Policy Measures Eyed As Market Awaits Q4 Data

4 Min. Read Time

Key News

Asian equities were lower today, except for Mainland China, following a mixed Monday, as the US 10-year Treasury yield rose above 4% this morning and US dollar strengthened.

Friday’s post-Hong Kong close South Morning China Post (SCMP) article on Baidu’s AI being used by the Chinese military, based on an academic journal, sent the US listing down by -7% Friday in US trading and -11.56% in Hong Kong Monday. The company has vehemently denied the article, which the SCMP edited to include Baidu’s denial, indicating the company was unaware the article was coming. The damage was exacerbated by light volumes due to the US holiday. The Hang Seng Tech index fell -1.95% Monday and -2.33% today. The article cost Baidu and its shareholders $4.7 billion in market capitalization.

Over the weekend, the Medium-Term Lending Facility (MLF) Rate, the rate the PBOC lends to big banks, was surprisingly left unchanged at 2.50%. However, the economy’s problem is not a supply problem but a demand problem. The lack of an interest rate cut should somewhat support the Renminbi (CNY).

Taiwan’s DPP candidate won the Presidential election as expected, though rivals KMT and TPP won seats in the legislature as the DPP lost its majority. Gridlock! The muted reaction is another indication of the change of tone from China's government.

This was reiterated today in Davos, where Premier Li stated, “We will take active steps to address reasonable concerns of the global business community,” according to Reuters. Like President Xi’s speech at APEC, Li's speech addressed foreign corporations and investors’ concerns about investing in China. He also stated that China’s GDP grew 5.2% in 2023.

Real Estate was weak on the chatter of weak sales and Ping An Insurance lending to 41 unnamed property developers. Hong Kong’s most heavily traded stocks were Tencent, which fell -2.42%, Meituan, which fell -2.31%, Alibaba, which fell -2.29%, HSBC, which fell -3.04%, and Hong Kong Exchanges, which fell -4.13%. Analysts continue to bring down their Alibaba price targets as they near earnings season.

Mainland China was off but not to the extent of Hong Kong as the Hang Seng and Hang Seng Tech indexes hit new 52-week lows. Shanghai and Shenzhen are also sitting on support levels, which explains the after-close report of a new $139 billion (RMB 1 trillion) government bond issuance to “fund projects related to food, energy, supply chains, and urbanization,” according to Bloomberg News. This would only be the 4th time of such a bond issuance, the others being the 1998 financial crisis and the 2020 COVID crisis. There was also talk about China’s sovereign wealth fund buying stocks.

Tomorrow is a big day as Q4 GDP, December Industrial Production, Retail Sales, property sales, and fixed asset investment will be released. An element of weakness could be investors waiting for tomorrow’s release. Regardless, policymakers should note the market’s reaction to stimulus measures or a lack thereof.

For our foreign readers, one understated element of US politics is the Presidential primaries and who is allowed to vote. Most states, like Iowa, only allow voters registered to a political party are allowed to vote in the primary. Gallup says this is important because 40% of voters are independent (28% Republican, 29% Democrats). These independent voters have no say in determining the candidates, which explains an element of the divisiveness of US politics.

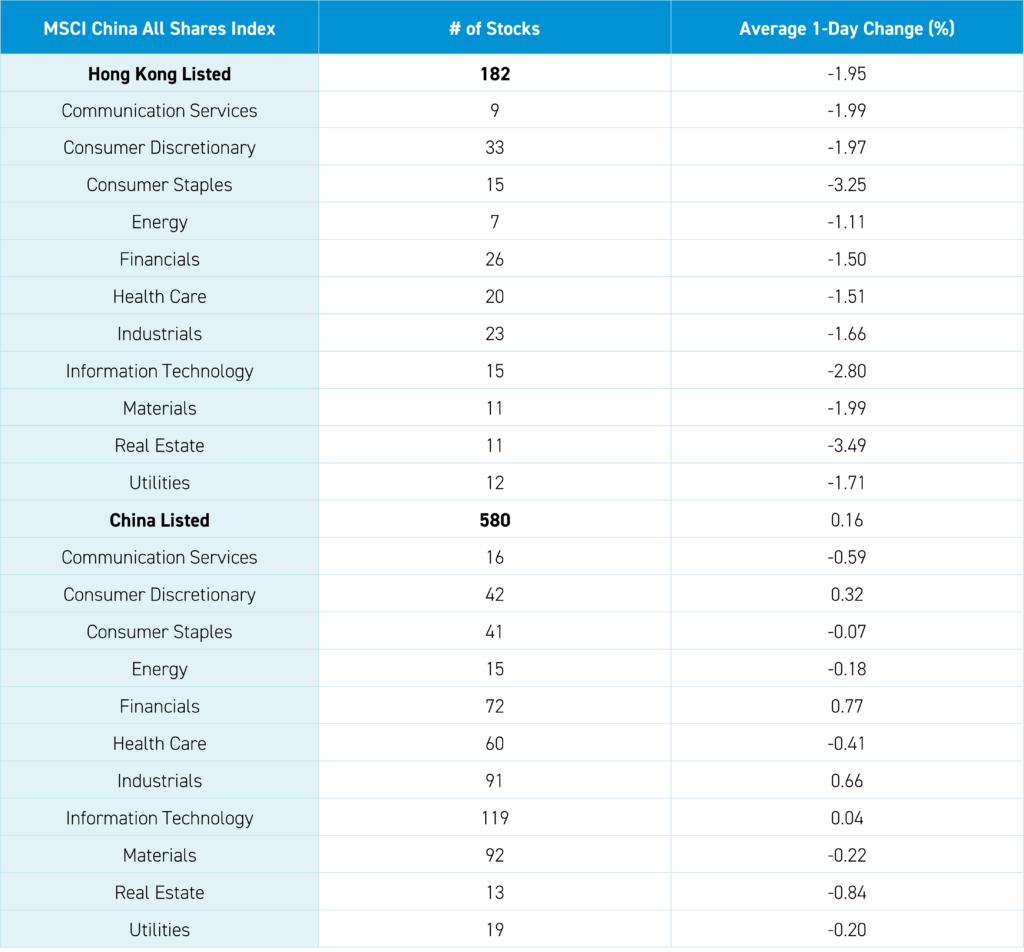

The Hang Seng and Hang Seng Tech indexes fell -2.16% and -2.29%. respectively, on volume that increased +18.76% from yesterday, 82% of the 1-year average. 71 stocks advanced, while 427 declined. Main Board short turnover increased +16.42% from yesterday, which is 101% of the 1-year average as 21% of turnover was short turnover (remember that Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor and large caps “outperformed” (i.e. fell less than) the growth factor and small caps. All sectors were negative, including Real Estate. which fell -3.49%, Consumer Staples, which fell -3.26%, and Technology, which fell -2.8%. Communication Services constituted the only positive sector. Meanwhile, Foodstuffs, Beverages, and Media were among the worst-performing subsectors. Southbound Stock Connect volumes were moderate-to-light as Mainland investors sold a net $376 million worth of Hong Kong-listed stocks and ETFs, including China Mobile, Wuxi Biologics, and Ping An Insurance. Meanwhile, they were net sellers of Hong Kong Exchanges, Tencent, and Li Auto.

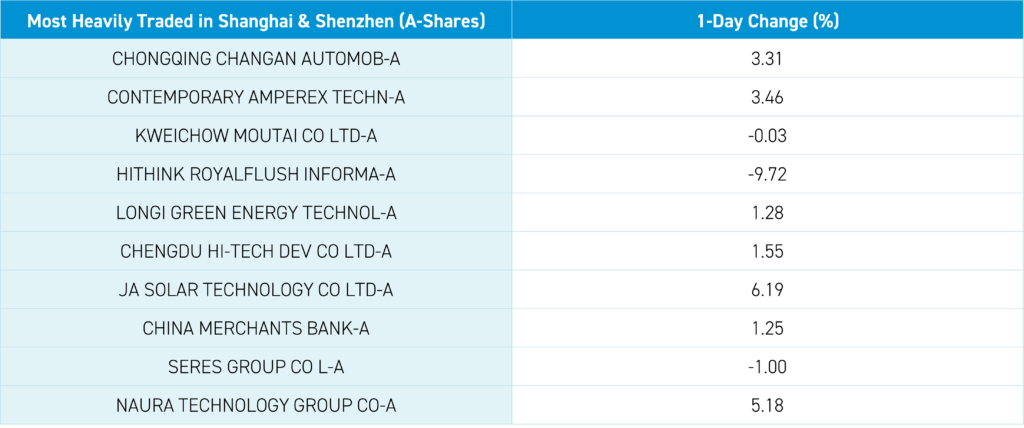

Shanghai, Shenzhen, and the STAR Board diverged to close +0.27%, -0.03%, and +0.52%, respectively, on turnover that increased +12% from yesterday, which is 79% of the 1-year average. 1,379 stocks advanced, while 3,459 declined. The value factor and large caps “outperformed” (i.e. fell less than) the growth factor and small caps. The top-performing sectors were Financials, which gained +0.78%, Industrials, which gained +0.67%, and Consumer Discretionary, which gained +0.32%. Meanwhile, Real Estate fell -0.84%, Communication Services fell -0.59%, and Health Care fell -0.41%. The top-performing subsectors were airports, insurance, and aviation. Meanwhile, leisure products, real estate, and business services were among the worst-performing subsectors. Northbound Stock Connect volumes were moderate as foreign investors sold a net -$574 million worth of Mainland stocks, including Sevenstar, Will Semiconductor, and Midea. Meanwhile, they were net sellers of Changan Auto, BYD, and Kweichow Moutai. CNY and the Asia Dollar Index weakened versus the US dollar. Treasury bonds sold off along with copper and steel.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.19 versus 7.17 yesterday

- CNY per EUR 7.82 versus 7.84 yesterday

- Yield on 10-Year Government Bond 2.52% versus 2.51% yesterday

- Yield on 10-Year China Development Bank Bond 2.73% versus 2.73% yesterday

- Copper Price -0.03%

- Steel Price -0.21%