Mainland Markets Shrug Off Headlines

2 Min. Read Time

Key News

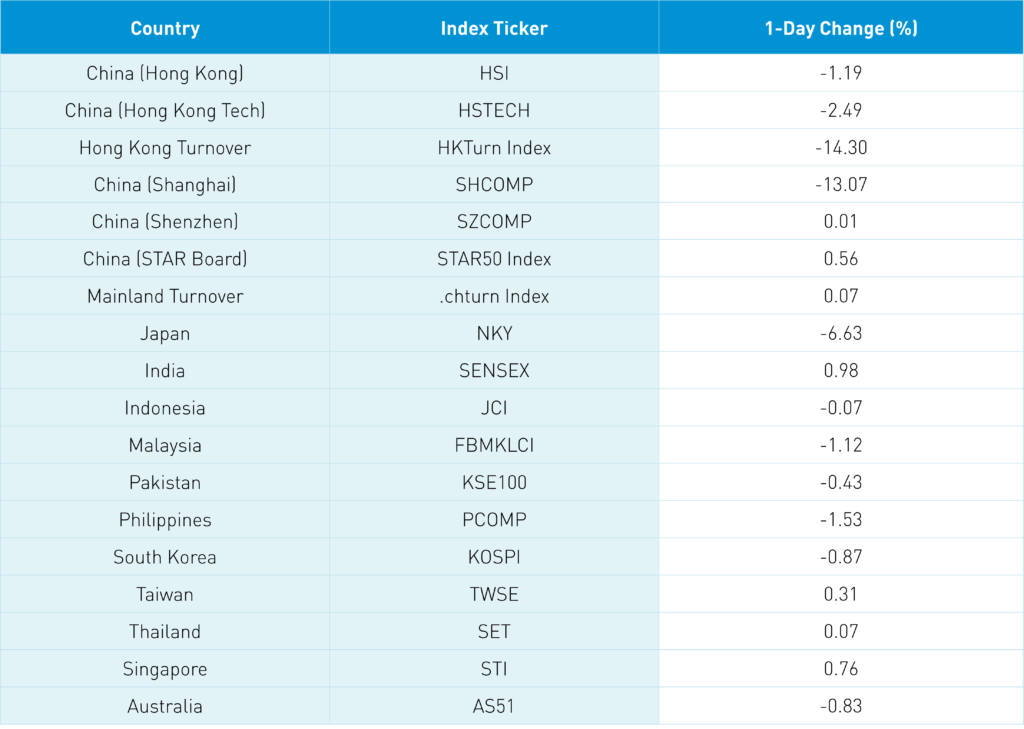

Asian equities were mixed overnight as President Biden visited the region.

On the positive side, US tariffs on Chinese consumer goods might be cut. Also, Australia voted in a new Prime Minister with inflation concerns among voter concerns.

This weekend’s Investor’s Business Daily front-page article was on the US stock market’s weakness. Retirees and investors listed their concerns and inflation was in the top ten.

There will be meetings by the Quad and Indo-Pacific Economic Framework (IPEF). However, as Secretary of Commerce Raimondo stated, the goal is to “make Indo-Pacific countries beyond China more attractive as manufacturing hubs,” according to the South China Morning Post. Mainland markets shrugged off these headlines though they did weigh on investor sentiment in Hong Kong.

This morning, we had news that Didi’s listing will migrate from the New York Stock Exchange (NYSE) to the pink sheets/over-the-counter (OTC) to fulfill its regulatory review. It is feasible that the company could relist once the review takes place.

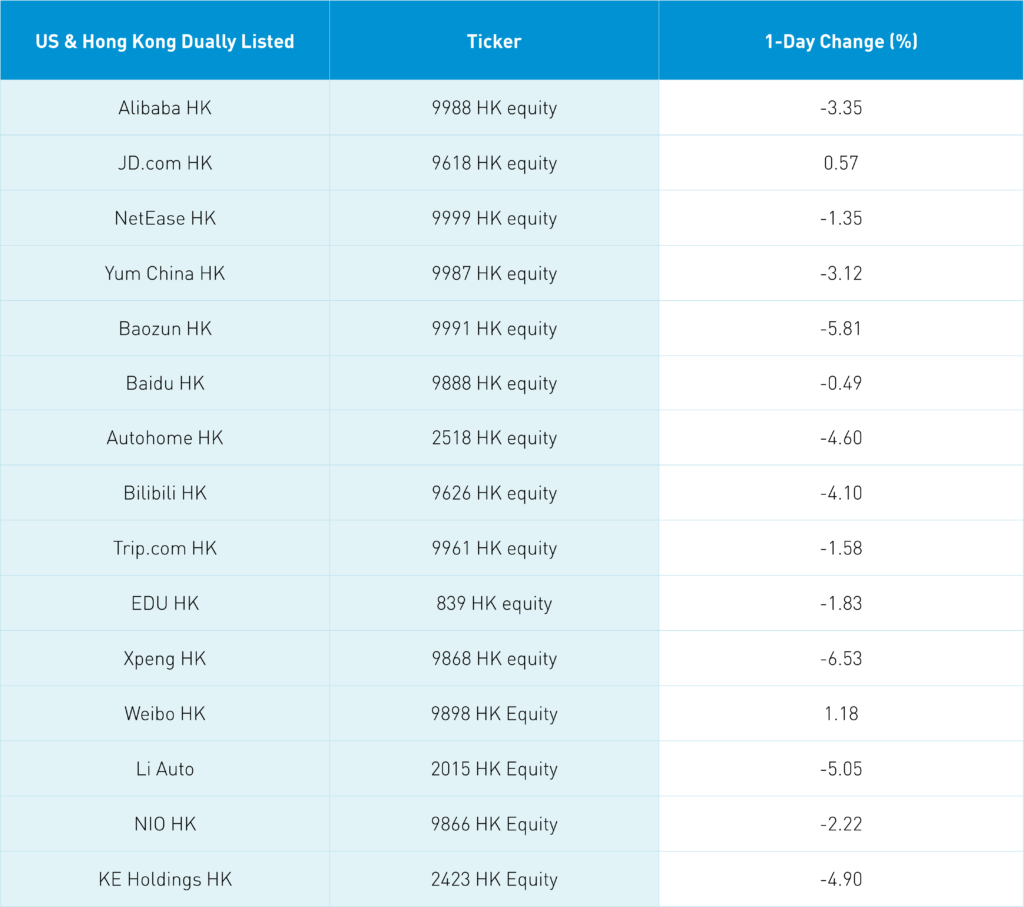

Hong Kong internet stocks were off following Friday’s US drawdown though it is shaping up to be a busy earnings week as NetEase and Kuaishou will report Tuesday, Alibaba, Baidu, and iQiyi will report Thursday, and Pinduoduo will report on Friday.

The Hang Seng Index did not add any internet stocks in its June rebalance as anticipated. Their inclusion of the stocks was at its peak, so hopefully, their lack of inclusion is a contrarian indicator. My weekend reading included several technical analysts’ more favorable views of China tech versus US tech. Fingers crossed!

Real estate was off despite favorable policy adjustments as traders took quick profits following the pop last week. After the close, a release from the State Council noted policies supporting tax rebates, social security payment waivers, private company loans, and waiving the auto sales tax. However, the latter did not differentiate between EVs and internal combustion engines.

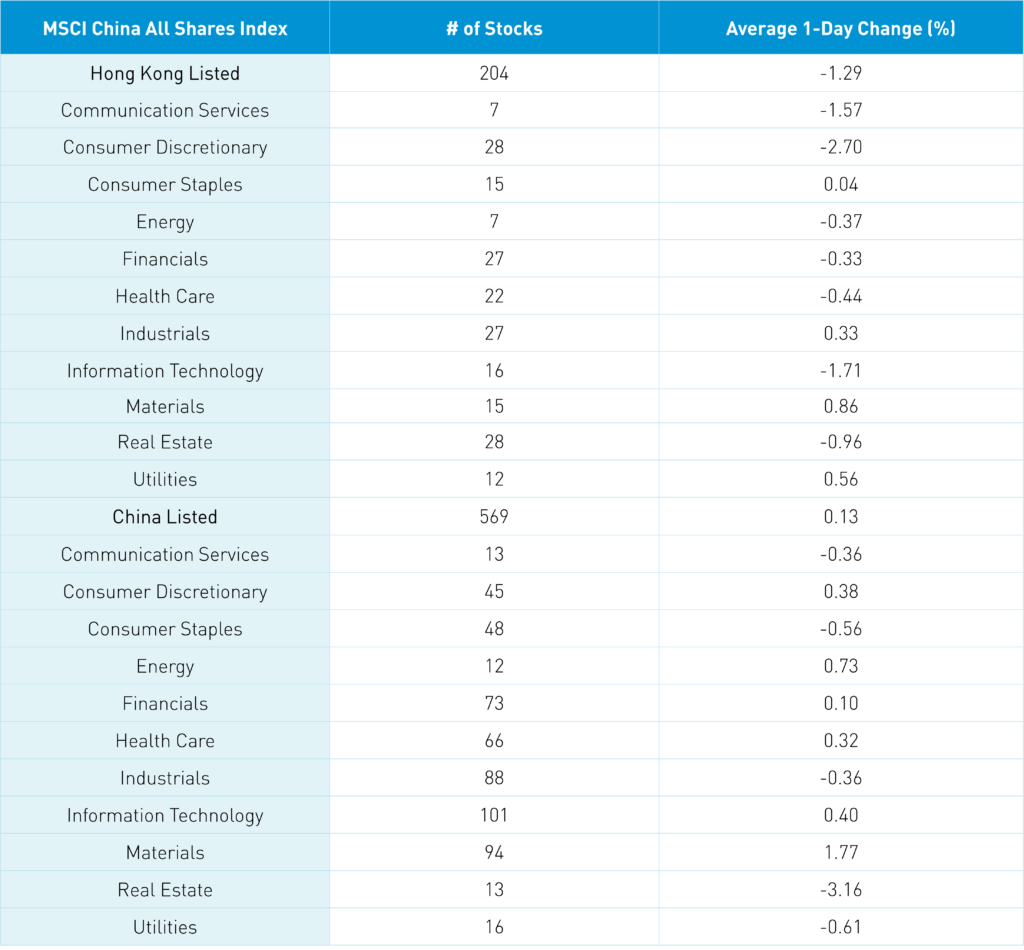

The Hang Seng and Hang Seng Tech Indexes were off -1.19% and -2.49%, respectively, on volume that was -14.3% lower than Friday, which is just 73% of the 1-year average. 194 stocks advanced while 272 declined. Hong Kong short sale turnover was down -13.07% from Friday, which is 83% of the 1-year average. Value factors outperformed growth factors as small caps outperformed large caps. The top sectors were materials, which gained +0.86%, utilities, which gained +0.57%, and industrials, which gained +0.33%. Meanwhile, discretionary fell -2.7%, tech fell -1.71%, communication fell -1.57%, and real estate fell -0.96%. Southbound Stock saw net buying by Mainland investors though Tencent and Meituan were small net sales.

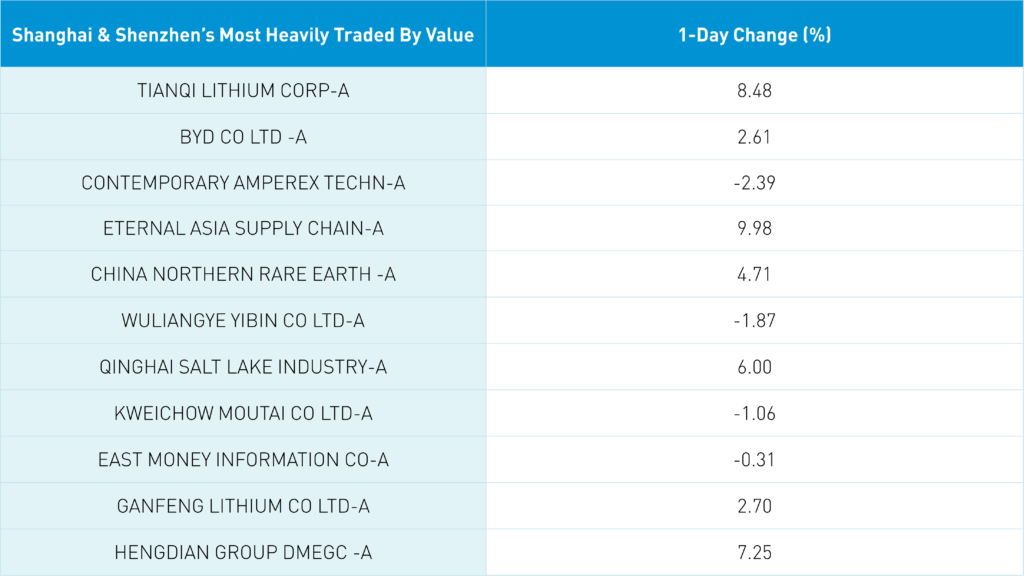

Shanghai, Shenzhen, and the STAR Board gained +0.01%, +0.56%, and James Bond +0.07%, respectively, on volume that was down -6.63% from Friday, which is 80% of the 1-year average. There were 3,296 advancing stocks and 1,140 declining stocks. Growth factors outperformed value factors while small caps outperformed large caps. The top sectors were materials, which gained +1.76%, energy, which gained +0.72%, and technology, which gained +0.39%. Meanwhile, real estate fell -3.18% and utilities fell -0.63%. Northbound Stock Connect volumes were light as foreign investors sold -$864 million worth of Mainland stocks today. Treasury bonds rallied, CNY gained +0.69% versus the US dollar, and copper gained +0.35%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.65 versus 6.69 Friday

- CNY/EUR 7.10 versus 7.06 Friday

- Yield on 1-Day Government Bond 1.31% versus 1.31% Friday

- Yield on 10-Year Government Bond 2.77% versus 2.79% Friday

- Yield on 10-Year China Development Bank Bond 3.00% versus 2.99% Friday

- Copper Price +0.35% overnight