US-China Diplomatic Communication Picks Up, Week in Review

3 Min. Read Time

Week in Review

- Asian equities were mixed for the week as Mainland China outperformed.

- The electric vehicle ecosystem was energized as BYD announced its second-highest-ever monthly sales in March and smartphone maker Xiaomi entered the space with great fanfare.

- President Biden and President Xi spoke for the first time since their November San Francisco meeting on Wednesday, with both calling the conversation “candid and constructive,” with the China release noting the implementation of the “San Francisco Vision.”

- The March Caixin Services purchasing managers’ index (PMI), released Wednesday, was 52.7 versus expectations of 52.5 and February’s 52.5. Manufacturing PMIs, both officially gathered and from private surveys, beat expectations in March as well.

Key News

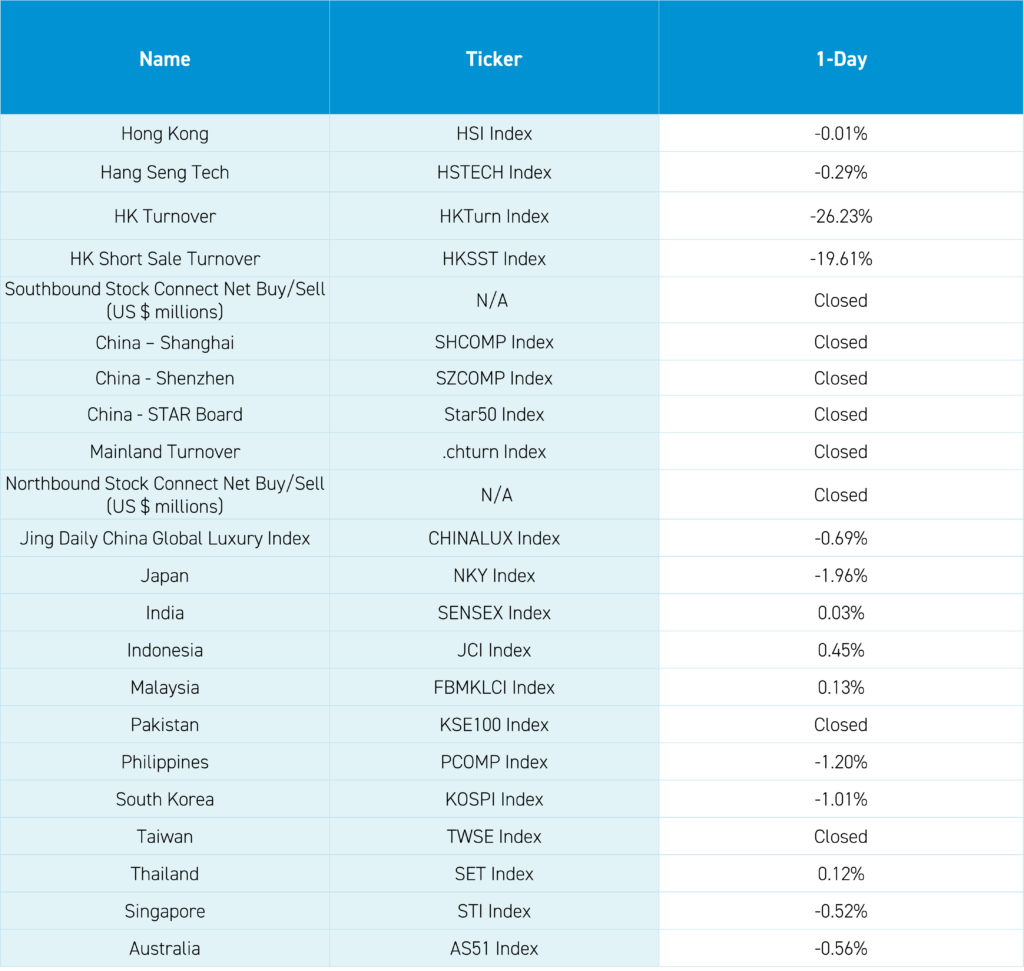

Asian equities were mixed overnight as South Korea and Japan underperformed following Minneapolis Fed President Neel Kashkari stating that there might not be interest rate cuts in 2024 if inflation remains “sideways”. The sideways comments led investors to ease their pain with some red wine, but not Merlot! (a Sideways, the movie, reference).

Southeast Asia held up well while several Asian markets were closed overnight: Mainland China for the Ching Ming Festival, Pakistan for Juma Tul Vida, and Taiwan for Tomb Sweeping Day.

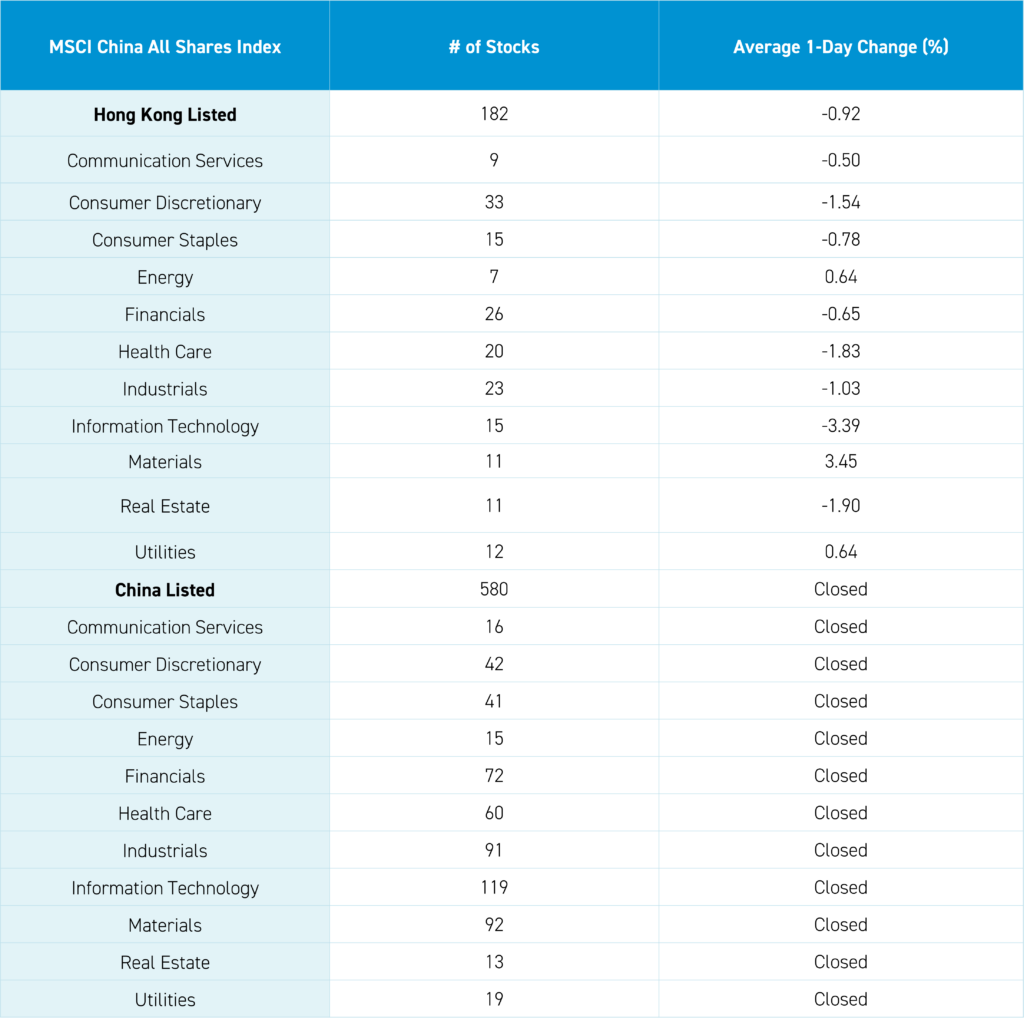

Hong Kong curtailed intra-day lows for the Hang Seng, -1.46%, and the Hang Seng Tech Index, -2.31%, to end up with both indexes closing only slightly lower by -0.01% and -0.29%, respectively, on light volumes with Southbound Stock Connect closed.

Janet Yellen’s comments on China’s overcapacity in electric vehicles (EVs) and solar garnered attention after she landed in Guangzhou yesterday. Limiting overcapacity would be beneficial to investors as companies undercut one another, hurting their financials. We saw this when Uber and Didi almost bankrupted themselves fighting for taxicab hailing market share. This morning, Mainland media reported that Yellen met with Vice Premier He Lifeng.

Despite Yellen’s comments, there were three days of China-US Commerce and Trade Working Group meetings between Ministry of Commerce Vice Minister Wang Shouwen and US Deputy Secretary of Commerce Largo in Washington DC. While there were no specific details on discussion points other than clean energy technology and trade, China’s press statement noted that the Vice Minister also met with White House’s National Economic Council, Treasury Department, Homeland Security, Commerce Department and entered an “extensive exchange with representatives of the U.S. business community and think tank scholars.” Clearly, more communication is occurring, which is good news, after US-China diplomacy went through a COVID disruption, despite US and China business leaders getting along just fine, for the most part.

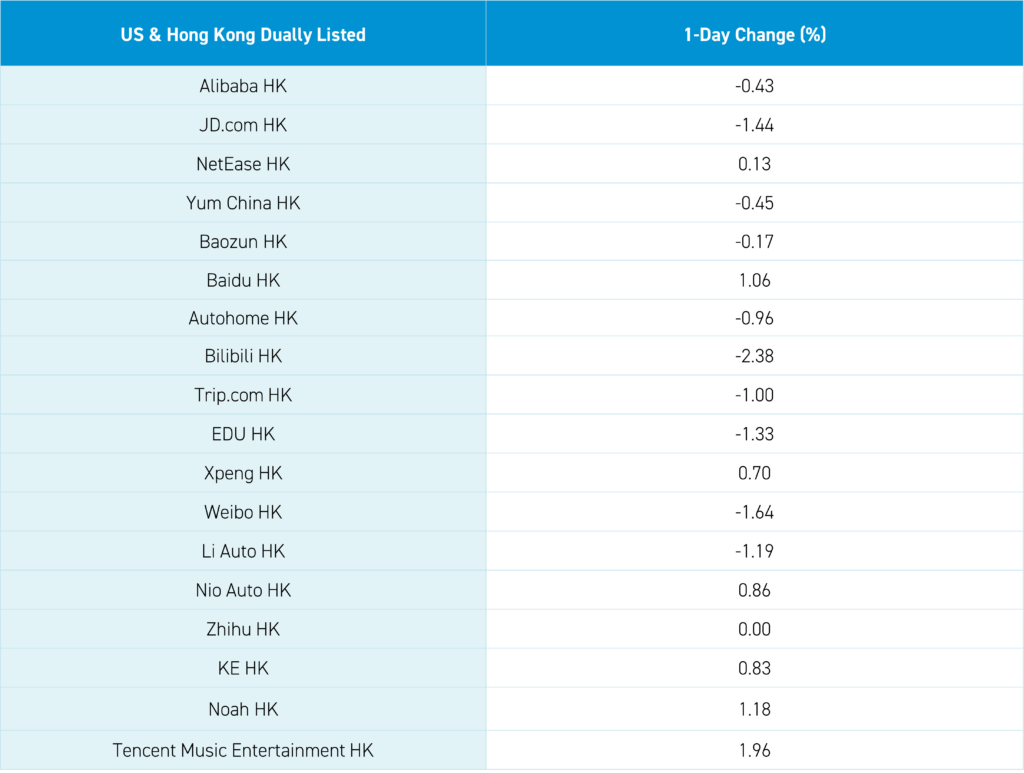

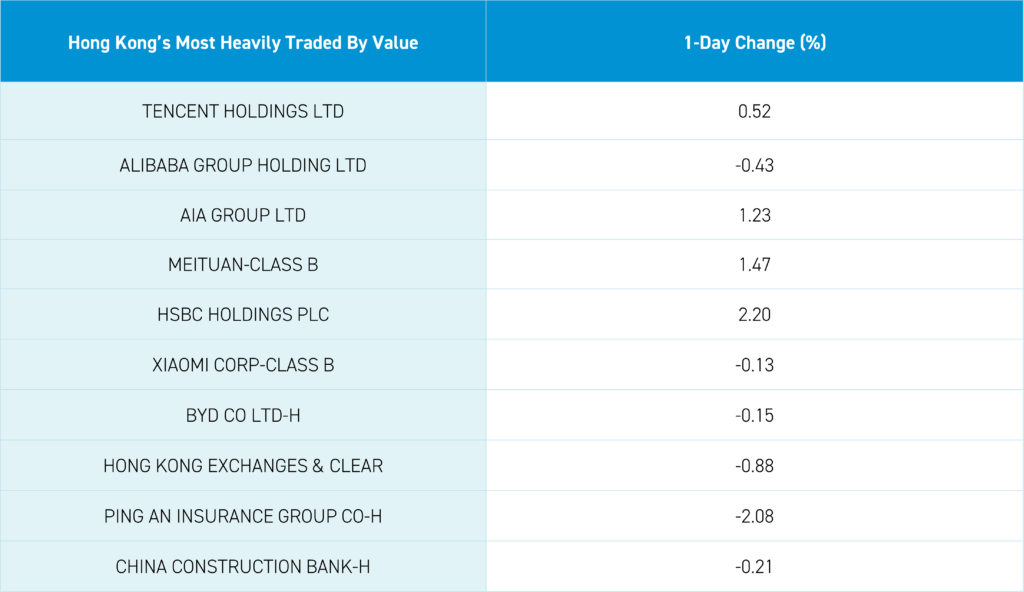

Hong Kong’s most heavily traded stocks were Tencent, which gained +0.52% after buying back 3.25 million shares today, Alibaba, which fell -0.43%, AIA, which gained +1.23%, Meituan, which gained +1.47% after announcing they bought back 3.5 million shares today, and HSBC, which gained +2.2%. Internet plays were mixed as JD.com fell -1.44%, Trip.com fell -1.00% despite very strong travel numbers around China’s four-day weekend, Baidu gained +1.06%, NetEase gained +0.13%, and Kuaishou gained +0.91%.

Energy was weak despite high WTI as China Oilfield Services fell -16.11% after speculation that Saudi Arabia’s Aramco halted production on 4 of the company’s rigs pending contract negotiations.

Health Care was weak as Wuxi Biologics fell -4.84% and WuXi AppTec fell -5.51% on concerns that the US Congress’ Biosecure Act could be expanded, according to Endpoint News, a media organization that I have never heard of.

Real Estate was off, though state-owned developer Vanke fell -4.2%, despite Mainland media noting the company has paid RMB 5.6 billion worth of maturing bonds listed outside of China.

Hoing Kong ended the week higher though I am likely the only person to notice China tech has outperformed US tech by +12% since February 5th. China’s internet and technology sectors are beating broad China as well.

The Hang Seng and Hang Seng Tech indexes fell -0.01% and -0.29%, respectively, on volume that declined -29.23% from Wednesday, which is 75% of the 1-year average.115 stocks advanced while 363 declined. Main Board short turnover declined -19.61% from yesterday, which is 93% of the 1-year average, as 22% of turnover was short turnover (remember Hong Kong’s short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). All factors were negative as the growth factor and large caps fell less than the value factor and small caps. Communication Services became the only positive sector, gaining +0.47%. Meanwhile, Health Care fell -2.69%, Energy fell -2.2%, and Utilities fell -1.99%. The top-performing subsectors were consumer durables, software, and media. Meanwhile, pharmaceutical biotech, diversified finance, and healthcare equipment were among the worst-performing. Southbound Stock Connect was closed today.

Shanghai, Shenzhen, and the STAR Board were closed today.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

Mainland China’s fixed income, commodity, and currency markets were closed overnight.