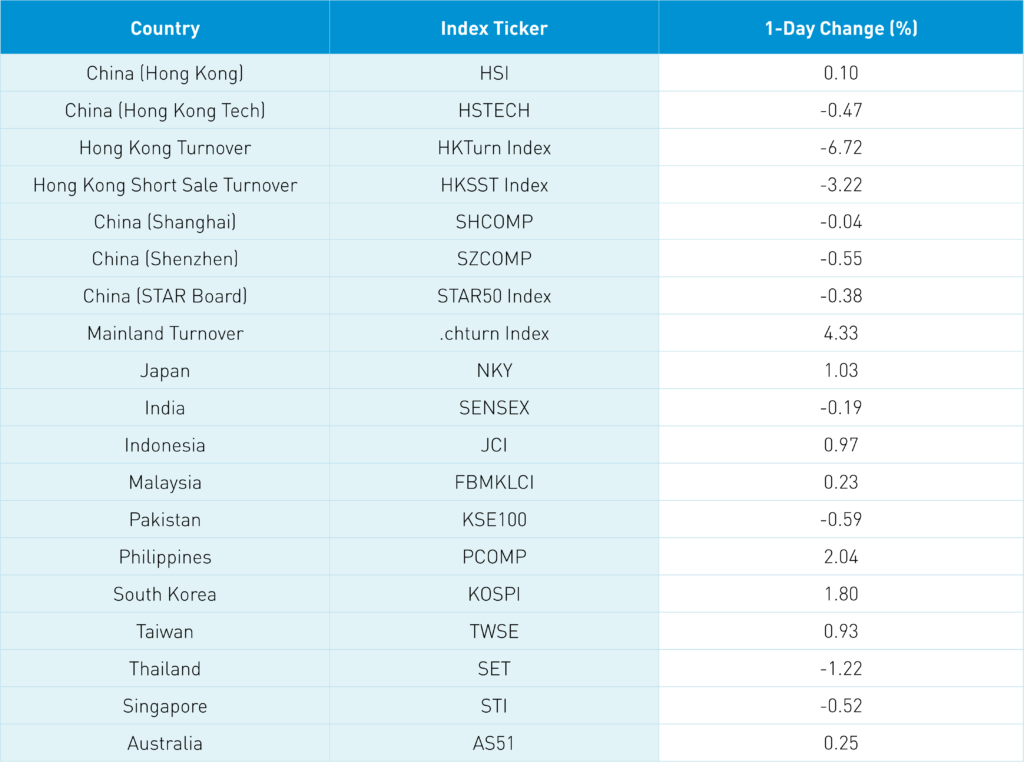

Asian equities were mixed overnight as Hong Kong and Mainland China were underperformers on low volumes after strong performance last week, closing flat and slightly lower, respectively.

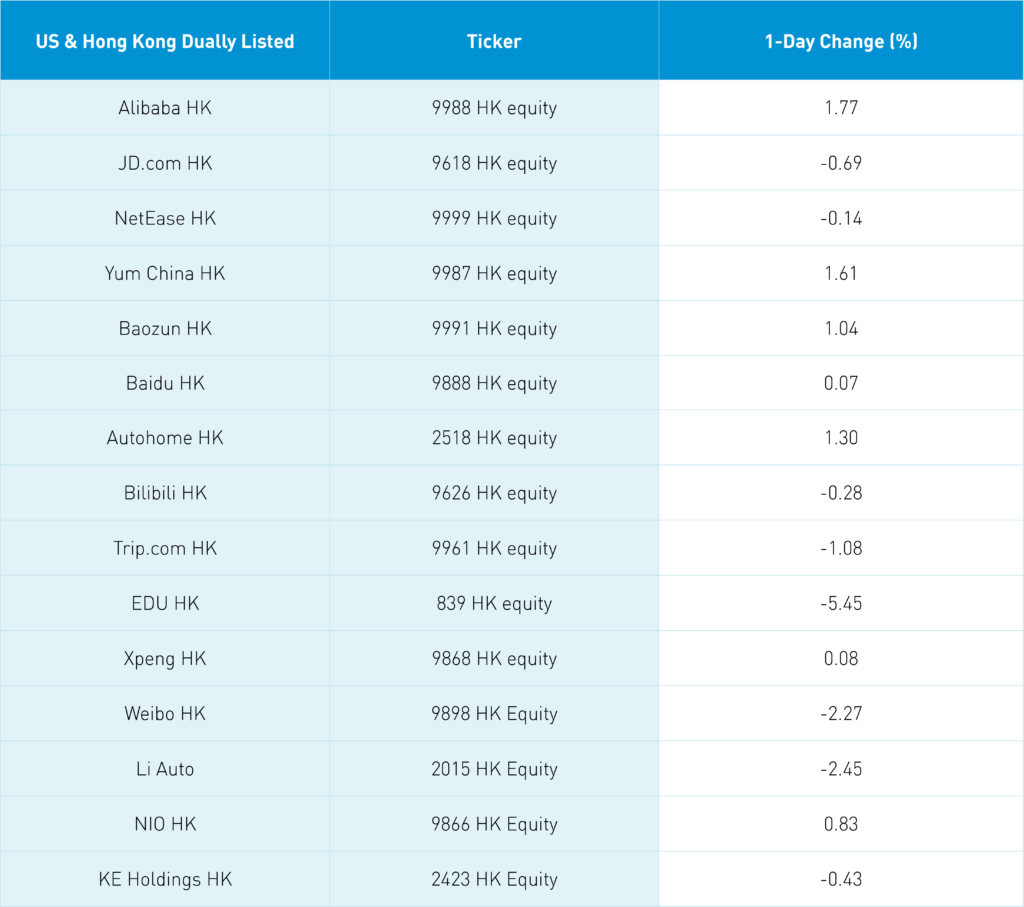

There is some optimism that President Joe Biden may announce week a rollback of some US tariffs on Chinese consumer goods as soon as this week. Meanwhile, Chinese Vice Premier Liu He held a video call with US Treasury Secretary Janet Yellen this morning before the US open, with the talks described as "candid and substantive".

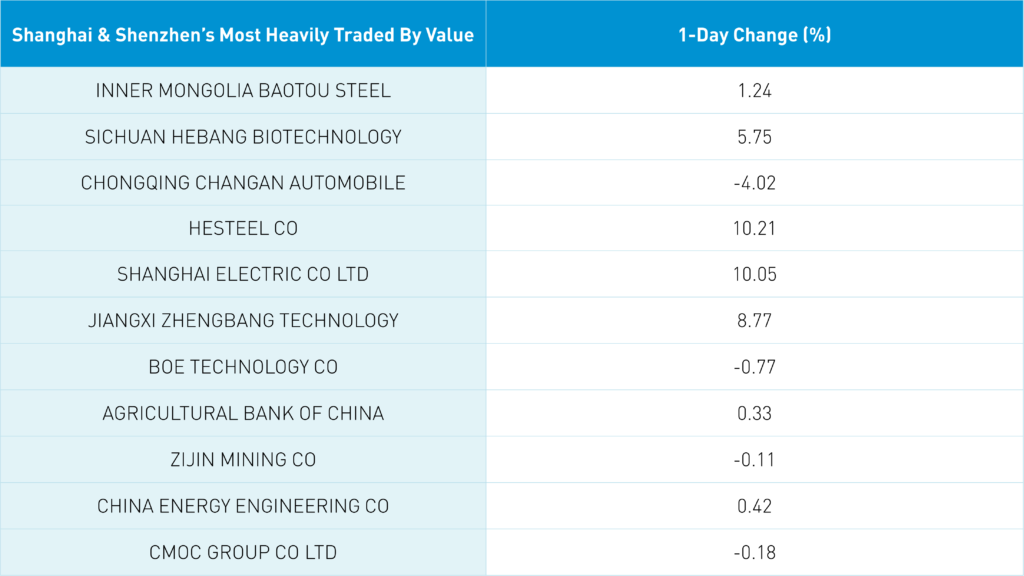

China-related commodity futures have been seeing disparate performance over the past two days as steel prices rise on the government’s infrastructure plans and copper prices have declined. Major steel producers were sharply higher in the Mainland equity market overnight.

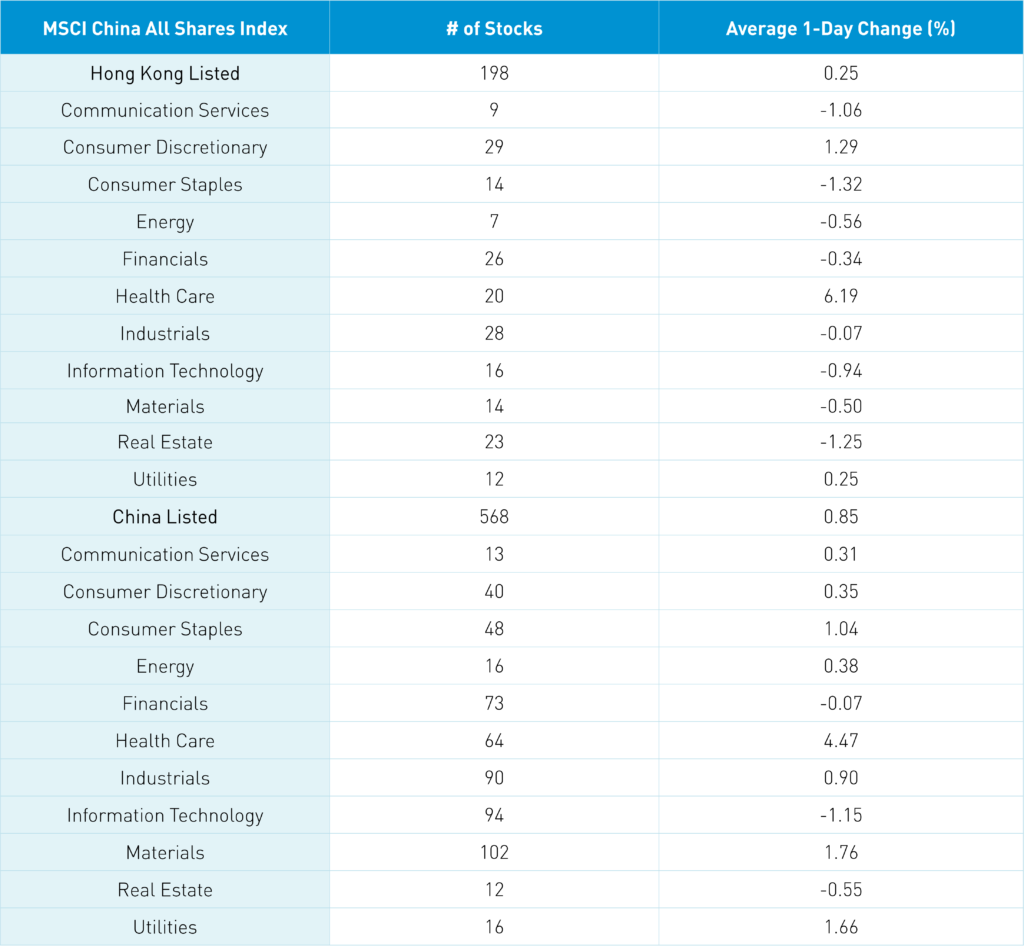

Health care names including WuXi Biologics and Ali Health were sharply higher overnight. WuXi’s catalyst was the possibility of the company being removed from the US unverified list. Ali Health lacked a specific catalyst, but it is likely that investors Are coming to terms with new regulations for the online health industry, recognizing that the regulatory changes are not the end of the world and may help the industry’s sustainable growth. More to come on this issue!

Hog futures surged overnight, rising +8% and reaching the daily limit of RMB 22,755. This is mainly due to an outbreak of African Swine Fever (ASF) in China. This may lead to more inflation, though the government has set a normal schedule for any slaughtering needed to prevent disease. Inflation in China has been relatively muted lately compared to the US and Europe as China’s CPI rose +2% year-over-year in May versus +8% year-over-year in the US.

The Hang Seng and Hang Seng Tech Indexes closed +0.10% and -0.47%, respectively, on volume that decreased -7% from yesterday.

Shanghai, Shenzhen, and the STAR Board fell -0.04%, -0.55%, and -0.38%, respectively, overnight on volume that was +4% higher than yesterday.

A belated happy 4th of July to US readers!

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.72 versus 6.70 yesterday

- CNY/EUR 6.89 versus 6.99 yesterday

- Yield on 1-Day Government Bond 1.30% versus 1.30% yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.84% yesterday

- Yield on 10-Year China Development Bank Bond 3.07% versus 3.08% yesterday

- Copper Price -3.74% overnight