Command Without Control, Week in Review

3 Min. Read Time

Week in Review

- It was reported on Tuesday that BYD sold 341,000 NEVs in December, which brought their 2023 total to more than 3 million.

- The PBOC announced RMB 350 billion ($9 billion) of pledged supplementary lending to three policy banks in December for the first time since November 2022.

- Mainland China's Ministry of Finance’s Lan Fo’an spoke on Thursday on expanding the budget deficit to support the economy and extending preferential tax policies for small/micro enterprises, individuals, and industrial and commercial households.

Friday's Key News

Asian equities ended a poor start to 2024 mixed as investors waited for this morning’s payroll release as the US 10-year Treasury yield rose above 4% overnight with the US dollar rallied. A strong release could validate the recent strong Fed talk on higher for longer.

It was a quiet night as Mainland China and Hong Kong closed lower on little news as investors bought bonds again in advance of anticipated rate cuts. China’s 10-year Treasury yield fell to 2.53% from yesterday’s 2.54%. Mainland stocks’ yield versus the 10-year yield is almost at its all-time high, which was reached on December 26th.

Yes, there were some headlines overnight, including a proposed tit-for-tat tariff on European brandy as the European Union looks at tariffs on China-made electric vehicles (EVs). There have also been reports that President Biden will maintain Trump’s Section 301 tariffs on Chinese goods despite 160 US business associations jointly complaining about how they have been negatively impacted, according to Politico.

Hong Kong’s most heavily traded stocks were Tencent, which fell -2.21% despite buying $1.3 billion worth of stock in December, Alibaba, which fell -3.24% despite its buyback and proposed Lazada spin-off, the Hong Kong Tracker ETF, which was flat, China Mobile, which gained +2.73%, and Meituan, which gained +0.32%.

Trip.com gained +2.86%, though failing to match its US-listed counterpart’s rise of +5.72%, after China and Thailand waived visa requirements and Mainland media reports that international flights will materially rise in 2024.

Health Care was weak in both Hong Kong and Mainland China, though I have not seen any news or catalysts.

Mainland investors bought the Hong Kong dip via Southbound Stock Connect.

The Mainland market had a poor day, with decliners outpacing winners 10 to 1. The most interesting news was regulators asking fund families to list more equity funds to get markets higher. While the Mainland China ETF market has seen strong inflows, I read active Mainland mutual funds have seen redemptions as PMs have found adding alpha difficult. I’ll do some work over the weekend and report back with the data. Mainland indices are near lows despite the jawboning from the government and the economy’s slow/incremental rebound. Today’s performance indicates that investors want to see the gas pedal pushed harder as words have fallen flat.

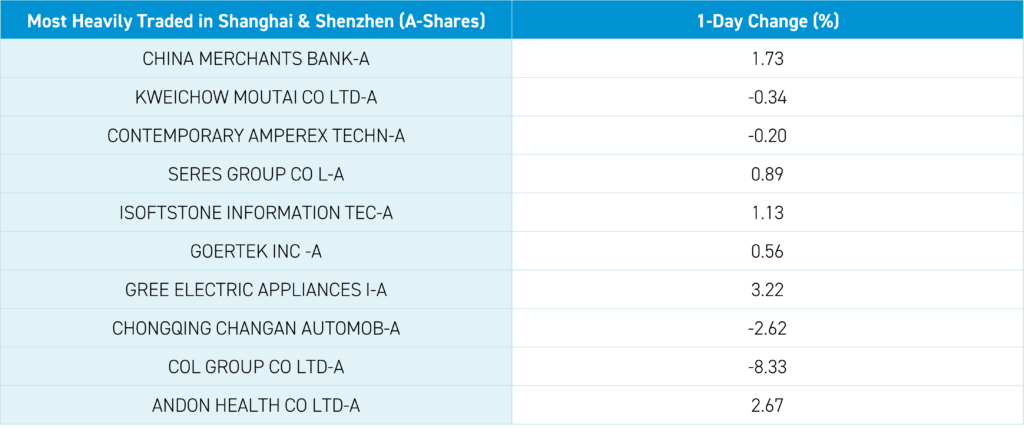

China Merchants Bank gained +1.73% and was the Mainland’s most heavily traded by value following yesterday’s very high volume in Agriculture Bank -1.06%. These are historical footprints of the “National Team”/institutions affiliated with the government, such as the sovereign wealth fund, insurance companies, Social Security Fund, etc. The market doesn’t care about these symbolic gestures, as actions (or the lack thereof) speak louder than words. Foreign investors were net buyers of Mainland stocks via Northbound Stock Connect.

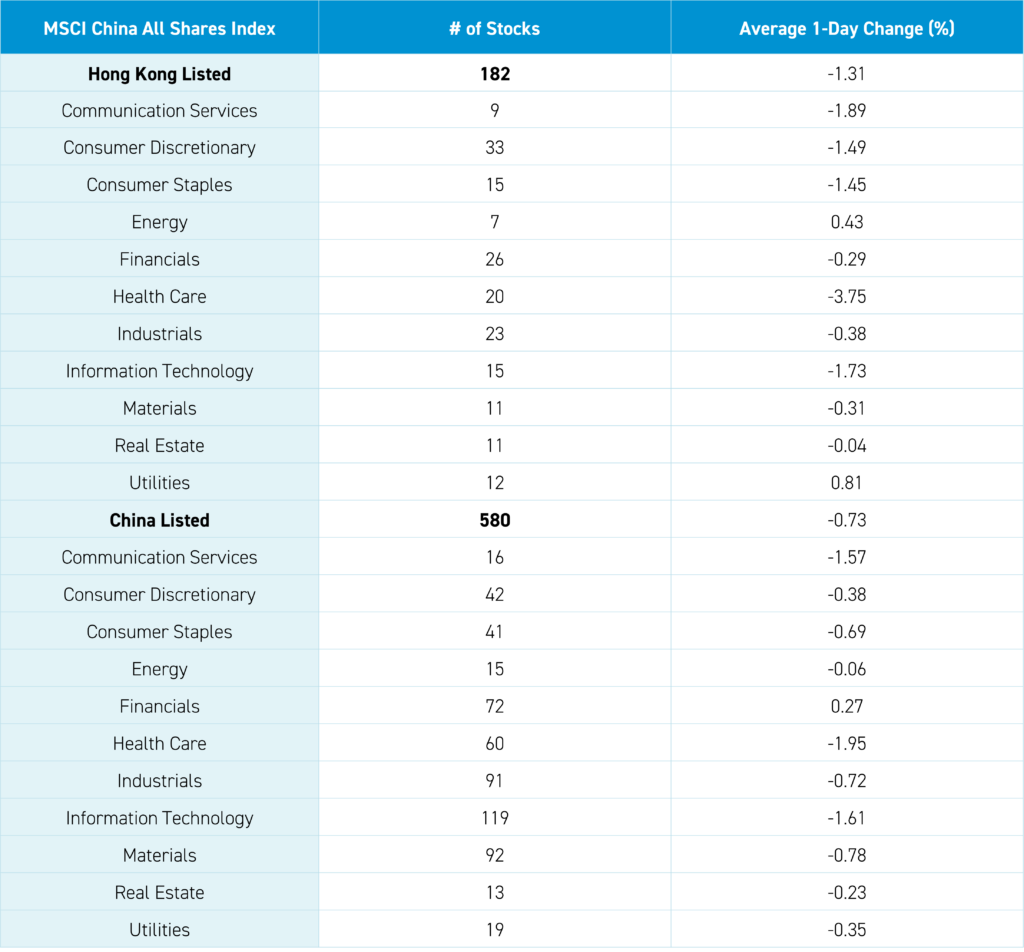

The Hang Seng and Hang Seng Tech fell -0.66% and -1.71%, respectively, on volume that increased +16.25% from yesterday, which is 78% of the 1-year average. 140 stocks advanced, while 340 declined. Main Board short turnover increased by +6.89% from yesterday, which is 79% of the 1-year average, as 17% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor and large caps “outperformed”/fell less than the growth factor and small caps. Utilities and energy were the only positive sectors, +0.81%, and +0.43%, while healthcare -3.75%, communication -1.89%, and tech -1.73%. The top sub-sectors were telecom, media, and business services, while pharmaceutical, retailing, and software were the worst. Southbound Stock Connect volumes were light/moderate as Mainland investors bought $205mm of Hong Kong stocks and ETFs, with the Hong Kong Tracker ETF, CNOOC, and China Mobile seeing small net buys, while Tencent was a moderate net sell, CCB and Ag Bank small net sells.

Shanghai, Shenzhen, and STAR Board fell -0.85%, -1.34%, and -1.96%, respectively, on volume that increased +9.11% from yesterday, 84% of the 1-year average. 476 stocks advanced, while 4,477 declined. The value factor and large caps “outperformed”/fell less than the growth factor and small caps. Financials was the only positive sector, +0.27%, while healthcare -1.95%, tech -1.61%, and communication -1.57%. The top sub-sectors were banks, household appliances, and building materials, while aerospace, computer hardware, and communication equipment were the worst. Northbound Stock Connect volumes were moderate as foreign investors bought $278mm of Mainland stocks with Gree, China Merchants Bank, and Kweichow Moutai small net buys, while Wuliangye, Midea, and BYD were small net sells. CNY and the Asia dollar index fell slightly versus the US dollar. Treasury bonds rallied (again) while copper and steel were off.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.15 versus 7.15 yesterday

- CNY per EUR 7.80 versus 7.83 yesterday

- Yield on 10-Year Government Bond 2.51% versus 2.53% yesterday

- Yield on 10-Year China Development Bank Bond 2.71% versus 2.72% yesterday

- Copper Price -0.10%

- Steel Price -0.84%