Mortgage Rate Cut and New CSRC Head’s Outreach Lift Markets

2 Min. Read Time

Key News

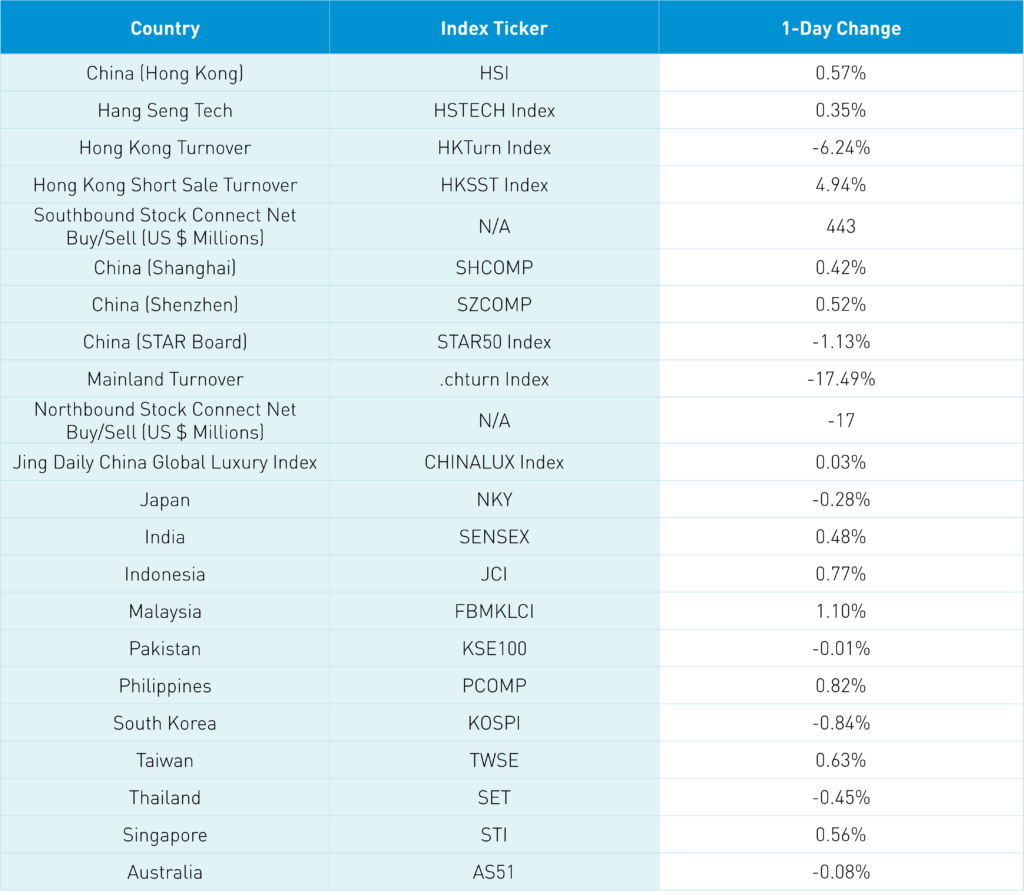

Asian stocks were mixed overnight as the PBOC announced a larger-than-expected cut of the 5-year Loan Prime Rate (LPR).

The LPR, which helps set mortgage rates, is now down to 3.95% from 4.20% versus expectations of 4.10%. This is the largest single LPR cut ever and indicates the government’s focus on stabilizing housing prices. Due to households’ significant exposure to real estate, a price stabilization should help raise consumer confidence and spending over time. I have not seen data on the amount of cash that could be returned to households via refinancing, though I would assume it will be a significant amount.

Shanghai and Shenzhen overcame early losses to post their fifth positive day in a row, led by large/mega caps. The new CSRC, China’s version of the SEC, Chairman Wu Qing, has hit the ground running by hosting ten symposiums on the market with a variety of investors as he clearly wants to get the stock market up! It was interesting that a Mainland media source noted he is examining China’s settlement on trade data (T+0, trade date plus zero). Moving to T+1 (trade date plus one) would actually be a positive as T+0 is problematic for index funds’ rebalancing.

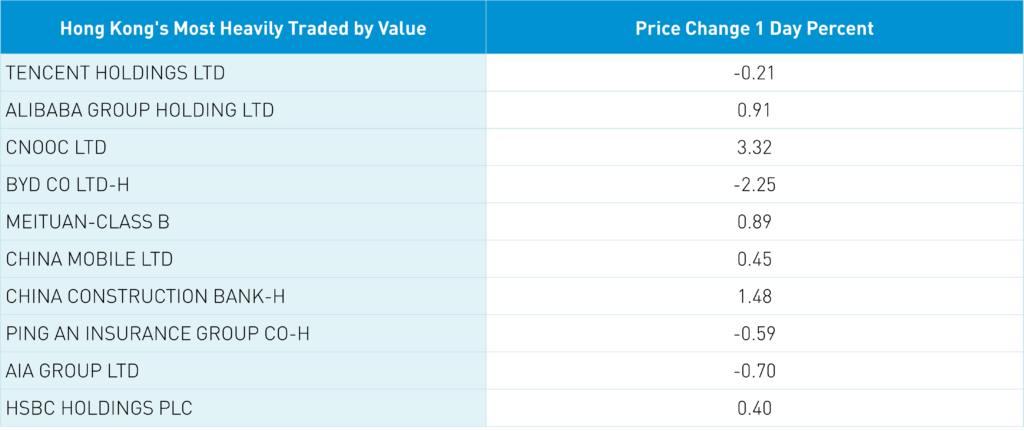

Hong Kong posted a small gain after a rough Monday trading session. The most heavily traded stocks by value were Tencent, which fell -0.21%, Alibaba, which gained +0.91%, energy giant CNOOC, which gained +3.32%. Meanwhile, BYD was down -2.25% on EV price war fears, which weighed on the space, and Meituan gained +0.89%.

The negativity around China’s strong travel data as the nattering nabobs of negativity focus on “per capita” data. Tomorrow, Trip.com (TCOM) will report Q4 earnings, which should provide a good insight into the Chinese New Year data and the consumer.

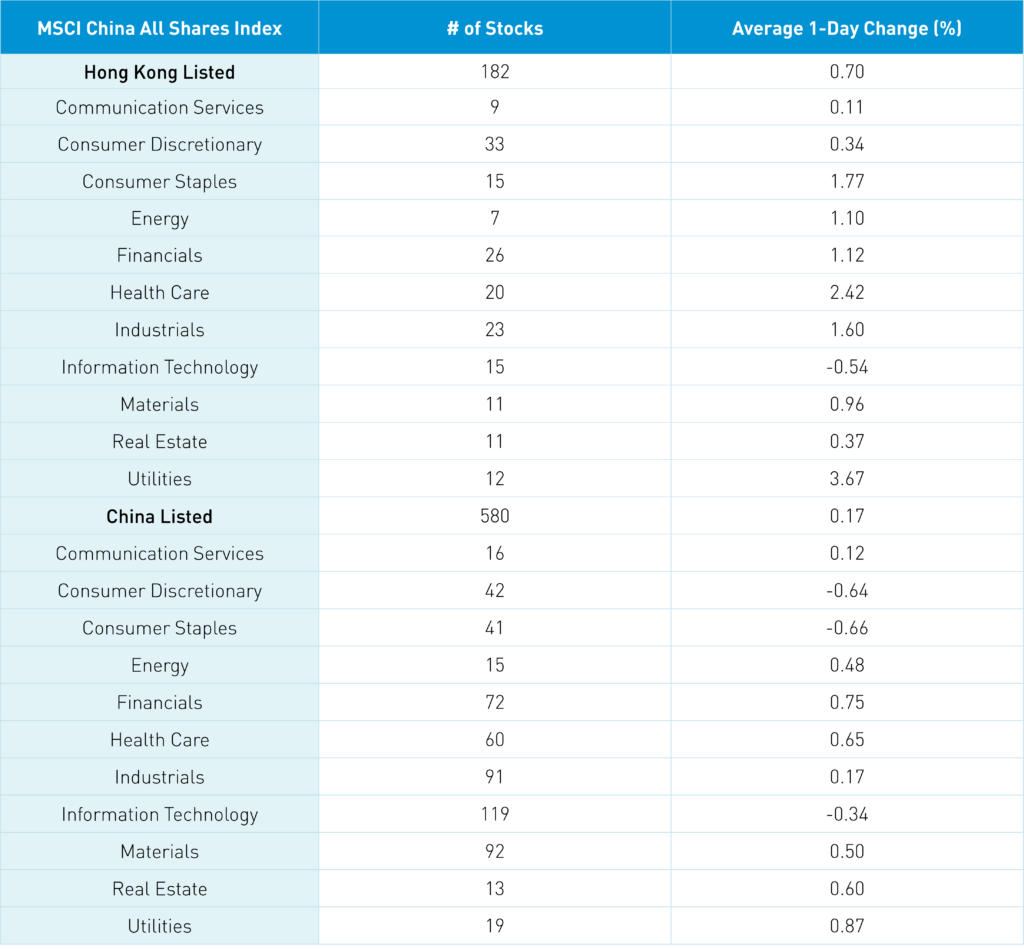

The Hang Seng and Hang Seng Tech indexes gained +0.57% and +0.35%, respectively, on volume that declined -6.24% from yesterday, which is 77% of the 1-year average. 340 stocks advanced, while 151 declined. Main Board short turnover increased by +4.94% from yesterday, which is 79% of the 1-year average, as 18% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The growth factor and large caps outperformed the value factor and small caps. All sectors were positive except for technology, which fell -0.54%, led by Utilities, which gained +3.67%, Health Care, which gained+2.42%, and Consumer Staples, which gained +1.77%. The top-performing subsectors were business/professional services, pharmaceuticals, and healthcare equipment. Meanwhile, media, auto, and semiconductors were among the worst-performing. Southbound Stock Connect volumes were moderate/light as Mainland investors bought $443 million worth of Hong Kong-listed stocks and ETFs, led by energy giant CNOOC, China Mobile, and China Construction Bank. Meanwhile, Tencent, Semiconductor Manufacturing (SMIC), and Sinopec were small net sells.

Shanghai, Shenzhen, and the STAR Board diverged +0.42%, +0.52%, and -1.13%, respectively, on volume that declined -17% from yesterday, which is 92% of the 1-year average. 3,286 stocks advanced, while 1,549 declined. The value factor and large caps outperformed the growth factor and small caps. The top-performing sectors were Utilities, which gained +0.85%, Financials, which gained +0.73%, and Health Care, which gained +0.63%. Meanwhile, Consumer Staples fell -0.67%, Consumer Discretionary fell -0.66%, and Technology fell -0.36%. The top-performing subsectors were leisure products, cultural media, and chemicals. Meanwhile, auto, motorcycle, and power generation equipment were among the worst-performing. Northbound Stock Connect volumes were moderate as foreign investors sold an net -$17 million worth of Mainland stocks, including Mindray, which was a small net buy, Kweichow Moutai and CATL, which were moderate net buys. Meanwhile, BYD, Midea, and CMB were moderate/small net sells. CNY made a small gain versus the US dollar overnight. Treasury bonds rallied while copper and steel were off.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.19 versus 7.20 yesterday

- CNY per EUR 7.77 versus 7.75 yesterday

- Yield on 10-Year Government Bond 2.41% versus 2.43% yesterday

- Yield on 10-Year China Development Bank Bond 2.59% versus 2.60% yesterday

- Copper Price -0.09%

- Steel Price -1.23%