Caixin Services PMI Exceeds Expectations as Chinese Semis Rally

2 Min. Read Time

Key News

Asian equities were mixed on light pre-holiday volumes, as Hong Kong and India posted small gains, Japan and Korea were down more than 1%, and the Philippines and Thailand were closed.

Yesterday US-China ADRs were off significantly intra-day due to the light holiday volumes this week, which tends to exacerbate volatility. McCarthy’s meeting with Taiwan’s President Tsai was likely a factor in yesterday’s trading. As I mentioned on Twitter (ahern_brendan) yesterday, what did CNH, China’s currency trading during US trading hours, and our risk monitor tell us about yesterday’s move? CNH was unchanged; we should have ignored the move in China ADRs. What was the reaction despite all of the media attention? A yawn! The more significant news was March’s Caixin Services PMI was 57.8 versus expectations of 55 and February’s 55, which is a two-year high. The Caixin survey, which S&P Global owns, focuses on small companies that employ most workers in China.

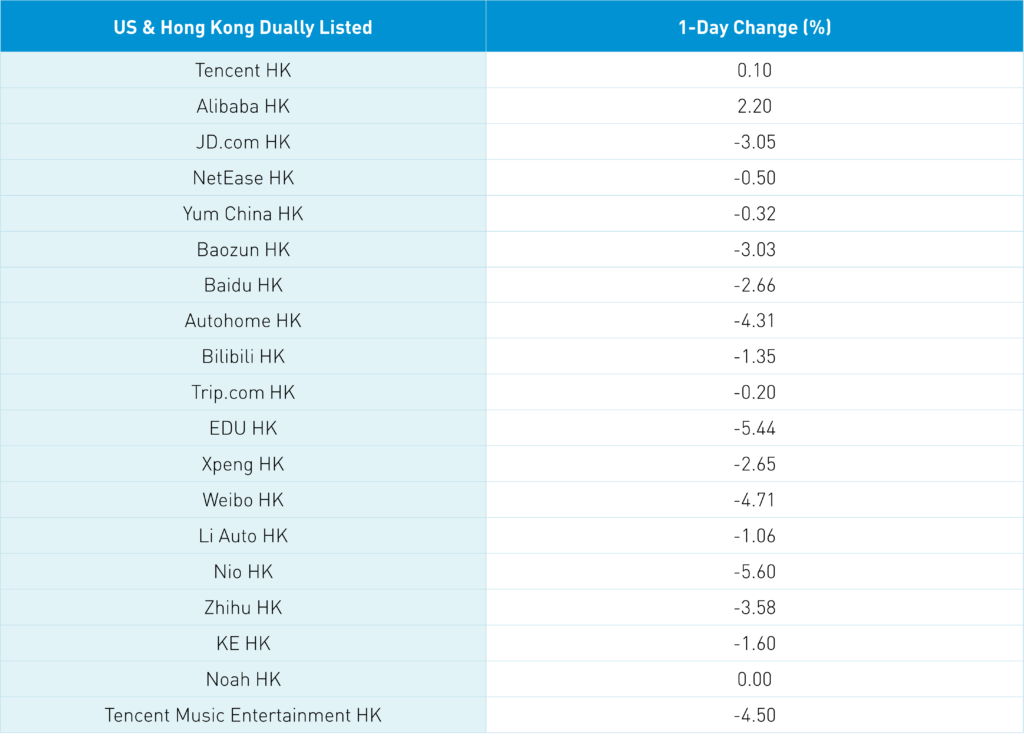

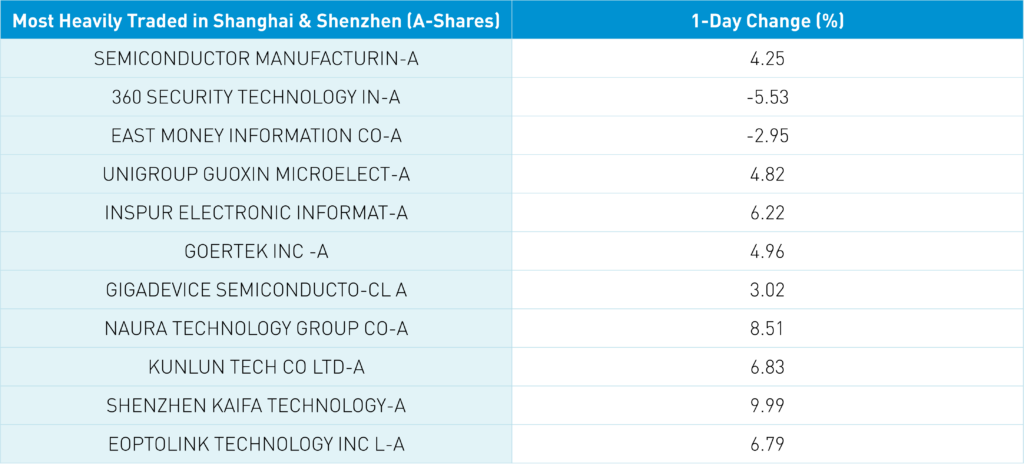

China’s economy is rebounding, while I believe many investors are underweight Chinese stocks. Pain trade higher! One consequence of the McCarthy/Taiwan visit was the rally in Chinese semiconductor stocks, which was led by Hong Kong’s most heavily traded SenseTime (20 HK), +2.15% after yesterday’s strong move. In China, the STAR Board gained +1.58%. Hong Kong’s most heavily traded after SenseTime was Tencent +01.% after buying 920k shares back today, making it eight straight days of buying, Semiconductor Manufacturing +7.67%, Alibaba HK +2.2% on rumors of a ChatGPT offering, Meituan -0.07% and JD.com HK -3.05%. Mainland investors bought a healthy $603mm of Hong Kong stocks. Worth highlighting how high volumes in China have been. Could this be the knock-on effect of animal spirits as the economy rebounds? Maybe! Semis were the big story today, along with broader tech. Northbound Stock Connect was closed overnight. France’s President Macron is in China, with reports of Ukraine being a top subject. EU chief Michel is also in China as the three heads will meet. As we noted yesterday, Airbus’ President is with Macron as a new Airbus factory in China was announced, which is unfortunate for Boeing. Create voids, and they get filled!

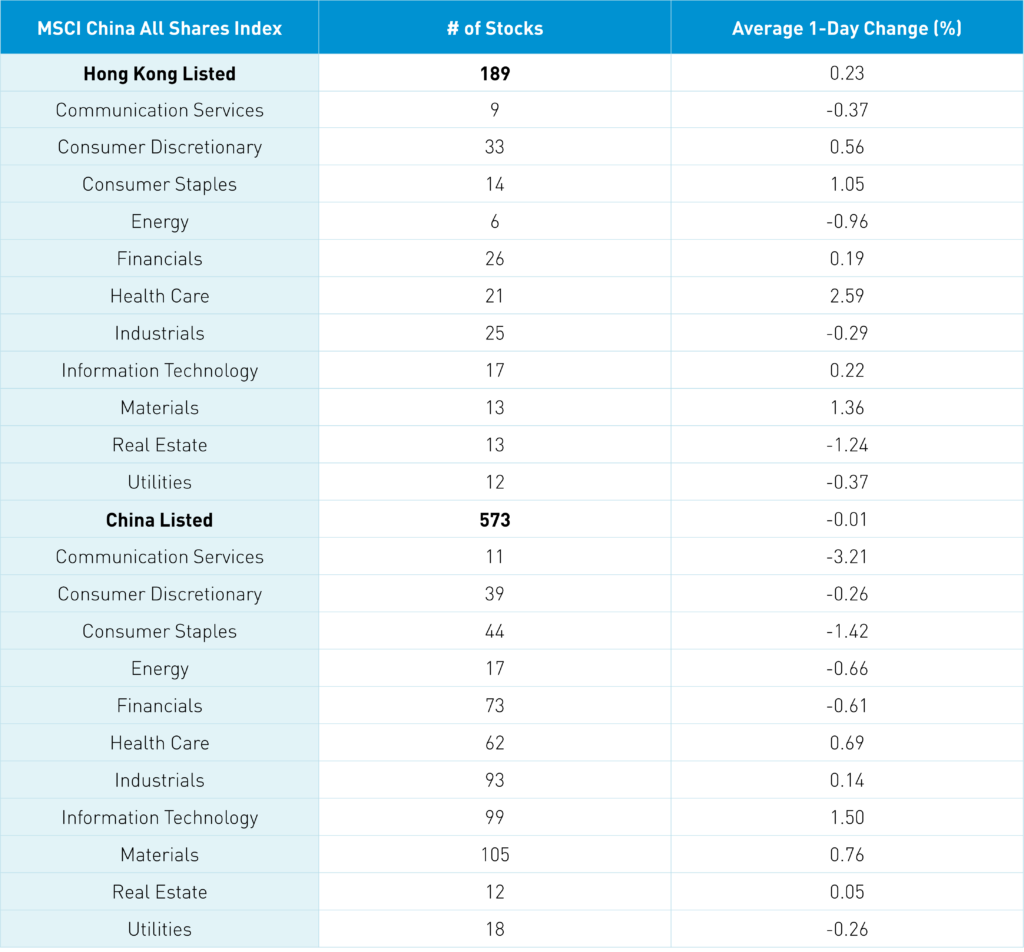

Hang Seng and Hang Seng Tech gained +0.28% and +0.1% on volume -14.83% from yesterday, 84% of the 1-year average. 229 stocks advanced, while 254 declined. Main Board short turnover fell -21.07% from yesterday, 65% of the 1-year average, as 13% of turnover was short turnover. Growth factors outpaced value factors as small caps outpaced large caps. The top sectors were healthcare +2.59%, materials +1.36%, and staples +1.05%, while real estate -1.24%, energy -0.96%, and communication -0.37%. The top sub-sectors were pharma, healthcare equipment, and semis, while media, energy, and business services. Southbound Stock Connect volumes were moderate as Mainland investors bought $603mm of Hong Kong stocks, with SMIC and SenseTime were large net buys, Meituan a small net buy, Tencent and Kuiashou were small net sells.

Shanghai, Shenzhen, and STAR Board were flat/0.0%, -0.04%, and +1.58% on volume -10.28% from yesterday, which is 131% of the 1-year average. 1,752 stocks advanced, while 2,972 stocks declined. Growth factors outperformed value factors, while small caps outpaced large caps. The top sectors were tech +1.51%, materials +0.77%, and healthcare +0.7%, while communication -3.2%, staples -1.41%, and energy -0.65%. The top sub-sectors were precious metals, semis, and communication equipment, while cultural media, soft drinks, and internet. Northbound Stock Connect was closed. CNY gained +0.08% versus the US dollar. Treasury bonds sold off while Shanghai copper and steel was off.

Major Chinese City Mobility Tracker

It appears that lots of folks are punching out for vacation!

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.87 versus 6.88 yesterday

- CNY per EUR 7.50 versus 7.51 yesterday

- Asia Dollar Index -0.01% overnight

- Yield on 10-Year Government Bond 2.86% versus 2.86% yesterday

- Yield on 10-Year China Development Bank Bond 3.04% versus 3.03% yesterday

- Copper Price -0.81% overnight

- Steel Price -1.20% overnight