EVs’ Silent Roar as Real Estate Receives Further Support

2 Min. Read Time

Key News

Asian equities were higher as Taiwan, South Korea, and Australia outperformed.

China and Hong Kong had a positive day driven by sixteen measures to support the real estate sector, including extending the due date on loans due in 2023 to 2024. The measures aren’t considered a silver bullet, though they should allow distressed property developers to muddle through as measures to stimulate demand are implemented. Real estate and property developers are under the government’s microscope in order to prevent them from causing a financial crisis. It is anticipated further economic support is coming with the month-end Politburo meeting of keen interest.

Interest rate easing appears to be working as June aggregate financing, and new loans were RMB 4.22 billion and RMB 3.05 billion, beating expectations of 3.10 billion and 2.32 billion, with a strong uptick from May’s 1560 billion and 1360 billion. Money supply (M2) increased 11.3% year over year, beating expectations of 11.2% though off slightly from May’s 11.6%.

Mainland media noted the Beijing government held a meeting to “strengthen and expand the digital economy” with an emphasis on promoting technologies such as AI. Mainland AI/tech/big data stocks were strong performers though foreign favorite Hundsun Technologies was an outlier, down -7.89% on fears Ant Group could reduce its stake. Hong Kong’s most heavily traded by value were Alibaba +2.01%, Tencent +1.52%, China Construction Bank -0.46%, Meituan +0.74%, BYD +2.8%, XPeng +8.9%, and Li Auto +4.37%. EVs performed well, driven by new EV insurance registrations showing a nice gain from Li Auto and XPeng on expanding into Israel and a broker upgrade. The China Association of Automobile Manufacturers reported June EV sales increased by +35.2% to 806,000 out of a total of 2.622 million vehicles sold, which is a penetration rate of 30.7%. EV exports increased 170% YoY to 78,000 cars, though due to auto tariffs, we aren’t going to see any inexpensive Chinese EVs here in the US. Government social media star Hu Xijin posted online that today’s market move increased his profits. As mentioned previously, it is interesting to see him so publicly invest in Mainland stocks for the first time. Interesting!

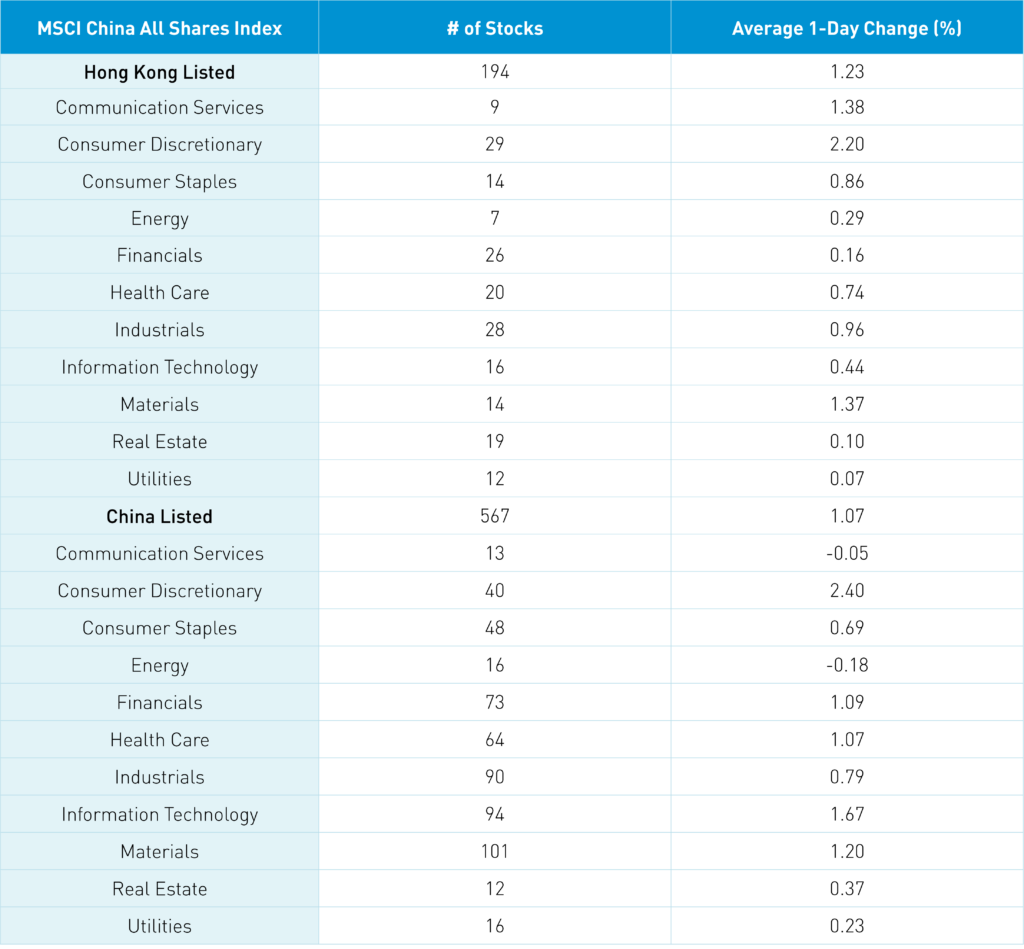

The Hang Seng and Hang Seng Tech gained +0.97% and +1.47% on volume +7.17% from yesterday, which is 74% of the 1-year average. 347 stocks advanced, while 120 declined. Main Board short turnover increased +1.73% from yesterday, which is 78% of the 1-year average, as 18% of volume was short volume. Growth factors outperformed value factors as large caps outpaced small caps. All sectors were positive, led by discretionary +2.21%, communication +1.38%, and materials +1.38%. The top sub-sectors were auto, consumer services, and consumer durables, while telecom, food, and banks were at the bottom. Southbound Stock Connect volumes were light as Mainland investors sold -$265 million of Hong Kong stocks, with XPeng a small net buy, Tencent a small net sell, and CNOOC a small/moderate net buy.

Shanghai, Shenzhen, and STAR Board gained +0.55%, +0.79%, and +0.77% on volume +1.32% from yesterday, which is 85% of the 1-year average. 3,107 stocks advanced, while 1,502 declined. The growth factor outperformed the value factor as small caps outpaced large caps. The top sectors were discretionary +2.41%, tech +1.68%, and materials +1.21%, while energy -0.18% and communication -0.04% were the bottom performers. The top sub-sectors were motorcycles, auto parts, and auto, while education, coal, and cultural media were the worst. Northbound Stock Connect volumes were light as foreign investors bought $484 million of Mainland stocks, with Hundsun Technologies a small net buy, Longi Green Tech a small/moderate sell, and Foxconn a small net buy. CNY and the Asia dollar index gained +0.35% and +0.49% versus the US dollar while Treasury bonds rallied. Copper gained while steel was off small.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.20 versus 7.23 yesterday

- CNY per EUR 7.92 versus 7.93 yesterday

- Yield on 10-Year Government Bond 2.63% versus 2.64% yesterday

- Yield on 10-Year China Development Bank Bond 2.76% versus 2.77% yesterday

- Copper Price +0.31% overnight

- Steel Price -0.05% overnight