Hong Kong’s “Good Stuff” Gets Going

4 Min. Read Time

Key News

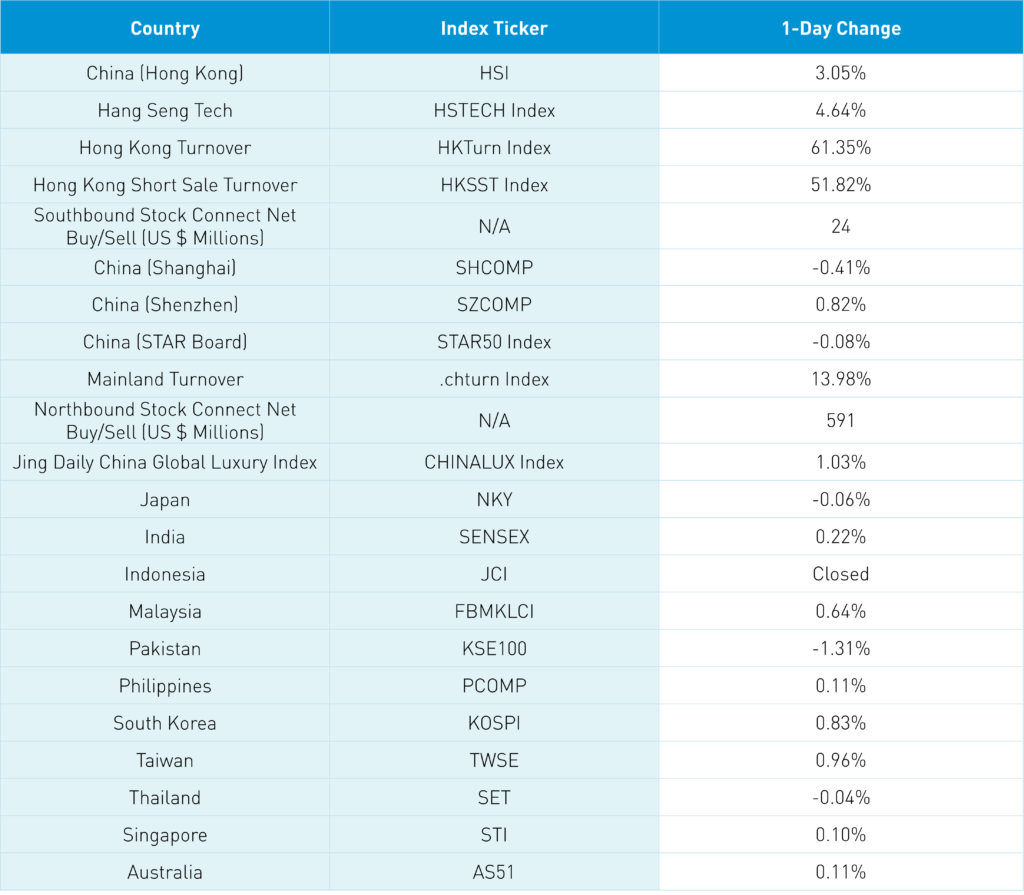

Asian equities were largely higher as Hong Kong outperformed, while Japan underperformed and Indonesia was closed for the second day of the Hindu Saka New Year.

The Hang Seng is now positive year to date, having closed above 17,000 for the first time since late November 2023 on strong volumes +61% from yesterday, which is 152% of the 1-year average and strong breadth (4 to 1, advancers versus decliners). Having cleared both the 50 and 100-day moving averages, the 200-day moving average is at 17,652. The Hang Seng Tech Index outperformed the Hang Seng Index, validating our thesis that investors will want the “good stuff,” i.e. growth stocks versus stocks in slow/no growth sectors despite their high dividend yields.

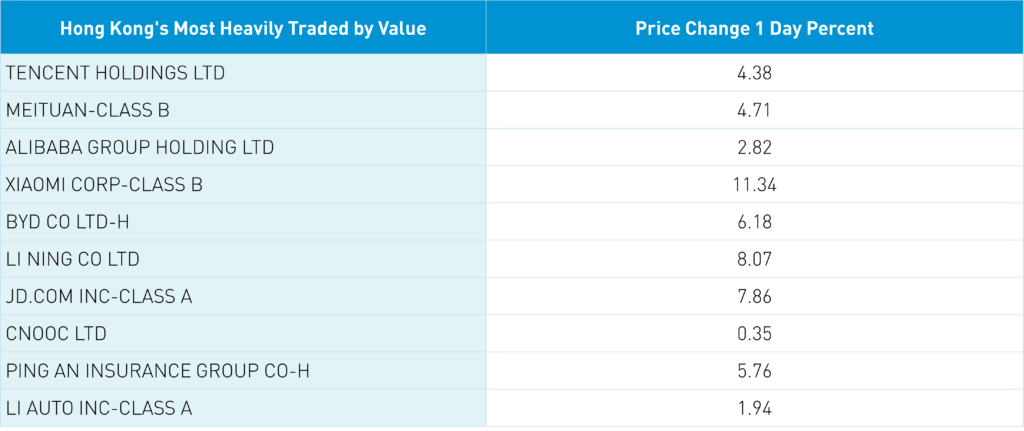

Growth stocks were Hong Kong’s most heavily traded, as Tencent gained +4.38% on its 6th day of net buying via Southbound Stock Connect, Meituan gained +4.71%, Alibaba gained +2.82%, Xiaomi gained +11.34% on launching its first EV, and BYD gained +6.18% on further auto consumption policy support from the "Two Sessions" important policy meetings, though we lack details thus far.

Sports apparel maker Li Ning (2331 HK) was up +8.07% on reports that the CEO is considering taking the company private, with the stock down 79% from its 2021 high. The company generated revenue of RMB 14.5 billion in 2020, RMB 22.6 billion in 2021, RMB 25.8 billion in 2022, and on March 19th they will report 2023 results with an expected total revenue of RMB 27.9 billion.

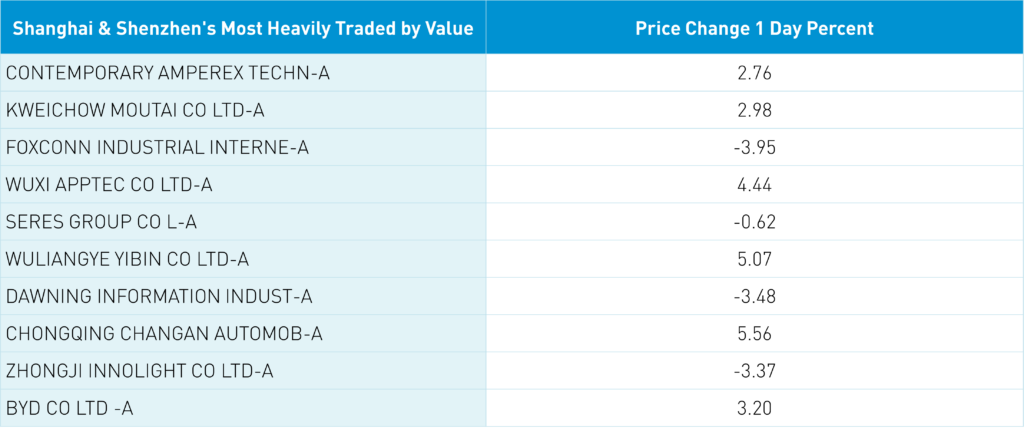

Mainland China was a bit mixed, though large/mega cap growth stocks favored by foreign investors had a strong day with CATL up +2.76% after another massive net buy via Northbound Stock Connect. Kweichow Moutai and other liquor stocks were as hot as your throat would be after drinking the fire water, with Kweichow Moutai up +2.98% and Wuliangye Yibin up +5.07%. Northbound Stock Connect volumes were very high, with $591 million worth of net buying.

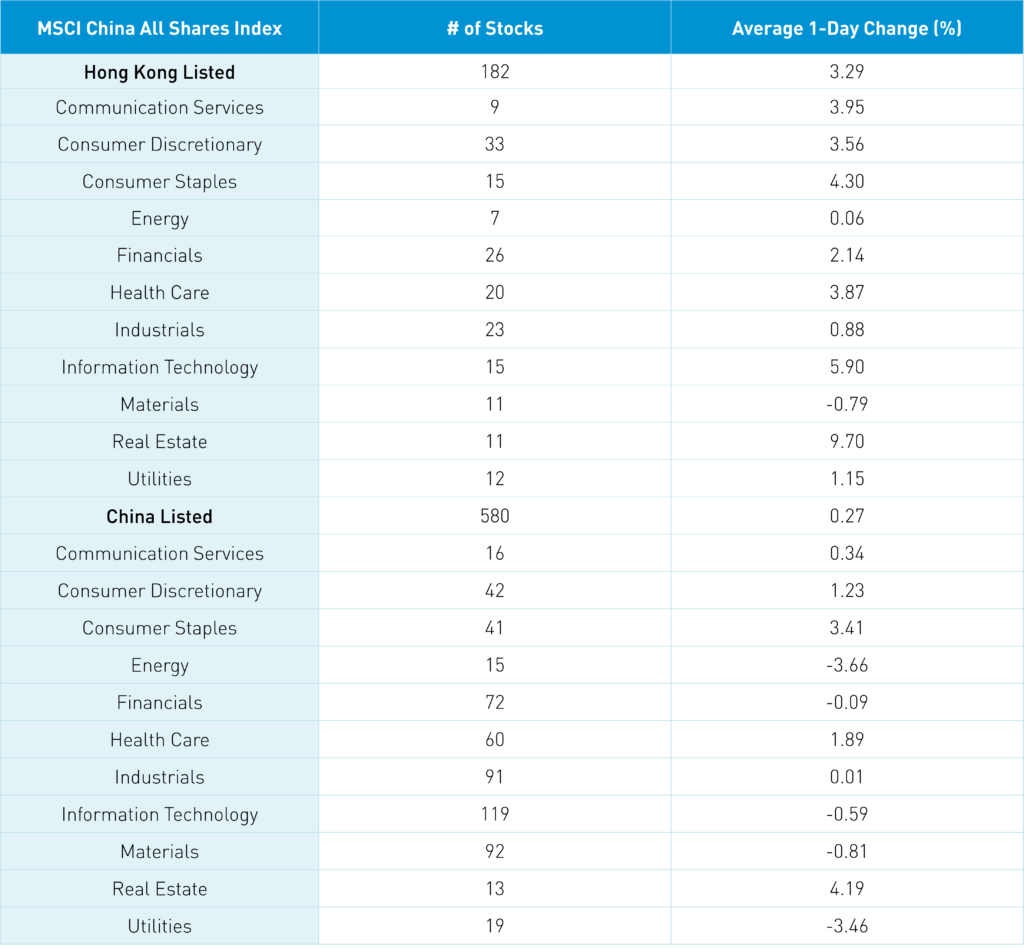

Real estate gained +4.19% in Mainland China and +9.70% in Hong Kong despite Moody’s downgrading SOE developer Vanke because the company is rumored to have secured a debt restructuring. The company’s bonds rallied on the news along with its stock in Hong Kong, which was up +10.33%, and in Mainland China, where it was up +5.71%. Remember, real estate is now a small sector, which is why we prefer the bonds over the stocks to play a rebound. The two Mainland-listed equity ETFs favored by the National Team had above-average volume in the morning but were below-average in the afternoon. It was a solid day overall. Remember, if the rally keeps going, this is going to get very uncomfortable for professional investors who are underweight in China as they have to disclose their holdings at quarter end.

There has been very little media attention to Trump's opposition to a TikTok ban. He mentioned using tariffs to do a trade deal with China, which one suspects would happen. I am shocked there has not been more attention to his mildly pro-China comments.

At month's end, India will move stock trading settlement from T+1 to T+0 on an optionable basis with a full transition in a year. Trade date plus Zero means you have to deliver the cash on the day you trade. Sounds good but T+0 is highly problematic for index funds and passive ETFs.

MSCI’s China A-share inclusion was suspended partly due to China A-shares having a T+0 settlement. Why is it an issue? On index rebalance days, if I need to sell T+2 markets to fund a purchase of T+0 markets, you have a problem since you don’t get the cash until Trade plus two days, but I need the cash today to buy. Will MSCI cap or limit India’s weight in indices similar to their suspension of Chinese A-shares? It is hard to say, but index fund managers and ETF managers will complain. The effect of T+0 on intra-day trading is something to think about as well.

The Hang Seng and Hang Seng Tech gained +3.05% and +4.64%, respectively, on volume that increased +61.35% from yesterday, which is 152% of the 1-year average. 403 stocks advanced, while 93 declined. Main Board short turnover increased by +51.82% from yesterday, which is 134% of the 1-year average, as 15% of turnover was short turnover (remember Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor outperformed the growth factor slightly as small caps outpaced large caps. The top-performing sectors were Real Estate, which gained +9.69%, Technology, which gained +5.89%, and Consumer Staples, which gained +4.30%. Meanwhile, Materials declined -0.80%. The top-performing subsectors were technical hardware equipment, real estate, and software services. Meanwhile, telecom and materials were among the worst-performing. Southbound Stock Connect volumes were very high as Mainland investors bought a net $24 million worth of Hong Kong-listed stocks and ETFs, including Kuaishou, a small net buy, and Tencent and Bank of China, which were large net buys. Meanwhile, Li Ning, CNOOC, and Hang Seng Tech ETF were large net sells.

Shanghai, Shenzhen, and the STAR Board diverged to close -0.41%, +0.82%, and -0.08%, respectively, on volume that increased +13.98% from yesterday, which is 132% of the 1-year average. 3,428 stocks advanced, while 1,483 declined. The growth factor and large caps outperformed the value factor and small caps. The top-performing sectors were Real Estate, which gained +4.19%, Consumer Staples, which gained +3.41%, and Health Care, which gained +1.88%. Meanwhile, Energy fell -3.67%, Utilities fell -3.46%, and Materials fell -0.82%. The top-performing subsectors were liquor, office supplies, and real estate. Meanwhile, coal, oil & gas, and precious metals were among the worst-performing. Northbound Stock Connect volumes were very high as foreign investors bought a net $591 million worth of Mainland stocks, including CATL, which was a very large net buy, and Kweichow Moutai and Wuliangye, which were also large net buys. CNY gained a James Bond +0.07% versus the US dollar. Treasury bonds sold off. Copper gained while steel fell.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.18 yesterday

- CNY per EUR 7.84 versus 7.84 yesterday

- Yield on 10-Year Government Bond 2.34% versus 2.31% yesterday

- Yield on 10-Year China Development Bank Bond 2.48% versus 2.41% yesterday

- Copper Price +0.22%

- Steel Price -0.55%